Chevron Corp (NY:CVX)

Headline News about Chevron Corp

The Birth of a $58 Billion Shale Titan: Devon and Coterra Reshape the Delaware Basin

February 13, 2026

Via MarketMinute

Topics

Energy

Permian Powerhouse: Devon and Coterra’s $58 Billion Merger Reshapes the American Shale Landscape

February 12, 2026

Via MarketMinute

Topics

ETFs

Via MarketMinute

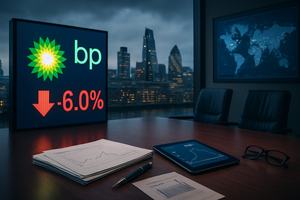

Energy Is Leading in 2026—But Are the Oil Majors Cracking? ↗

February 09, 2026

Via MarketBeat

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.