Invesco CurrencyShares Japanese Yen Trust (NY:FXY)

All News about Invesco CurrencyShares Japanese Yen Trust

Fed Day: Vigorous Defense of Independence While Standing Pat ↗

January 29, 2025

Via Talk Markets

GBP/JPY Price Analysis: Falls Toward 193.00 Near Nine-Day EMA Within Ascending Channel ↗

January 27, 2025

Via Talk Markets

Topics

Currencies/Forex

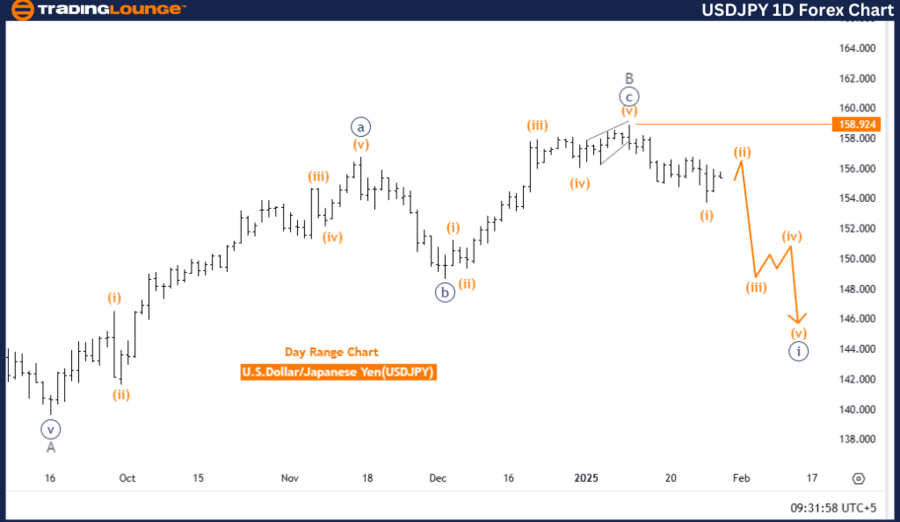

USD/JPY Price Analysis: Dollar Steadies, Eying Fed Policy Signals ↗

January 28, 2025

Daily Market Outlook - Tuesday, Jan. 28 ↗

January 28, 2025

Via Talk Markets

Via Talk Markets

Via Talk Markets

Topics

Currencies/Forex

Via Talk Markets

Topics

Currencies/Forex

"U.S. Exceptionalism" Faces Its Sternest Test Of The Year ↗

January 26, 2025

Via Talk Markets

Pairs In Focus - Sunday, Jan. 26 ↗

January 26, 2025

Via Talk Markets

The Market’s Risk/Reward Does Not Favor The Bulls ↗

January 26, 2025

Via Talk Markets

Trump Trade Back In Vogue – Societe Generale ↗

January 26, 2025

Via Talk Markets

Via Talk Markets

Topics

Currencies/Forex

Market Talk - Friday, Jan. 24 ↗

January 24, 2025

Via Talk Markets

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.