Global X Uranium ETF (NY:URA)

All News about Global X Uranium ETF

Via Talk Markets

Via Talk Markets

Via Talk Markets

Topics

Energy

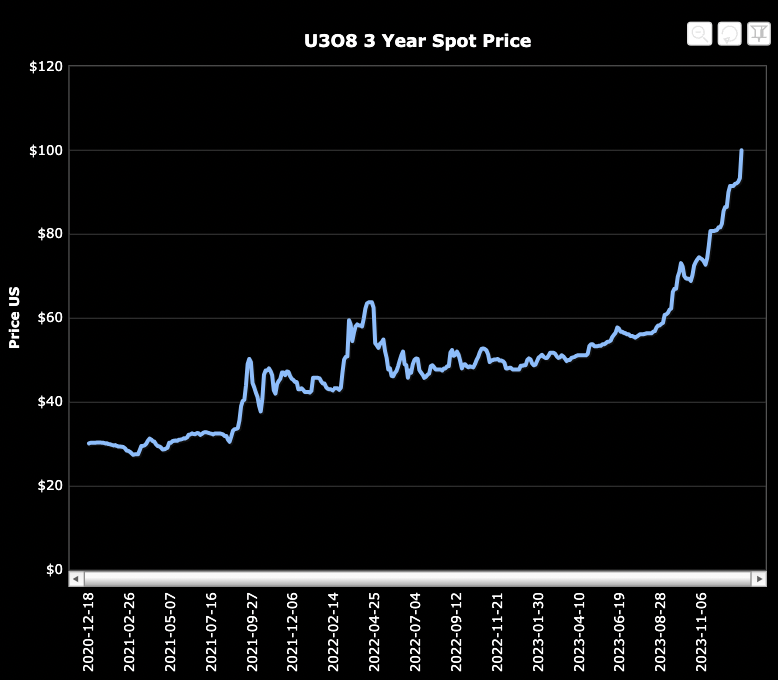

Uranium Market Surges To Triple Digits, Signaling Strong Bull Run ↗

February 21, 2024

Via Talk Markets

Skyharbour’s Prospect Generator Model Thrives At $100+/lb. #uranium ↗

February 06, 2024

Via Talk Markets

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.