BMW i4 Ranks Highest Overall, MINI Cooper Electric Ranks Highest among Mass Market Brands

As more car buyers make the switch to battery electric vehicles (BEVs), traditional factors that are also important to buyers of gas-powered vehicles are becoming critical to satisfaction among BEV owners. Quality and cost of ownership have emerged as the top factors influencing satisfaction, according to the J.D. Power 2024 U.S. Electric Vehicle Experience (EVX) Ownership Study,SM released today. The study also reveals that public charger availability not only remains the least satisfying aspect of owning a BEV, but also that the experience has become notably worse.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240227891371/en/

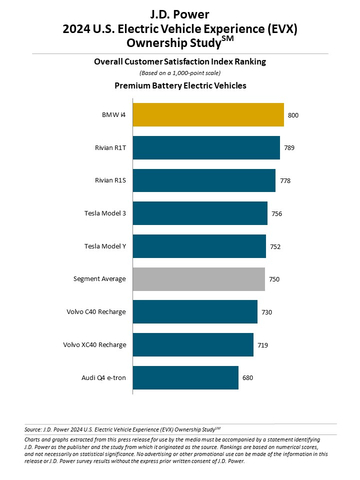

J.D. Power 2024 U.S. Electric Vehicle Experience (EVX) Ownership Study (Graphic: Business Wire)

The BMW i4 ranks highest overall and among premium BEVs, while the MINI Cooper Electric is the highest-ranking mass market BEV for a second consecutive year. Both models rank highest in their respective segment on the strength of their performance in the vehicle quality and reliability factor. Each model scores more than 60 points (on a 1,000-point scale) higher than their respective nearest segment competitor for that factor.

“The increase in the EV share of the new-vehicle market, reflected by seven new rank-eligible models this year, is a notable step in the transition toward vehicle electrification,” said Brent Gruber, executive director of the EV practice at J.D. Power. "Many products are hitting the mark and resonating with shoppers but, at the same time, the decline in satisfaction with public charging availability should serve as a warning because concern about access to public charging is a key reason many buyers currently reject BEVs. For EVs to reach their full potential, this issue needs to be resolved."

Following are key findings of the 2024 study:

- Public charging isn’t just bad—it’s getting worse: The study finds that the public charging experience continues to be a major source of EV owner frustration. Further, non-Tesla owners indicate that the situation is deteriorating. Among mass market BEV owners, satisfaction with public charger availability is 32 points lower than a year ago. “The industry should view this lack of improvement as a critical issue that requires decisive action,” Gruber said.

- Mass market BEVs deliver higher quality than premium BEVs: Owners of mass market brand BEVs experience fewer problems with their vehicle than do owners of premium BEVs. Eleven of the 14 ranked mass market models outperform the premium brand market average in total problems. “Quality and reliability are the most important drivers of a positive EV ownership experience,” Gruber said. “As EVs extend to the broader market, minimizing problems will be key to meeting consumer expectations.”

- First-time BEV owners are less satisfied than BEV veterans: Buyers new to BEV ownership are less satisfied than those who have previously owned a BEV. This year, the satisfaction gap between the two groups is 28 points, whereas a year ago, the gap was 14 points. Overall satisfaction among first-time BEV owners has declined 16 points from 2023. Battery range and public charging availability are the two factors in which the gap between previous BEV owners and new owners is greatest.

- Most BEV owners say they’ll consider a BEV again, but first-time BEV owners may be more fickle: First-time BEV owners say they are open to considering non-BEVs in the future. However, almost half (48%) say they will consider a plug-in hybrid vehicle (PHEV) and 39% say they are willing to consider hybrid or internal combustion engine (ICE) vehicles. Meanwhile, 38% of previous BEV owners say they are willing to consider a PHEV and only 19% would consider a hybrid or ICE vehicle for their next purchase.

- PHEVs might not present a good alternative to BEVs: Recently, news reports have suggested that plug-in hybrid vehicles could solve many of the issues plaguing BEVs, such as range limitations and lack of public charging availability. However, this year’s study finds that owners of PHEVs are, on the whole, much less satisfied with their vehicle than are owners of BEVs. Overall satisfaction with PHEVs is 629, while mass market BEVs (718) and premium BEVs (750) score much higher. “Plug-in hybrids may not be the simple solution to solving early issues with full battery electric vehicles,” Gruber said. “Expected lower running costs is a top purchase reason for EVs but satisfaction with the cost of ownership is much lower for plug-in hybrids. Plug-in hybrids retain the costs of maintaining a traditional powertrain yet without the benefit of the extended electric driving range found in full battery electric vehicles.”

Study Rankings

BMW i4 ranks highest overall and highest in the premium BEV segment with a score of 800. Rivian R1T (789) ranks second and Rivian R1S (778) ranks third.

MINI Cooper Electric ranks highest in the mass market BEV segment for a second consecutive year, with a score of 770. Ford Mustang Mach-E (764) ranks second and Hyundai IONIQ 6 (759) ranks third.

The number of award-eligible models in the premium segment has grown from five to eight year over year. Award-eligible mass market models have increased from 10 to 14. Satisfaction among owners of premium EVs averages 750, while satisfaction among mass market EV owners averages 718.

The U.S. Electric Vehicle Experience (EVX) Ownership Study, now in its fourth year, focuses on the crucial first year of ownership. The overall EVX ownership index score measures electric vehicle owner satisfaction in both premium and mass market segments. The 2024 study includes 10 factors (in alphabetical order): accuracy of stated battery range; availability of public charging stations; battery range; cost of ownership; driving enjoyment; ease of charging at home; interior and exterior styling; safety and technology features; service experience; and vehicle quality and reliability.

The study is conducted in collaboration with PlugShare, the leading EV driver app maker and research firm. This study sets the standard for benchmarking satisfaction with the critical attributes that affect the total or overall EV ownership experience for both BEV and PHEV vehicles. Survey respondents for the 2024 study include 4,650 owners of 2023 and 2024 model-year BEVs and PHEVs. The study was fielded from August through December 2023.

For more information about the U.S. Electric Vehicle Experience (EVX) Ownership Study, visit

https://www.jdpower.com/business/automotive/electric-vehicle-experience-evx-ownership-study.

See the online press release at http://www.jdpower.com/pr-id/2024012.

About PlugShare

Based in El Segundo, Calif., PlugShare maintains the most comprehensive census of EV infrastructure in the world. They make the PlugShare app for iOS, Android and the Web, the most popular EV driver app globally, in use by most drivers in North America and more than seven million EV drivers worldwide. PlugShare also provides sophisticated data tools, reports, custom consulting and comprehensive research on EVs for automakers, utilities, charging networks, government and the rest of the EV industry. It operates the world’s largest EV driver survey research panel, PlugInsights, now with more than 150,000 members.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services, and data and analytics. A pioneer in the use of big data, artificial intelligence (AI), and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe, and Asia Pacific. To learn more about the company's business offerings, visit JDPower.com/business. The J.D. Power auto-shopping tool can be found at JDPower.com.

About J.D. Power and Advertising/Promotional Rules: http://www.jdpower.com/business/about-us/press-release-info

View source version on businesswire.com: https://www.businesswire.com/news/home/20240227891371/en/

Contacts

Media Relations Contacts

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com

Shane Smith; East Coast; 424-903-3665; ssmith@pacificcommunicationsgroup.com