iShares TIPS Bond ETF (NY:TIP)

All News about iShares TIPS Bond ETF

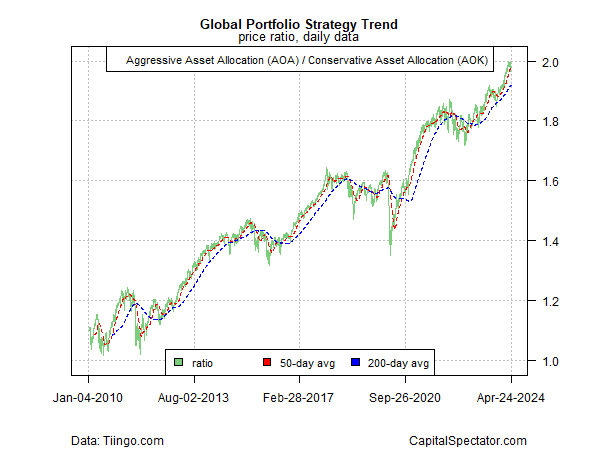

Via Talk Markets

Topics

ETFs

Via Talk Markets

Topics

Economy

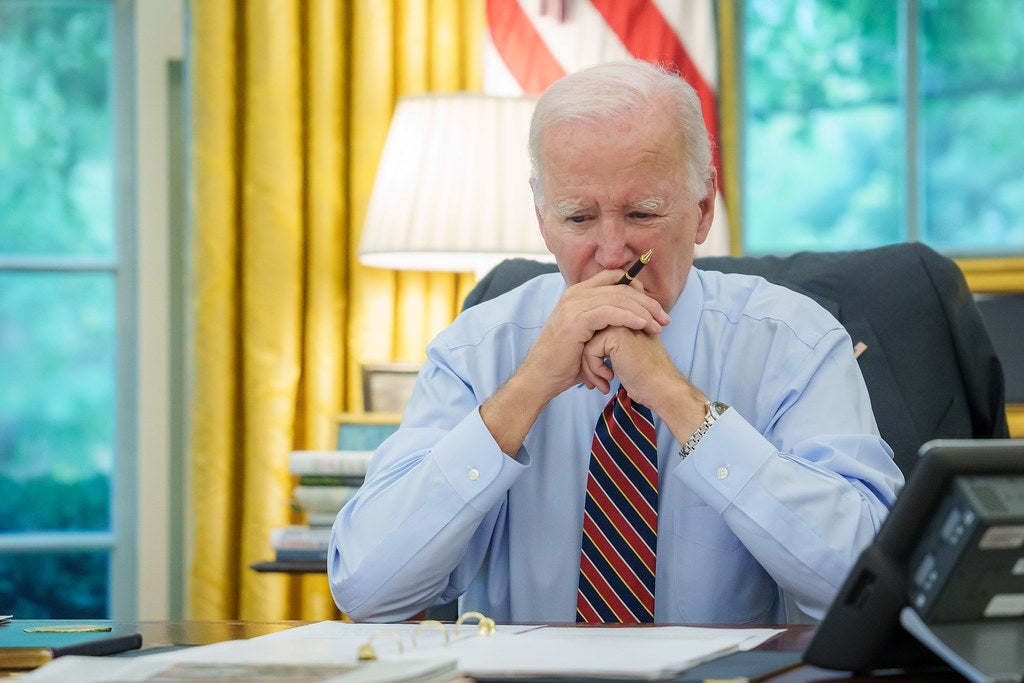

El-Erian Thinks Biden's Economic Woes Could Be Self-Inflicted As Trump Gains Ground In Voter Confidence ↗

February 12, 2024

Via Benzinga

Topics

Government

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.