UTILITIES SEL (NY:XLU)

All News about UTILITIES SEL

XLU: Lifetime Support ↗

October 02, 2023

Via Talk Markets

Topics

Stocks

Successful Long Trade ↗

October 01, 2023

Via Talk Markets

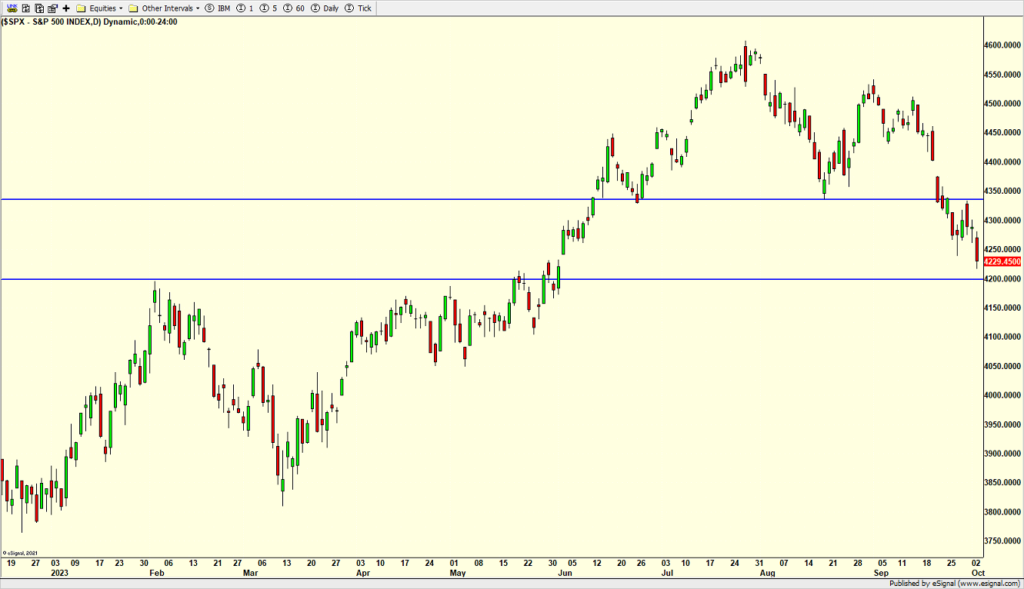

Conquer Your “FUD” Now, Because A Rally Should Come Later ↗

October 03, 2023

Via Talk Markets

Topics

Stocks

Bonds, Bullion, & Black Gold Battered As Hawkish FedSpeak & Inflation Fears Lift The Dollar ↗

October 02, 2023

Via Talk Markets

Topics

Economy

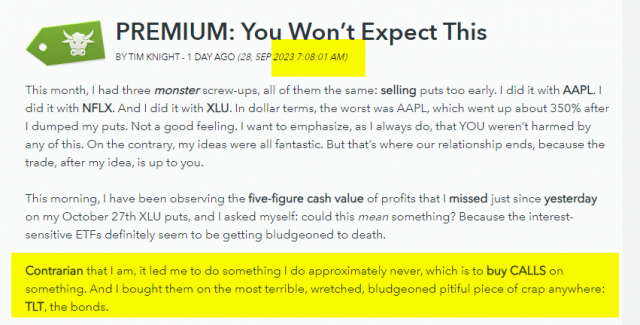

Delightful Dozen ↗

September 29, 2023

Via Talk Markets

Topics

ETFs

Post-Fumble Tumble ↗

September 22, 2023

Via Talk Markets

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.