Invesco DB Agriculture Fund (NY:DBA)

All News about Invesco DB Agriculture Fund

Trump and Xi’s Two-Hour Call Triggered A Rally In This Commodity - It's Not Gold Or Silver ↗

February 12, 2026

Via Stocktwits

Topics

Government

Via Benzinga

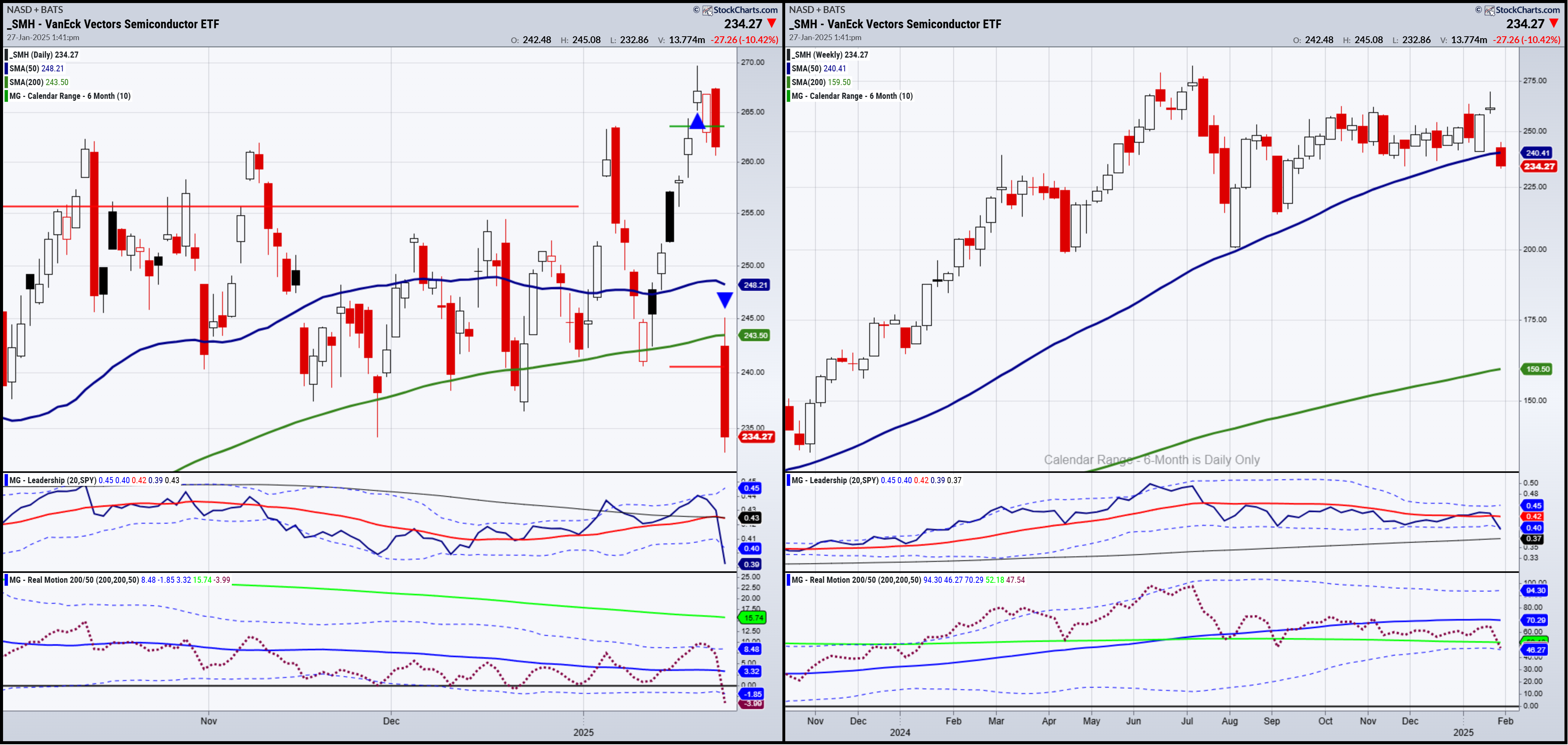

From Bad To Worse, But There’s Hope ↗

April 06, 2025

Via Talk Markets

Via Talk Markets

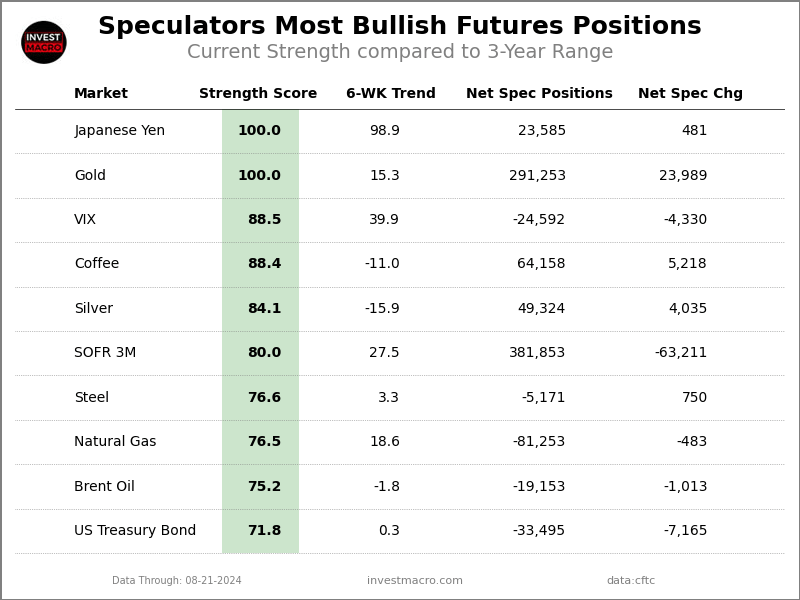

Unstoppable: What Does The Fed Know That We Don't? ↗

September 22, 2024

Via Talk Markets

Topics

Economy

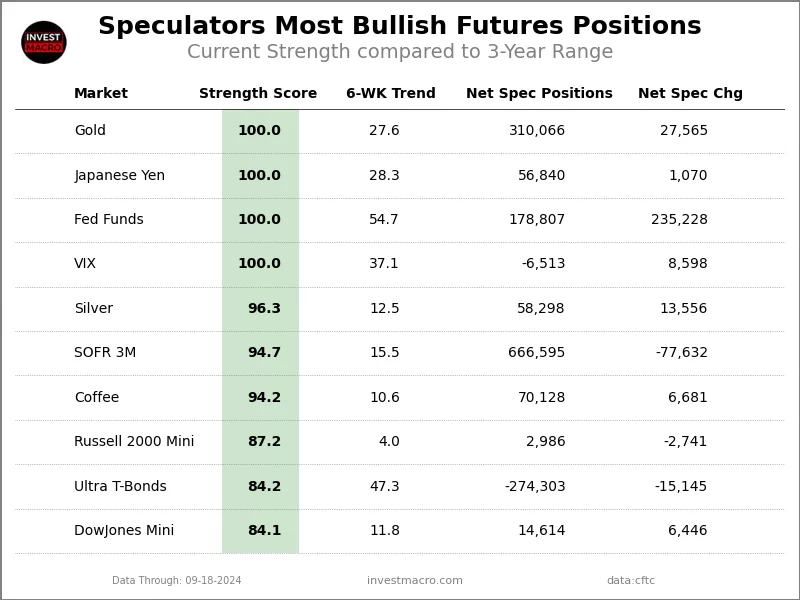

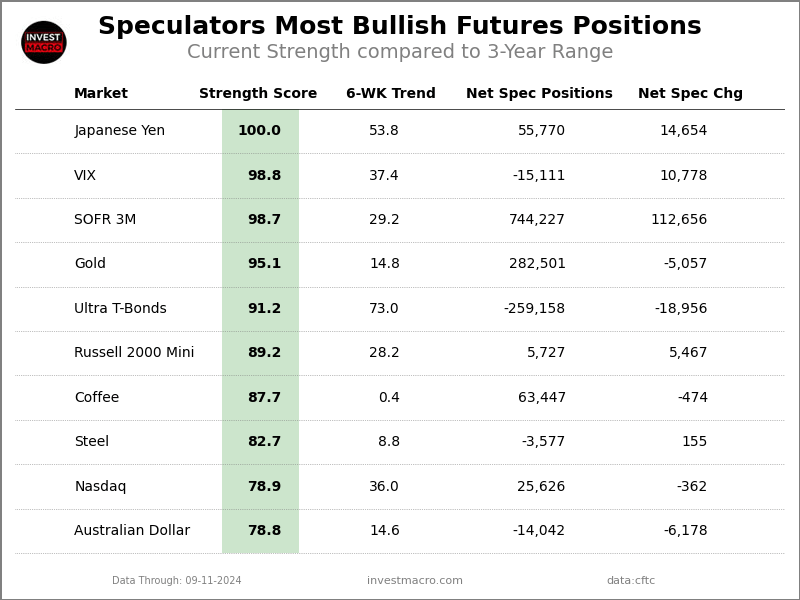

Speculator Extremes: Yen, VIX, Cotton & WTI Crude Oil Top Bullish & Bearish Positions ↗

September 15, 2024

Via Talk Markets

Topics

Stocks

Via Talk Markets

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.