iShares iBoxx $ High Yield Corporate Bond ETF (NY:HYG)

Headline News about iShares iBoxx $ High Yield Corporate Bond ETF

Risk Premia Forecasts: Major Asset Classes - Thursday, Dec. 2

December 02, 2021

Via Talk Markets

Best Pick For Corona Woes

November 22, 2021

Via Talk Markets

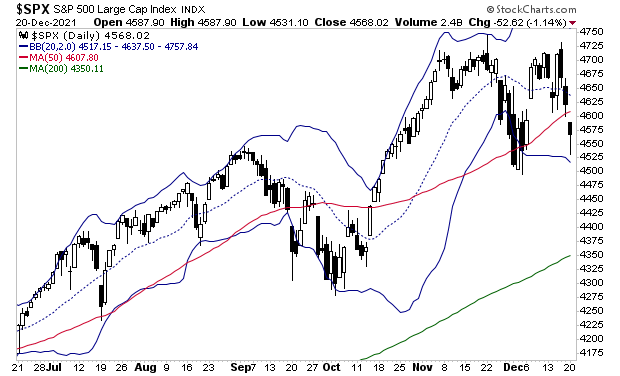

On A Knife-Edge

December 13, 2021

Via Talk Markets

Topics

Stocks

Fed “Taper” Is Good News For The Bond Market

November 22, 2021

Via Talk Markets

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms Of Service.