VANCOUVER, BC / ACCESS Newswire / October 8, 2025 / Metallic Minerals Corp. (TSX.V:MMG)(OTCQB:MMNGF) ("Metallic Minerals" or the "Company") is pleased to provide an update on field activities across its gold and silver royalty portfolio in the Yukon, along with ongoing exploration programs at its and Keno Silver Project in central Yukon. A separate update will follow shortly on the Company's active exploration initiatives at its La Plata Copper-Silver-PGE-Gold Project in southwestern Colorado.

"Following the successful completion of $8 million in financings at the end of August - with strong participation from existing shareholders, management, the board, and strategic investors including Newmont Corporation - Metallic Minerals has launched a series of active exploration and development programs across its portfolio," stated Greg Johnson, CEO and Chairman. "These initiatives are designed to build on our near-term gold and silver production from Yukon alluvial royalties, while continuing to expand our copper, silver, and critical mineral resources at our flagship Keno Silver and La Plata copper-silver-PGE-gold projects."

Mr. Johnson continued, "We see the current metals market as an exceptional opportunity for investors. While large and mid-cap producers are trading at or near their all-time highs, many high-quality resource-stage companies - the foundation of future production growth - remain significantly undervalued. With gold, silver, and copper all demonstrating strong performance, Metallic Minerals' diversified U.S. and Canadian portfolio offers a rare combination of royalty income, production growth, and discovery potential heading into 2026."

Klondike and Keno Gold and Silver Royalty Portfolio

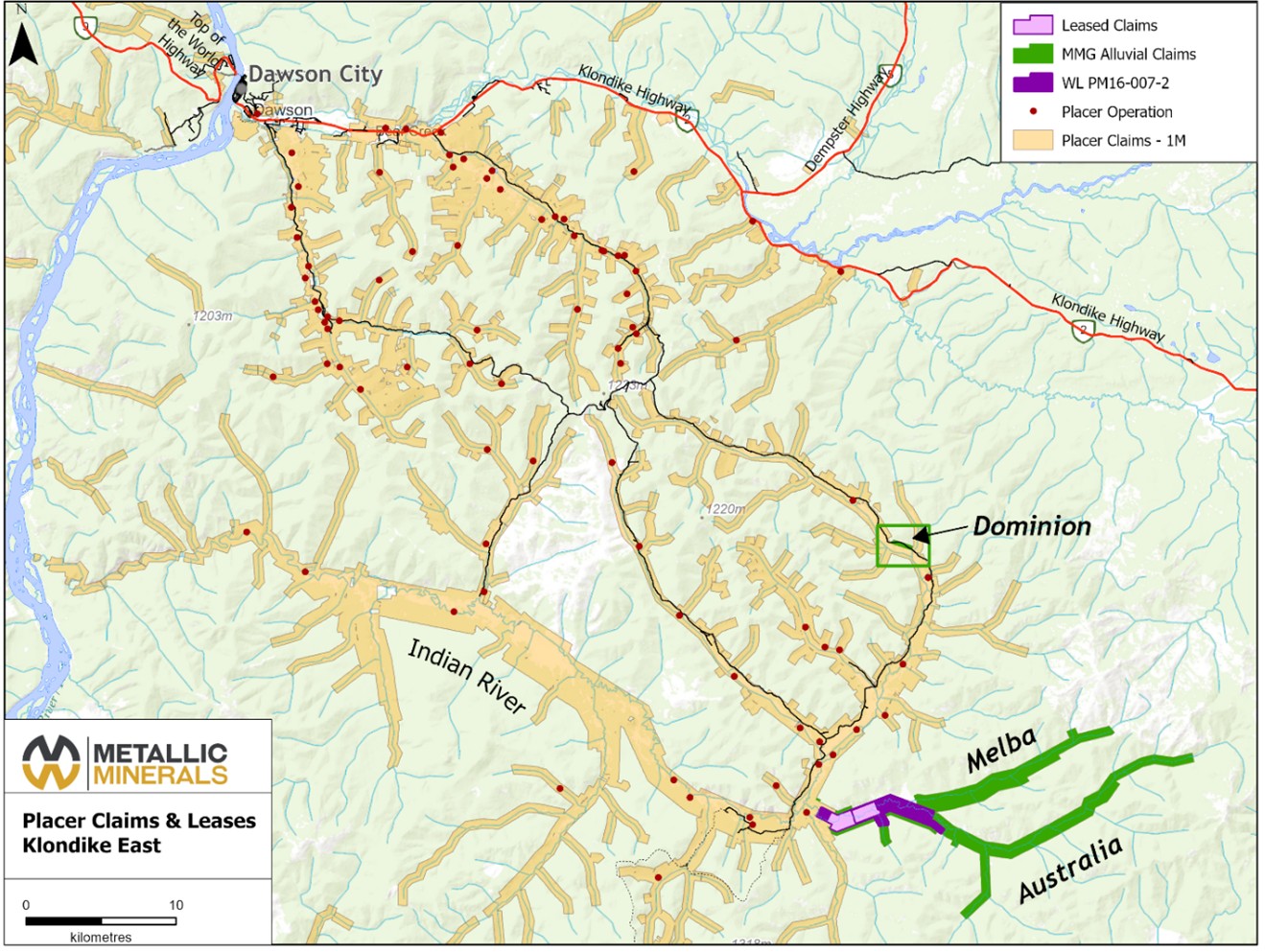

Metallic Minerals is one of the largest holders of alluvial mining claims in the Yukon Territory, Canada. The Company is advancing a growing royalty portfolio through partnerships with experienced placer mining operators across its extensive holdings.

Now in its third consecutive year of gold production, Metallic Minerals expects record royalty revenues in 2025 from its Australia Creek operations and has recently signed an agreement with an additional operator to commence test mining at its nearby Dominion Creek property. Both areas lie within the heart of the historic Klondike Goldfields, which have produced more than 20 million ounces of gold since the legendary 1898 gold rush.

The Company also holds substantial alluvial claims in the Keno Hill silver district, overlapping its high-grade Keno Silver Project, where over 16,000 ounces of alluvial gold were produced from 2015 to 2021. Exploration programs launched in September at both Australia Creek and South Keno include drilling and geophysical surveys to define new zones of recoverable native gold and silver and to advance future royalty-based production from these large-scale alluvial systems.

Klondike Goldfields Properties

Metallic Minerals holds a 100% interest in37.8 square kilometers of highly prospective alluvial ground along the Australia Creek and Dominion Creek drainages south of Dawson City, Yukon. Dominion Creek is a long-established gold-producing area, while Australia Creek has been recognized by the Yukon Geological Survey as the eastern continuation of the prolific Klondike Goldfields, the Yukon's largest placer gold-producing region (see Figure 1).

Although Australia Creek was not historically mined, having served as a key source of water and hydroelectric power for past dredging operations, recent drilling has revealed gold-in-gravel grades comparable to the best-producing Klondike areas, highlighting a major untapped royalty opportunity for the Company.

At Australia Creek, with two royalty agreements currently in place, 2025 will be Metallic Minerals' longest and most productive mining season to date. Additional royalties are expected as operations expand across the broader property. A 30-hole sonic drill program completed earlier this year extended known gold-bearing horizons beyond current pits, while a new 25-hole program and passive seismic surveys, initiated in September, is targeting additional mineralized zones for future production.

The Company is also finalizing new mining permits on its Australia and Melba Creek properties to support expansion. With elevated gold prices driving strong demand for production-ready ground, Metallic Minerals is well positioned to capture additional royalty income through new operator agreements.

At Dominion Creek, the Company has signed a new exploration agreement with an experienced operator to initiate test mining and infrastructure development. Follow-up drilling and geophysical surveys are planned for late 2025 or early 2026 to support the next phase of expanded production and royalty growth in 2026.

Figure 1: Klondike Goldfields and Metallic Minerals' Properties

South Keno Alluvial Properties

Metallic Minerals' 100%-owned 24.2 square kilometer South Keno alluvial property lies within the famous Keno Hill silver district, overlapping the Company's Keno Silver Project. The area is noted for its coarse gold and thick, stacked gold horizons, offering strong potential for large-scale placer operations.

Current exploration includes reverse circulation drilling, ground-based resistivity surveys, mapping, and sampling (see Figure 2). The program is designed to expand known gold-bearing zones from the adjacent up-valley operations and to support new lease and royalty agreements in today's robust gold-price environment.

Preliminary drill results confirm the presence of economic gold values, while geophysical data are refining the understanding of subsurface stratigraphy and gold-hosting units. Based on these results, Metallic Minerals anticipates additional drilling in early 2026 to further define resource potential.

Figure 2: Reverse Circulation Drilling at South Keno Alluvial Property in September

Keno Silver Project, Yukon, Canada Update

In Canada's Yukon Territory, Metallic Minerals has consolidated the second-largest land position in the high-grade Keno Hill silver district, directly adjacent to Hecla Mining's operations, which together host more than 300 million ounces of high-grade silver in past production and current Reserves and Resources¹.

Hecla Mining, now the largest primary silver producer in both the U.S. and Canada, has achieved a major milestone at its adjacent Keno Hill mine with its first quarter of positive free cash flow and continued strong production growth, marking the transition to sustained, self-funding operations in the district. Hecla has designated Keno Hill as a core, long-life asset that meets investment hurdles at $25 per ounce silver and continues to advance key infrastructure for the mining operations. Recent drilling at Bermingham has confirmed high-grade extensions up to 1,250 g/t silver over 3.8 meters, extending mineralization 150 meters below current reserves and demonstrating the impressive vertical continuity within the Keno district. To date, the mineralization at Keno Hill has been shown to extend over 1.5 kilometers vertically from the top of the Keno Hill mine to the deepest mineralization at Bermingham2.

These developments further validate the long-term production potential and strengthening infrastructure base immediately adjacent to Metallic Minerals' Keno Silver project. In 2024, Metallic Minerals announced its inaugural Inferred Mineral Resource Estimate of 18.2 million ounces silver equivalent, grading 223 g/t Ag Eq (120 g/t Ag, 0.10 g/t Au, 0.80% Pb, 1.77% Zn)1, focused on shallow, open-pittable mineralization amenable to low-cost development. This growing near-surface resource provides a complementary counterpart to Hecla's higher cost selective underground mining operations, highlighting the potential for a future hybrid mining model that could blend scalable bulk-tonnage open-pit feed with underground high-grade ore to enhance overall district throughput and extend mine life.

Field programs at Metallic Minerals Keno Silver project in 2025 are advancing detailed mapping, rock and soil sampling across high-priority targets prospective for bulk-tonnage silver-lead-zinc mineralization, in preparation for a robust 2026 drill campaign aimed at expanding resources, advancing resource-ready targets, and testing new discoveries. Metallic Minerals currently has 11 targets with positive drill results requiring follow-up and an additional 40 undrilled, highly prospective targets, representing significant upside potential in this historic yet newly emerging world-class silver district.

Recent Presentations and Collaboration with Columbia University

Greg Johnson, CEO and Chairman, recently presented at the Carbontech Summit in New York, an event co-hosted by Columbia University Technology Ventures. As part of a panel on successful community engagement in large-scale renewable power and resource development projects, he highlighted Metallic Minerals' approach to building partnerships that align responsible resource development with the global energy transition. The event provided an opportunity to engage with leading researchers, investors, and innovators working at the intersection of carbon management, clean technology, and sustainable mining.

In a May 2025 news release, Metallic Minerals announced the identification of significant potential for rare earth elements (REEs) and other critical technology metals at its La Plata project in southwestern Colorado. These materials, alongside the project's established copper, silver, gold, and platinum-group element endowment, represent a compelling new layer of value for investors. The recognition of REEs, gallium, scandium, tellurium, and other key metals expand the project's potential strategic importance as part of a U.S.-based supply chain for critical minerals essential to the U.S. economy and supply chains.

Building on this foundation, the Company has initiated a collaboration with Dr. Greeshma Gadikota, a professor at Columbia University and leading researcher in mineral processing and materials recovery, to advance studies on the extraction and recovery of rare earths, platinum group metals, and other key technology elements from La Plata. This partnership combines cutting-edge academic expertise with Metallic Minerals' extensive geological and metallurgical data, aimed at unlocking multiple value streams and enhancing the project's long-term economics. The Company anticipates providing further updates as this important research collaboration progresses.

Upcoming Events

Metallic's management team will be available at the following international events in 2025, in addition to other events to be added as the Company continues its marketing plans over the remainder of the year:

Red Cloud Fall Mining Showcase - Toronto, Canada, November 4-5, 2025. For information, click here.

Precious Metals Summit - Zurich, Switzerland, November 10-11, 2025. For information, click here.

AEMA's Annual Meeting - Sparks, Nevada, December 7-12, 2025. For information, click here.

VRIC 2026 - Vancouver, BC - January 25-26, 2026. For information, click here.

AMEBC Round Up - Vancouver, BC - January 26-29, 2026. For information, click here.

PDAC 2026 - Toronto, Canada, March 1-4, 2026. For information, click here.

Swiss Mining Institute Conference - Zurich, Switzerland, March 18-19, 2026. For information, click here.

About Metallic Minerals

Metallic Minerals Corp. is a resource-stage mineral exploration company, focused on copper, silver, gold, platinum group elements, and other critical minerals at the La Plata project in southwestern Colorado and the Keno Silver project adjacent to Hecla Mining's Keno Hill silver operations in the Yukon Territory. The Company is also one of the largest holders of alluvial gold claims in the Yukon and is building a production royalty business by partnering with experienced mining operators.

Metallic Minerals is led by a team with a track record of discovery and exploration success on several major precious and base metal deposits in North America, as well as having large-scale development, permitting and project financing expertise. The Metallic Minerals team is committed to responsible and sustainable resource development and has worked closely with Canadian First Nation groups, U.S. Tribal and Native Corporations, and local communities to support successful project development.

FOR FURTHER INFORMATION, PLEASE CONTACT:

www.metallic-minerals.com and info@metallic-minerals.com

Phone: 604-629-7800 and Toll Free: 1-888-570-4420

Footnotes:

Metallic Minerals Corp., NI 43-101 Technical Report for the Keno Silver Project, 2024.

Hecla Mining Company - Hecla Reports Second Quarter 2025 Results

Qualified Person

The scientific and technical information in this release has been reviewed and approved Scott Petsel, P.Geo, President of Metallic Minerals Corp., who is a Qualified Person as defined by National Instrument 43-101-Standards of Disclosure for Mineral Projects.

Forward-Looking Statements

This news release includes certain statements that may be deemed "forward-looking statements". All statements in this release, other than statements of historical facts including, without limitation, statements regarding potential mineralization, title, expected results of operations, as well as financial position, prospects, and future plans and objectives of the Company are forward-looking statements that involve various risks and uncertainties. Although Metallic Minerals believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Forward-looking statements are based on a number of material factors and assumptions. These assumptions include, inter-alia, the continued interest and strategic alignment of certain investors such as Newmont Corporation (‘Newmont'); however, Newmont's participation in the Offering should not be construed as a commitment to future funding, operational involvement, or endorsement of the Company's long-term plans. Factors that could cause actual results to differ materially from those in forward-looking statements include failure to obtain necessary approvals, changes in project parameters as plans continue to be refined, results of future resource estimates, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, risks associated with regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, uninsured risks, unanticipated environmental impacts on operations and costs to remedy same and other exploration or other risks detailed herein and from time to time in the filings made by the Company with securities regulators. Readers are cautioned that mineral resources that are not mineral reserves do not have demonstrated economic viability. Mineral exploration, development of mines and mining operations is an inherently risky business. Accordingly, the actual events may differ materially from those projected in the forward-looking statements. For more information on Metallic Minerals and the risks and challenges of their businesses, investors should review their annual filings that are available at www.sedarplus.ca.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Metallic Minerals Corp.

View the original press release on ACCESS Newswire