Tesla’s (TSLA) ride through Europe has not been smooth lately. The company that once dominated the electric vehicle (EV) conversation is now feeling the pressure, with sales slipping in key markets. In November, registrations in France and Denmark dropped by double-digits, and the Model Y – once a superstar – slid all the way to 23rd place in Denmark. Even refreshed versions and earlier price cuts did not bring customers rushing back. Competition is rising, production delays are piling up, and European buyers suddenly have many cheaper alternatives, especially from fast-moving Chinese brands.

Still, a small spark exists. Model 3 registrations in Denmark climbed 29%, hinting that affordability still has pulling power. That is precisely where Tesla is now placing its next bet. It is now rolling out its new low-cost Model 3 Standard across Europe, starting at €37,970 in Germany and similarly trimmed-down prices in Norway and Sweden. It drops some premium touches but keeps over 300 miles of range, a move clearly meant to win back cost-conscious buyers and a market shaken by political backlash against Elon Musk.

And with TSLA stock already down 6.7% from its last year’s peak, can this cheaper Model 3 help Tesla rebuild its European momentum and maybe nudge its stock back on course?

About Tesla Stock

Tesla, founded in 2003 and headquartered in Texas, is an EV maker redefining how the world moves and stores energy. Guided by Elon Musk’s ambitious vision, it blends electric cars, battery storage, solar tech, and early robotics into one future-focused ecosystem. Operating across more than 30 countries in North America, Europe, and Asia, Tesla continues to set the tone for clean mobility and modern infrastructure. Its market capitalization stands at $1.5 trillion.

Tesla’s stock has spent 2025 on a dramatic ride, the kind only Roundhill Magnificent Seven ETF (MAGS) heavyweight could deliver. The year began with turbulence – slowing EV demand, tariff pressures, and Elon Musk’s constant place in the global spotlight all worked against the stock. For months, TSLA drifted sideways, unable to break out of its tight range. But then, in true Tesla fashion, the script flipped almost instantly.

A couple of months ago, Musk ignited a fresh rally. After securing a staggering compensation package potentially worth up to $1 trillion, he made his first personal share purchase in five years for roughly $1 billion. This insider buying spree stunned Wall Street and wiped out TSLA’s year-to-date (YTD) losses in a matter of days. Since then, momentum has quietly rebuilt. The stock is up 2.16% over the past five days, and although it is trading about 7.28% below November’s YTD high of $474.07, Tesla’s shares have surged 105.18% off its April low of $214.25 and climbed nearly 48.88% over the past six months.

Technically, the chart is showing renewed strength. The bounce off the crucial $385 support – tested twice in November – confirmed buyers are defending the long-term rising trendline that has held firm since April. Holding a higher low confirms the uptrend is still strong, with buyers stepping in through recent price swings.

Volume has been ticking higher, supporting the move. The RSI sits near 53.73, no longer overbought like in September, but still holding in bullish territory even as it trends slightly lower. Meanwhile, the MACD paints an even stronger picture. The yellow MACD line is pushing above the blue signal line, with the gap widening and the histogram solidly positive, a classic sign that upward momentum is building again.

Tesla’s Mixed Q3 Results

Tesla’s Q3 2025 earnings report, released on Oct. 22, was mixed – part setback, part steady grind, part quiet ambition. Revenue of $28.1 billion slipped 12% year-over-year (YOY) but beat the estimates, and non-GAAP EPS was down 31% annually to $0.50, a miss that reminded Wall Street how tight the EV landscape has become. Gross margins felt the strain too, sliding to 18% from 19.8% in the year-ago quarter as tariffs, a softer mix, and lower factory absorption weighed on profitability, even as easing raw-material costs offered a bit of relief.

Yet beneath the pressure, Tesla showed financial muscle. Cash, equivalents, and investments surged 24% to $41.6 billion, powered by nearly $4 billion in free cash flow and $6.2 billion in operating cash flow. Operating income came in at $1.6 billion with a 5.8% margin, down sharply from 10.8%, as expenses jumped 50% YoY to $3.43 billion, driven by heavier AI and R&D spending. Energy storage quietly stole a scene with a record 12.5 GWh deployed.

Tesla’s Q3 production slipped to 447,450 units, down 5% and below expectations, but deliveries told a stronger story. The company shipped 497,099 vehicles, up 7% YOY, driven by a 9% jump in Model 3/Y deliveries to 481,166. Automotive revenue rose 6% to $21.2 billion.

While Tesla offered no Q4 guidance, it highlighted a push toward 3 million annual units within two years, leaning heavily on AI, autonomy, and energy growth.

And with Tesla’s EV deliveries slipping through the first three quarters, it is clear the core business is feeling the squeeze, caught between fierce Chinese rivals and the backlash around Musk’s political antics. The robotaxi dream is not riding to the rescue yet either; Tesla has only a small fleet, still relying on human safety drivers, while Alphabet’s (GOOG) (GOOGL) Waymo and China's Baidu (BIDU) race ahead with far larger, fully driverless operations.

On the robotics side, Musk is pitching a bold future for Optimus – machines taking over everyday tasks, with plans for massive production scaling from one million units a year to tens of millions, and each robot promised to outperform humans fivefold.

Analysts tracking Tesla predict the EV company’s earnings dipping hard in 2025, with EPS sliding 44.1% YOY to $1.14. Yet the comeback could be quick, with forecasts pointing to a solid 64.9% annual rebound, lifting EPS to $1.88 by fiscal 2026.

Tesla’s Slipping November Sales

Tesla’s November numbers in Europe painted a rough picture, with sales sliding 12.3% YOY to about 17,000 units, down from 19,400 in 2024. And once Norway is taken out of the mix – a market temporarily boosted by tax timing – Tesla’s decline across the continent deepens sharply to 36.3%.

Key markets delivered some of the toughest blows. France registration plunged 57.8% to 1,593 units, Sweden deliveries dropped 59.3% to 588, the Netherlands slid 43.5% to 1,627, and Germany fell 20.2% to 1,763 vehicles. Even the refreshed Model Y has not stopped the slide in Germany, with analysts pointing to an ageing lineup and growing brand fatigue as drivers of Tesla’s weakness there.

Spain slipped 8.7% to 1,523 units, while Belgium, Denmark, Portugal, Switzerland, and Finland logged double-digit drops ranging from 20% to 55%.

Norway stood as the lone bright spot, soaring 175% to 6,215 registrations as buyers rushed to beat 2026 tax changes that will remove benefits for premium EVs. Despite its smaller size, Norway made up over 35% of Tesla’s European volume, with a 31.2% market share and a new annual record of 28,606 units through November.

Across the Channel, the UK also slipped, with Tesla registrations down 19% to 3,784 units. Overall, UK registrations fell 6.3% to 146,786, as battery-electric sales dipped 1.1% and plug-in hybrids rose 3.8% – a shift possibly influenced by proposed pay-per-mile EV charges that leaked documents suggest could deter over 440,000 future EV sales.

Tesla’s New Model 3 Standard

Tesla’s rollout of the new Model 3 Standard in Europe marks a calculated push to revive demand in a cooling EV market. Priced at €37,970 in Germany, 330,056 kroner in Norway, and 449,990 kronor in Sweden, the trim undercuts much of the competition while still offering over 300 miles of range.

The model arrives just months after Tesla introduced a lower-priced Model Y, extending its value-focused strategy as European and Chinese rivals intensify pressure with cheaper EVs. With demand cooling across several key markets, this streamlined Model 3 is designed to reignite showroom interest and reinforce Tesla’s regional market share.

What Do Analysts Expect for TSLA Stock?

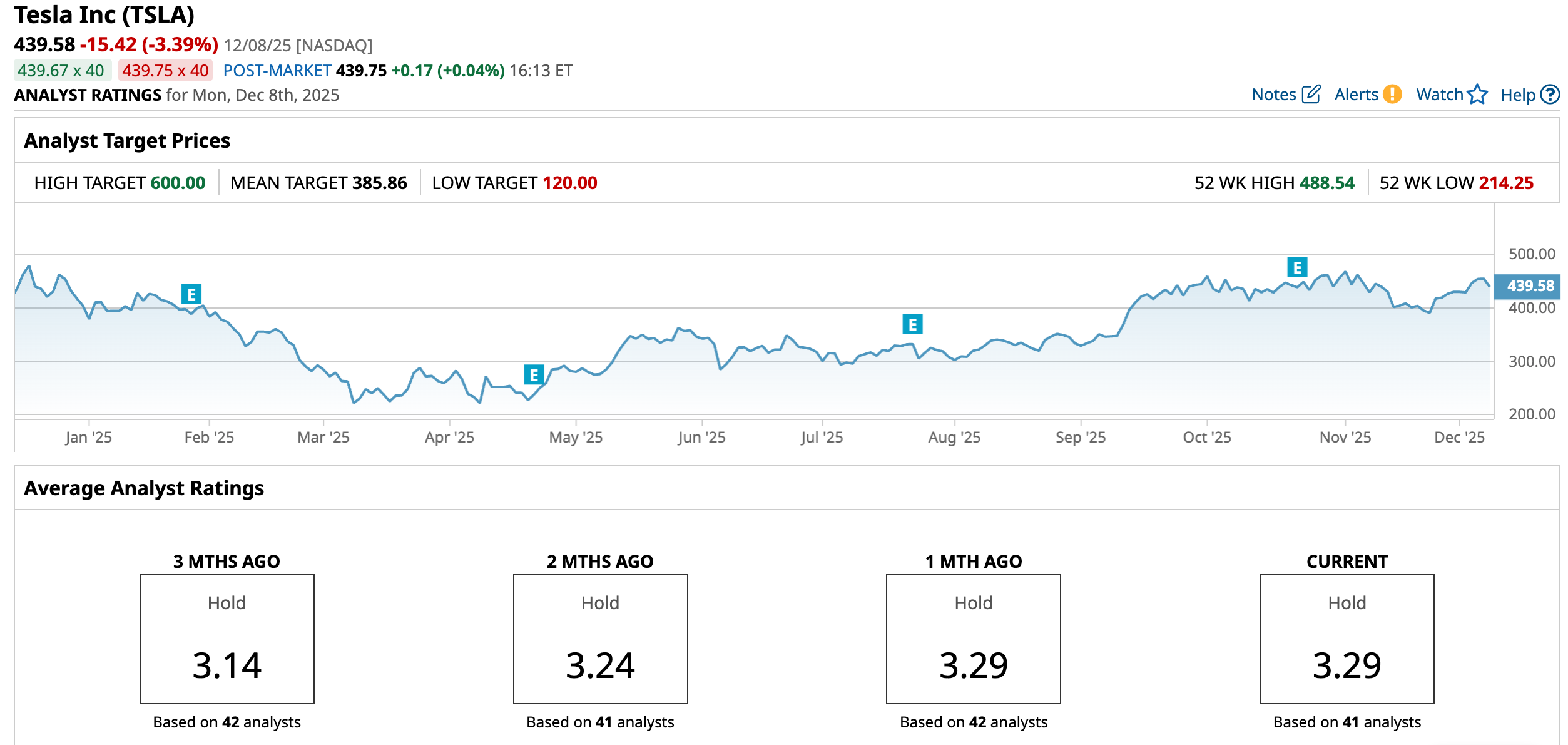

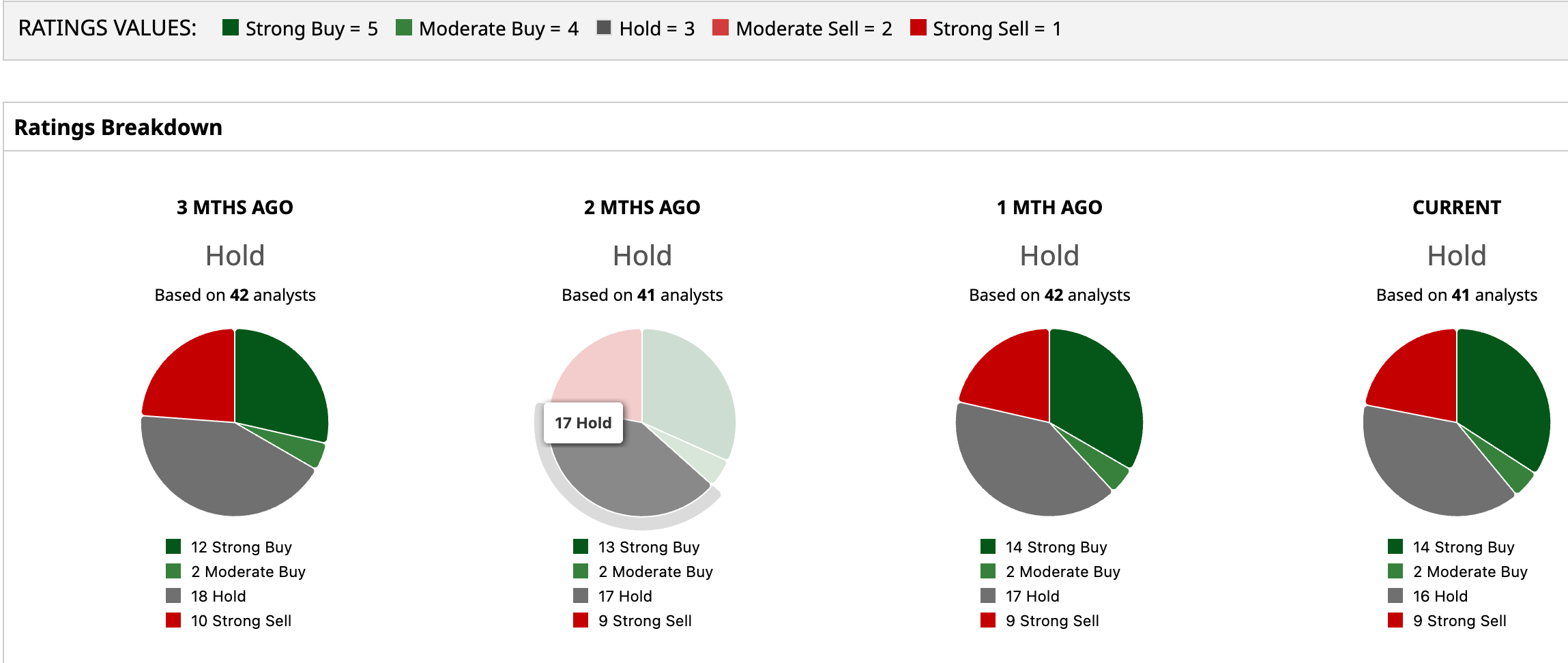

Analysts remain sharply divided on Tesla. The stock has a “Hold” rating overall. Of the 41 analysts covering the stock, 14 recommend a “Strong Buy,” two have a “Moderate Buy,” 16 suggest a “Hold,” and the remaining nine have a “Strong Sell” rating.

While the EV stock is currently trading above its mean price target of $385.86, Wedbush’s street-high of $600 implies potential upside of 36.5%.

On the date of publication, Sristi Suman Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- These 2 High-Yield Dividend Stocks Are Some of the Safest Buys Right Now

- A Low-Cost Model 3 Just Hit the Streets in Europe. Can That Help Turn Tesla Stock Around?

- Is It Too Late to Chase the IBM-Driven Rally in Confluent Stock?

- Here Is Where Option Traders Expect Carvana Stock to Be When It Joins the S&P 500 Index