Intel (INTC) has suddenly reemerged as one of the most talked-about names in semiconductor markets, and not just because of its own product launches or earnings. Recent reports suggest tech heavyweights Apple (AAPL) and Nvidia (NVDA) are exploring partnerships with Intel’s foundry business, potentially shifting portions of their 2028 chip production away from long-time contract manufacturer Taiwan Semiconductor (TSM) toward U.S.-based facilities.

Both Nvidia and Apple are reportedly keeping TSMC as their primary partner for high-end, mission-critical chips, while selectively bringing Intel into the supply chain. This strategy helps diversify manufacturing risk and supports domestic production goals without disrupting core performance roadmaps.

For Nvidia, the Feynman architecture (successor to Rubin) is expected to be the first major test case. While the main GPU die will remain with TSMC, parts of the I/O die could shift to Intel’s 14A process by 2028, following Nvidia’s $5 billion investment in Intel in late 2025. Intel is also set to handle up to 25% of advanced chip packaging using its EMIB technology, with TSMC retaining the majority.

Meanwhile, Apple is exploring a limited return to Intel fabs for entry-level M-series MacBook processors, marking its first meaningful manufacturing collaboration with Intel since transitioning to Apple Silicon in 2022. The move is driven largely by U.S. policy pressures and supply-chain diversification needs rather than performance considerations.

Does Intel’s emerging role as a domestic supply-chain alternative, buoyed by interest from Apple and Nvidia, make INTC stock a buy at current levels? Let's take a closer look.

About Intel Stock

Intel is a leading technology company specializing in the design, development, manufacture and marketing of semiconductor products, including microprocessors, chipsets, GPUs, memory and related hardware for consumer, enterprise and industrial markets. Headquartered in Santa Clara, California, Intel remains a key player in data center, PC and emerging artificial intelligence (AI) and networking segments. Intel’s market capitalization is around $243 billion, reflecting its valuation among the world’s largest semiconductor companies.

Intel's stock price has been one of the more dramatic stories in the semiconductor sector over the past year. After languishing through much of 2024 and early 2025 with share prices near multi-year lows, INTC stock began a remarkable turnaround in 2025, climbing substantially over the year as optimism about a refocused strategy and AI-linked opportunities took hold. On a 52-week basis, the stock has delivered 132% returns.

A key catalyst for the rebound was the U.S. government’s direct investment, stemming from an August 2025 deal under President Donald Trump's administration to purchase a sizable stake in Intel, aimed at reinforcing domestic semiconductor manufacturing capacity.

More recently, INTC stock surged after reports circulated that Nvidia and Apple may shift part of their future chip production to Intel’s foundry services, a move seen as a potential breakthrough for Intel’s long-struggling manufacturing business. This possible expansion of Intel’s customer base helped spark strong buying interest, lifting the stock around 11% on Jan. 28.

Nevertheless, Intel’s price action has remained volatile, with the stock experiencing both sharp rallies and sudden pullbacks. Intel stock reached a new 52-week high of $54.60 on Jan. 22, driven primarily by optimism about its business prospects. However, the stock fell as much as 17% in a single session on Jan. 23, after the company reported fourth-quarter results that beat expectations but issued weak guidance for Q1 2026.

As of this writing, INTC is up 26% year-to-date (YTD). The stock is also currently trading at a huge premium to its sector median at 1,091 times forward earnings.

Intel's Mixed Financial Performance

Intel reported its fourth-quarter and full-year 2025 earnings on Jan. 22. The results were a mix of modest beats and caution on the outlook.

For the quarter ended Dec. 27, Intel posted net revenue of $13.7 billion, which represents a year-over-year (YOY) decline of about 4% compared with Q4 2024. On profitability, Intel reported non-GAAP EPS of $0.15, which was up from around $0.13 a year earlier and well above analysts’ estimates.

The Data Center and AI (DCAI) segment delivered one of the strongest performances with approximately $4.7 billion in revenue, up about 9% YOY, highlighting healthy demand. By contrast, the Client Computing Group (CCG) generated about $8.2 billion in revenue, down 7% YOY.

Overall, Total Intel Products revenue was down slightly by about 1% YOY. Intel’s foundry unit reported roughly $4.5 billion in revenue, up 4% YOY, reflecting the continued ramp of advanced process technologies. Finally, the company's “All Other” category declined sharply.

For full-year 2025, Intel reported about $52.9 billion in revenue, which was essentially flat compared with 2024. Non-GAAP EPS came in at $0.42, significantly higher than the prior year and marking a return to profitability.

Intel provided guidance for the first quarter of 2026, forecasting revenue between $11.7 billion and $12.7 billion, with a midpoint roughly below consensus expectations. It also projected a non-GAAP EPS of $0, implying a continued lag in supply and margin expansion before anticipated improvements later in the year.

Analysts predict EPS to be around $0.07 for fiscal 2026, an improvement of 158% YOY, then again rise substantially to $0.55 in fiscal 2027.

What Do Analysts Expect for Intel Stock?

Recently, Tigress Financial Partners raised its price target on Intel to $66 while maintaining a “Buy” rating, citing strong confidence in the company’s turnaround. The firm pointed to AI data-center tailwinds, solid progress on Intel’s 18A process, and a potential AI-driven PC refresh cycle as key long-term catalysts. UBS also raised its price target on Intel to $52 but kept a “Neutral” rating.

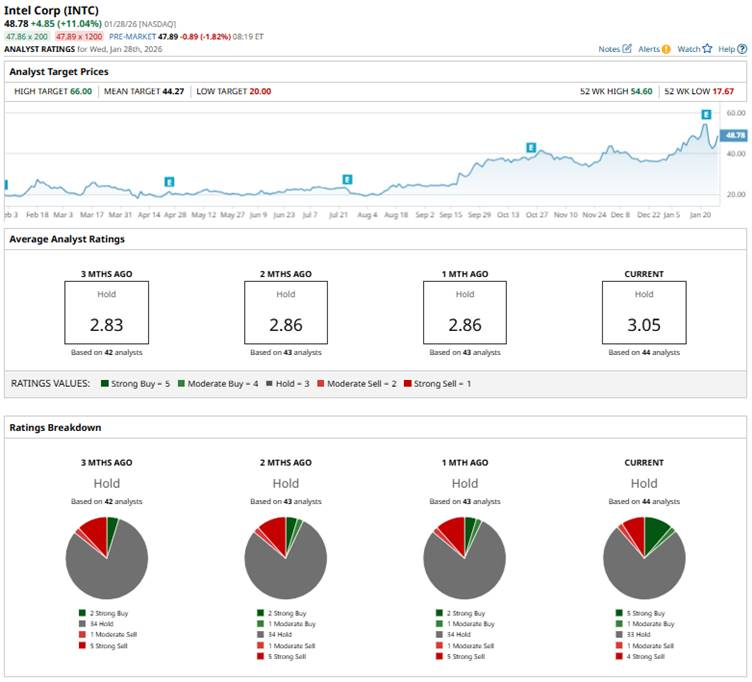

Overall, INTC stock has a consensus “Hold” rating, indicating a cautious stance. Of the 44 analysts covering the stock, five advise a “Strong Buy,” one recommends a “Moderate Buy,” 33 analysts are on the sidelines with a “Hold” rating, one suggests a “Moderate Sell,” and four propose a “Strong Sell.”

INTC has already surged past the average analyst price target of $44.27. Meanwhile, Tigress' Street-high target of $66 suggests as much as 43% potential upside from here.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Up 77% in the Past Year, This Analyst Says More Upside Is Still in Store for Applied Materials Stock

- This Trump Stock Just Announced a $100 Million Catalyst. Should You Buy Its Shares Now?

- Apple Is Reportedly Looking to Partner with Intel Foundry. Does That Make INTC Stock a Buy Here?

- Dear Disney Stock Fans, Mark Your Calendars for February 2