Healthpeak Properties, Inc. (DOC) is a fully integrated real estate investment trust (REIT) based in Denver, Colorado. Valued at a market cap of $12 billion, the company owns, operates, and develops high-quality real estate focused on healthcare discovery and delivery.

This healthcare REIT has considerably underperformed the broader market over the past 52 weeks. Shares of DOC have declined 18.1% over this time frame, while the broader S&P 500 Index ($SPX) has gained 15.5%. However, on a YTD basis, the stock is up 5.2%, surpassing SPX’s 1.9% uptick.

Similarly, DOC has lagged behind the State Street Real Estate Select Sector SPDR Fund’s (XLRE) 1.1% drop over the past 52 weeks but has exceeded XLRE’s 1.5% rise on a YTD basis.

On Jan. 7, Healthpeak shares rose 2.7% after the company announced plans to launch and list Janus Living through an IPO, creating a dedicated REIT focused on senior housing. Healthpeak will contribute its 34-community, 10,422-unit portfolio and act as external manager, while retaining a majority stake after the offering. The company has already filed a confidential draft registration with the U.S. Securities and Exchange Commission and is targeting the IPO for the first half of 2026, subject to market, regulatory, and financing conditions.

For FY2025 that ended in December, analysts expect DOC’s FFO to grow 1.1% year over year to $1.83 per share. The company’s earnings surprise history is promising. It met or exceeded the consensus estimates in each of the last four quarters.

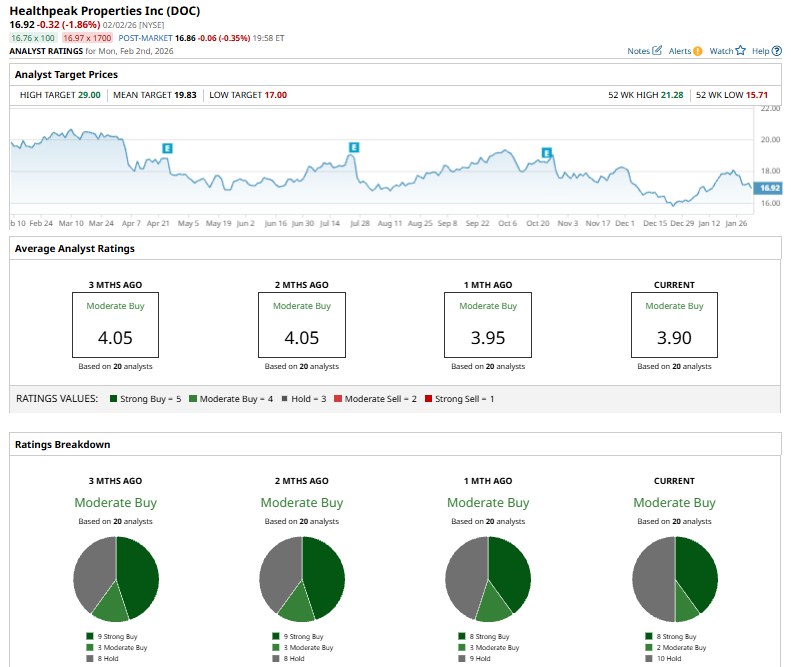

Among the 20 analysts covering the stock, the consensus rating is a "Moderate Buy,” which is based on eight “Strong Buy,” two "Moderate Buy,” and ten “Hold” ratings.

This configuration is slightly less bullish than two months ago, with nine analysts suggesting a “Strong Buy” rating.

On Jan. 9, Goldman Sachs initiated coverage of Healthpeak Properties with a “Neutral” rating and a $17 price target. Goldman highlighted the company’s portfolio transformation since 2019, driven largely by its 2024 merger with Physicians Realty Trust, which doubled its outpatient medical assets.

The mean price target of $19.83 represents a 17.2% premium from DOC’s current price levels, while the Street-high price target of $29 suggests an ambitious upside potential of 71.4%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart