Valued at a market cap of $28.6 billion, Fidelity National Information Services, Inc. (FIS) is a financial technology leader based in Jacksonville, Florida. It helps financial institutions, businesses, and governments process transactions securely and efficiently through core banking platforms, digital payment solutions, risk and compliance tools, and market infrastructure services.

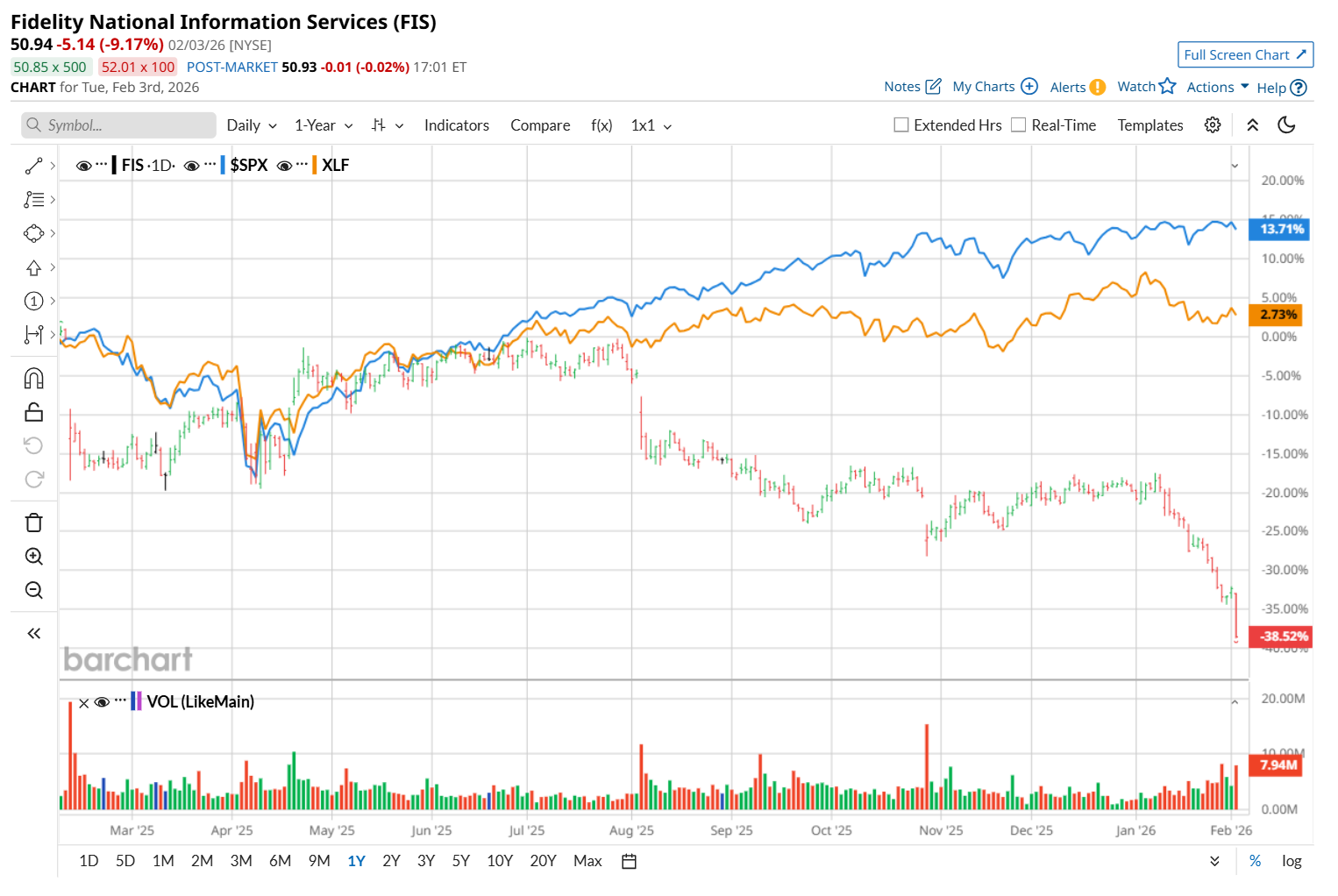

This fintech company has notably underperformed the broader market over the past 52 weeks. Shares of FIS have declined 37.8% over this time frame, while the broader S&P 500 Index ($SPX) has gained 15.4%. Moreover, on a YTD basis, the stock is down 23.4%, compared to SPX’s 1.1% uptick.

Narrowing the focus, FIS has also lagged behind the State Street Financial Select Sector SPDR ETF (XLF), which rose 4.4% over the past 52 weeks and declined 2.3% on a YTD basis.

On Nov. 8, FIS unveiled its Asset Servicing Management Suite, a unified platform built to automate and streamline key asset-servicing functions, including corporate actions, proxy voting, class-action and operational claims, and tax reclaims. By replacing fragmented, multi-vendor setups, the solution enhances efficiency, improves data accuracy, lowers costs, and reduces operational risk, while giving clients greater visibility and control across the entire asset-servicing lifecycle. The announcement was well received by the market, with FIS shares gaining about 1% in the following trading session.

For the current fiscal year, ending in December, analysts expect FIS’ EPS to grow 10.5% year over year to $5.77. The company’s earnings surprise history is promising. It met or topped the consensus estimates in each of the last four quarters.

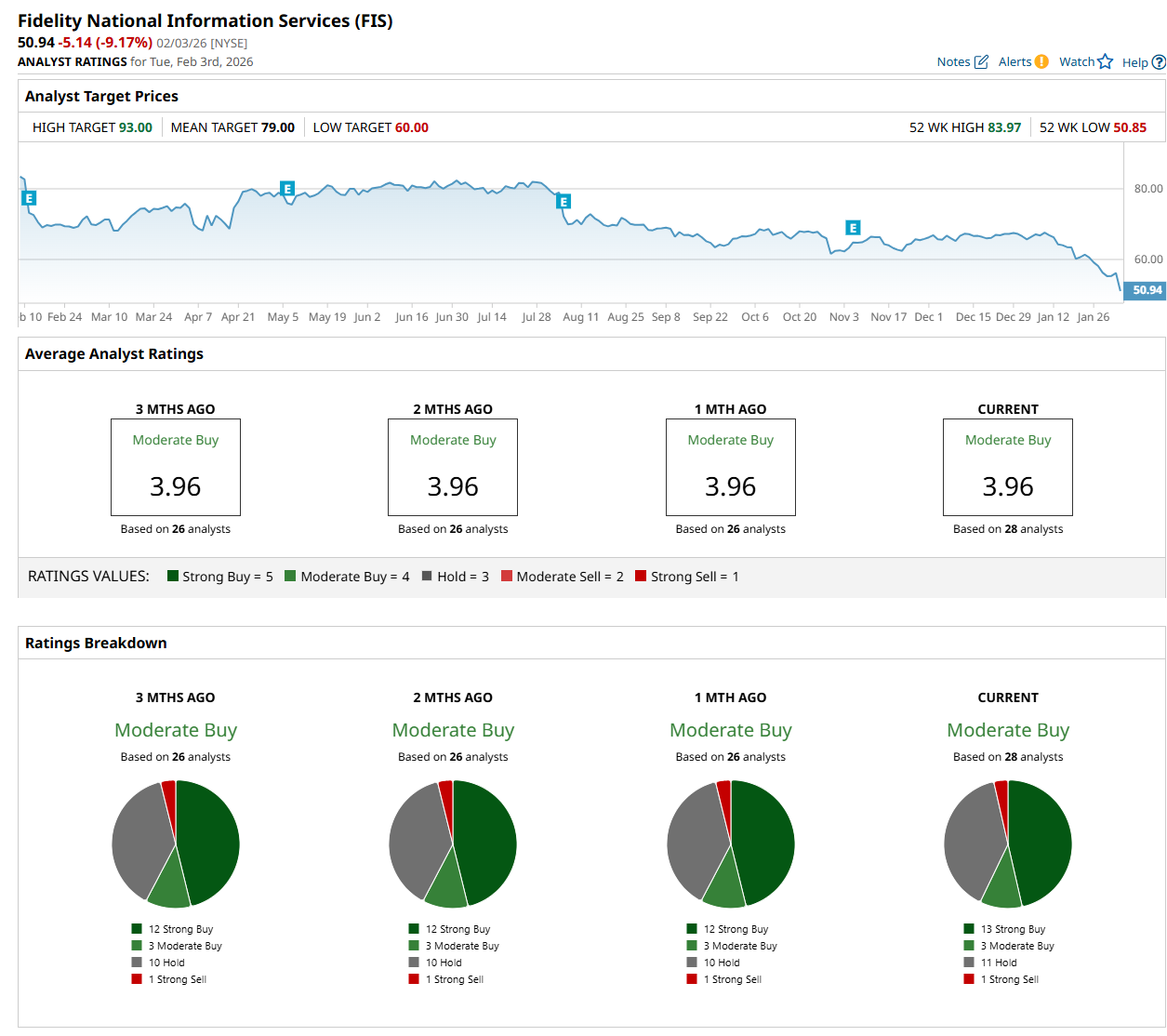

Among the 28 analysts covering the stock, the consensus rating is a "Moderate Buy,” which is based on 13 “Strong Buy,” three "Moderate Buy,” 11 "Hold,” and one “Strong Sell” ratings.

The configuration is more bullish than a month ago, with 12 analysts suggesting a "Strong Buy” rating.

On Jan. 26, Cantor Fitzgerald initiated coverage of FIS with an “Overweight” rating and $72 price target, indicating a 41.3% potential upside from the current levels.

The mean price target of $79 represents a 55.1% premium from FIS’ current price levels, while the Street-high price target of $93 suggests an ambitious 82.6% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Dear Qualcomm Stock Fans, Mark Your Calendars for February 4

- Palantir CEO Alex Karp Says ‘Inexplicable Growth in Revenue, but Not Inexplicable Growth in Customers’ Is Ahead. What Does That Mean for PLTR Stock?

- FuboTV Stock Plunges Deep Into Oversold Territory on Reverse Stock Split News. Should You Buy the Dip?

- Even More Layoffs Are Coming at Amazon. What Does That Mean for AMZN Stock?