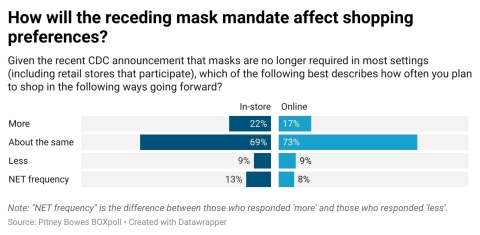

Consumers have mixed reactions to the easing of mask mandates: 22% will shop in-store more often while 17% will shop online more often

47% of consumers shop online more often today than before the pandemic

Pitney Bowes Inc. (NYSE: PBI), a global technology company that provides commerce solutions in the areas of ecommerce, shipping, mailing and financial services, today released results from its weekly BOXpoll™ consumer surveys, which found that ecommerce utilization rates remain high in the U.S., even as mask mandates ease, stores reopen and more than half of eligible U.S. citizens are vaccinated.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210629005722/en/

Pitney Bowes BOXpoll consumer surveys show pandemic's impact on U.S. consumer shopping habits (Graphic: Business Wire)

Forty-seven percent of U.S. consumers shop online more often today than they did before the pandemic. While this statistic underscores the record growth of ecommerce over the past 15 months, it also represents a seven-percentage point (pp) decrease from January and the longest sustained drop below 50% since BOXpoll started tracking the metric last August.

What’s behind the decrease? The easing of mask mandates seems to have had some impact, as 22% of consumers say they will shop in-store more often as a result of mandates being eased, versus 17% who say they will shop online more often for the same reason.

Driving this divergence are the attitudes of those who are vaccinated, versus those who are not.

- Those planning to take a COVID-19 vaccine (about 12% of consumers) are significantly less likely to be shopping in-store moving forward (12% less, compared to 8% of all respondents). They’re also significantly more likely to be shopping online more often (33% vs 16% of all respondents).

- Meanwhile, the behaviors of those who have already received at least one shot (57% of U.S. adults) seem to be aligned with those who are not planning to get the vaccine (21% of U.S. adults), with minimal difference in responses.

“The pandemic accelerated the shift from in-store to online shopping at a remarkable pace,” said Gregg Zegras, EVP and President, Global Ecommerce at Pitney Bowes. “Even as we see evidence of some natural regression in ecommerce utilization as vaccine rates increase and mask mandates ease, our latest surveys indicate that most of the shift from in-store to online shopping will be permanent.”

An elastic silver lining for fashion retailers. Americans buying more; bracketing less.

The reopening of stores, restaurants, entertainment venues and some offices are driving extraordinary year-over-year increases in clothing and accessory purchases. At the same time, the pandemic seems to have influenced fashion trends, at least in the near term. Namely, spandex may be woven into everything we wear now—at home, on the go, and even at work. BOXpoll found that the preference for comfortable clothing may be influencing another shopping trend that had fashion retailers anxious before the pandemic: bracketing – the practice of buying multiple sizes with the intent of returning what doesn’t fit.

- Forty-one percent of all consumers (ages 18+) confess to bracketing, a 10pp decrease from a 2019 Pitney Bowes consumer survey, driven by a 9pp decrease among those who said they “always” or “frequently” bracket.

-

Compared to last year—when few were buying clothes without an elastic waistband—only 8% of consumers say they bracket more often, and greater than 1 in 4 (28%) say they now bracket less than last year, totaling a net decrease of 20%

- Sixteen percent of millennials report bracketing more now versus last year

- Meanwhile, nearly 40% of Gen Z— the generation most affected by lower incomes and higher unemployment—report bracketing less than last year

Guarantee it.

BOXpoll also reveals the influence of delivery guarantees on consumers’ perceptions of – and behavior towards – a brand.

- Sixty-nine percent of consumers questioned agree that offering a delivery guarantee makes a retailer appear more trustworthy.

- Sixty-five percent say that seeing a delivery guarantee makes them more willing to buy from a retailer’s site

- Fifty-two percent would be more likely to buy from a retailer offering delivery guarantees than on offering fast shipping

- Parents are the most likely segment, at 53%, to buy from a higher-priced retailer who offers a delivery guarantee over a less-expensive retailer, offering the same product without a delivery guarantee.

- Groceries, vitamins, pet supplies and personal care items are the products consumers would like to see retailers offer guarantees for the most

Methodology

BOXpoll™ by Pitney Bowes is a weekly consumer survey on current events, culture and ecommerce logistics. Morning Consult conducts weekly polls on behalf of Pitney Bowes among a national sample of more than 2,000 online shoppers. The results included in this press release are extracted from surveys conducted over the past month. The interviews were conducted online, and the data were weighted to approximate a target sample of adults based on age, educational attainment, gender, race, and region. Results from the full survey have a margin of error of +/- 2 percentage points.

About Pitney Bowes

Pitney Bowes (NYSE: PBI) is a global technology company providing commerce solutions that power billions of transactions. Clients around the world, including 90 percent of the Fortune 500, rely on the accuracy and precision delivered by Pitney Bowes solutions, analytics, and APIs in the areas of ecommerce fulfillment, shipping and returns; cross-border ecommerce; office mailing and shipping; presort services; and financing. For 100 years Pitney Bowes has been innovating and delivering technologies that remove the complexity of getting commerce transactions precisely right. For additional information visit Pitney Bowes at www.pitneybowes.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210629005722/en/

Contacts

Brett Cody

Pitney Bowes

(203) 218 1187

brett.cody@pb.com