It’s been a tough year for payments platform fintech Block (NYSE: SQ) stock as it trades down (-58%) on the year. The old adage, “it’s better to have had and lost, than to never had it at all” is what optimistic investors must remind themselves every day. The pandemic was a boon for e-commerce and payments companies like Block, PayPal (NASDAQ: PYPL), Shopify (NASDAQ: SHOP), Ali Baba (NASDAQ: BABA), Amazon (NASDAQ: AMZN), and Apple (NASDAQ: AAPL) as consumers migrated to the digital economy which includes payments and investing. Bitcoin’s dramatic run up over $64,000 surged profits for Block accounting for nearly 70% of its total revenues in 2021. Unfortunately, the tragic collapse back down to $20,000 has left a lot of bagholders in its wake taking the focus away from its other segments. Sentiment has taken a complete nosedive as consumer’s rein in spending due to rising inflation and bitcoin prices can’t seem to rebound too much beyond the $20,000 level. As the hangover clears and the extreme 2021 year-over-year (YoY) comps get behind them, investors can reassess the strengths of Block’s ecosystems and their cumulative multiplier effect.

Network Effect of Ecosystems

At its core, Block successfully demonstrates how the network effect along with a one-stop shop strategy that enables overlapping services connecting merchants with consumers can have a multiplier effect on revenues. As the bitcoin mania has subsided, investors can focus back on the core drivers of its business. The two main ecosystems are the Square payments processing platform and merchant network and the $Cash app. Bitcoin trades are made through the $Cash App. The key point here is that while bitcoin prices have tanked, transaction volumes from its two ecosystems have continued to grow double-digits.

Legacy Square Ecosystem

Square is the legacy business that enables medium, and small businesses down to a single person accept and process credit card and digital payments. The business continues to expand at a slower rate as competition is plenty. The Square for Restaurants product suite that enables first and third party integrations for sellers. It’s product suite restaurants empowers any sized restaurant to control various aspects of its business from point-of-sale (POS) to delivery orders and team management. Its platform makes it easier for new Square businesses to import menus or create automated menus from PDF, photos, or websites. In-person integration has been added for Square sellers in the U.S. and Australia.

$Cash App Ecosystem

The $Cash App is the primary growth driver as it continues to add features for consumers to make digital payments, stock and bitcoin investments, and find deals on products and services. The $Cash App is becoming the central hub for its consumers beyond payments. It’s a discovery tool to find products, brands, offers, and businesses. Like Acorns, the Cash App also added a Round Ups feature that lets users invest the spare change rounded up to the nearest dollar on Cash App Card purchases into stock or Bitcoin. As a one-stop hub for transactions, $Cash App’s only true competitor is PayPal and its Venmo app.

Reversion Back to the Normal

Block’s recent quarter may be bringing the business back down to a normal baseline after digesting the pandemic gains as yearly comps become more reasonable. On Aug. 4, 2022, Block reported its Q2 2022 earnings for the quarter ended June 2022. The Company reported earnings-per-share (EPS) profits of $0.18 beating consensus analyst estimates for $0.20, by $0.02. Revenues fell (-5.8%) year-over-year (YoY) to $4.41 billion beating the $4.33 billion consensus analyst estimates. Rising operating expenses caused adjusted EBITDA to drop to $187 million compared to $360 million in the same period a year ago. Much of the operating expenses are related to the Afterpay platform. Square generated $681 million in gross profits, up 16% YoY, excluding $75 million gross profit from Afterpay . Afterpay added $150 million in gross profits split between Square and $Cash App. The $Cash App Business GPV rose 4% YoY to $4.2 billion. Cash App delivered gross profit of $705 million, up 29% YoY or 15% excluding Afterpay. The $Cash App generated $116 million in transaction-based revenues, up 5% thanks to increasing business accounts and transactions.

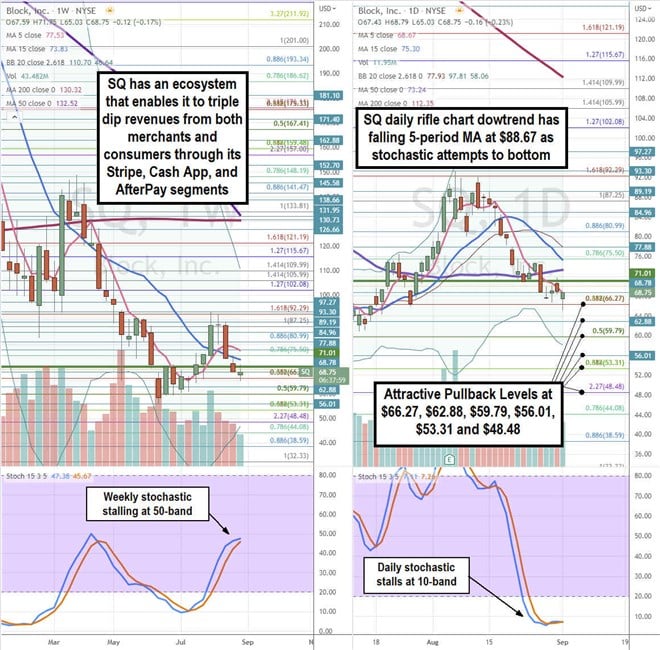

Here’s What the Charts Say

Using the rifle charts on a weekly and daily time frame provides a precision view of the landscape for SQ stock. The weekly rifle chart uptrend peaked near the $92.29 Fibonacci (fib) level. The weekly 5-period moving average (MA) support is starting to slope down at $71.53 along with the 15-period MA at $73.83. The weekly stochastic is still rising but slowing down at the 50-band. The weekly market structure low (MSL) buy triggers on the $71.01 breakout. The weekly upper Bollinger Bands (BBs) are compressing at $110.70 with weekly lower BBs at $46.64. The daily rifle chart has been downtrending with a falling 5-period MA resistance at $68.67 followed by the 15-period MA resistance at $75.30 wit the 50-period MA at $73.24. The daily lower BBs sit at $58.06. The daily stochastic completed a full oscillation down to attempt a bounce off the oversold 10-band. Attractive pullback levels sit at the $66.27 fib, $62.88, $59.79 fib, $56.01, $53.31 fib, and the $48.48 fib level.

Connecting the Ecosystems

Block CEO Jack Dorsey commented, “We continue to make progress, connecting our ecosystems. The connections we are building like with Afterpay are what set us apart and make us so valuable to our customers. In Cash App, we're just starting to bring Afterpay's discovery capabilities into our ecosystem. The greatest combined opportunity we see is in commerce. Afterpay will introduce discovery and shopping to build on the elements that Cash App has already created around commerce, like Cash App Pay and Boost. We believe our new design with Cash App will let us scale new products and drive deeper engagement. We're rolling out a new Discover tab to the main navigation, making it easier for customers to find and use brands and products that can save on with Boost and Pay in with installments with Afterpay.”

Afterpay Omnichannel Energizer

Afterpay is buy-now-pay-later (BNPL) service that Block is integrating into its Square and $Cash app ecosystems. It brings the transaction sequence full circle. It provides the option for customers to purchase items up front and make installment payments seamlessly from the app or online. It’s been proven to bolster sales for merchant and spending from consumers. It’s an omnichannel tool that will let sellers in the network help grow sales both online and in-person. Afterpay omnichannel customers spent 3X more than single channel consumers in 2021. This is the growth driver as it adds another layer of fees to merchants and customers with each sale. $Cash App users can use Afterpay to seamlessly purchase items on a convenient payment plan that can automatically withdraw funds from the connect banking source. Afterpay is an energizer that will bolster both the Square and $Cash App ecosystems. A rise in bitcoin prices is just icing on top of the multi-layered cake. In a nutshell, both the Square and $Cash App businesses grew 29% YoY while bitcoin tanked (-60%). The stock is down (-58%) for the year. Back out the bitcoin price drop, and you still have a solid growth company with its core businesses growing at a 29% YoY clip.