If The Coca-Cola Company (NYSE: KO) and PepsiCo (NASDAQ: PEP) were just about beverages, then The Coca-Cola Company would be the better choice. It is the larger of the 2 regarding its position in the beverage market, but this is not just a beverage story we are discussing. PepsiCo is a diversified play on snacks, breakfast, and beverages with much more to offer. Along with the diversification is a portfolio of brands with pricing power and consumer demand driving sustainable growth.

Considering they are both Dividend Kings with the power to continue raising their dividends, the choice is easy unless you just like The Coca-Cola Company or want pure-play exposure.

“Our results demonstrate that the investments we have made to become an even Faster, even Stronger, and even Better organization by Winning with pep+ are laying the foundation for durable and sustainable growth. We remain committed to our strategic agenda and will continue to invest in our people, brands, supply chain, go-to-market systems, and digitization initiatives to build competitive advantages and win in the marketplace.”

PepsiCo Outpaces Consensus, Guides Higher

Pepsico had a strong quarter in which pricing gains helped to offset weakness in volume sales. The company reported $17.85 billion in net revenue for a gain of 10.2% compared to last year. This is $.580 billion better than expected or 330 bps above the Marketbeat.com consensus due to strength in most operating geos.

Frito-Lay North America grew by 15% compared to 9% at Quaker and 8% at PepsiCo NA. Latin America was also strong with 21% growth, while Europe and AMS grew by low-single-digits and APAC contracted by 1%. FX also played a role; on an organic basis, sales are 14.3% and come with a widening margin.

The company’s GAAP gross margin widened by about 90 bps, and although the operating margin declined due to a benefit received in the prior year, the adjusted figures are much better. The adjusted margin improved compared to last year on pricing actions that left the EPS at $1.50 or up 18% YOY and $0.11 better than expected.

This led to an improvement in guidance, with revenue growing 8% this year compared to the previous 6% estimate and EPS of $7.25. That’s up 100 basis points compared to the prior guidance, but only as expected regarding the analyst consensus. The takeaway is that consensus was met, but there was an underlying fear in the market that the guidance would worsen.

The Analysts Are Pushing PepsiCo Higher

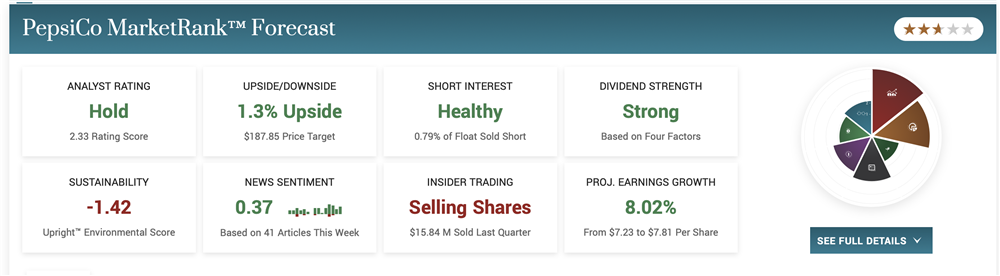

Marketbeat.com’s analyst tracking tools haven’t picked up any new commentaries yet, but the data takeaway is bullish. The consensus sentiment is down to a firm Hold compared to last year’s Moderate Buy, but the price target is trending higher compared to last year, last quarter and last month.

The most recent 3 reports came out in April, just ahead of the Q1 release, and include 3 price targets above the consensus price target and the current price action. Assuming this trend continues now that results are in, this stock’s target will continue to trend higher in 2023.

Pepsico’s shares are up more than 2.0% following the Q1 release and are trading at a new all-time high. This move is a break-out that crosses a critical resistance point and opens the door for a sustainable rally. Based on the price, PepsiCo stock could gain as much as $20 in the next few weeks and trade firmly above the $200 level.