As the Q2 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the software development industry, including Twilio (NYSE: TWLO) and its peers.

As legendary VC investor Marc Andreessen says, "Software is eating the world", and it touches virtually every industry. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming.

The 11 software development stocks we track reported a mixed Q2. As a group, revenues beat analysts’ consensus estimates by 1.6% while next quarter’s revenue guidance was in line.

Inflation progressed towards the Fed's 2% goal recently, leading the Fed to reduce its policy rate by 50bps (half a percent or 0.5%) in September 2024. This is the first cut in four years. While CPI (inflation) readings have been supportive lately, employment measures have bordered on worrisome. The markets will be debating whether this rate cut's timing (and more potential ones in 2024 and 2025) is ideal for supporting the economy or a bit too late for a macro that has already cooled too much.

Luckily, software development stocks have performed well with share prices up 10.8% on average since the latest earnings results.

Twilio (NYSE: TWLO)

Founded in 2008 by Jeff Lawson, a former engineer at Amazon, Twilio (NYSE: TWLO) is a software as a service platform that makes it really easy for software developers to use text messaging, voice calls and other forms of communication in their apps.

Twilio reported revenues of $1.08 billion, up 4.3% year on year. This print exceeded analysts’ expectations by 2.4%. Despite the top-line beat, it was still a mixed quarter for the company with a solid beat of analysts’ EBITDA estimates but decelerating customer growth.

“We are running the business with increased rigor and discipline, as evidenced by a record quarter of revenue and non-GAAP income from operations, as well as another quarter of strong cash generation,” said Khozema Shipchandler, CEO of Twilio.

Interestingly, the stock is up 27.1% since reporting and currently trades at $71.52.

Read our full report on Twilio here, it’s free.

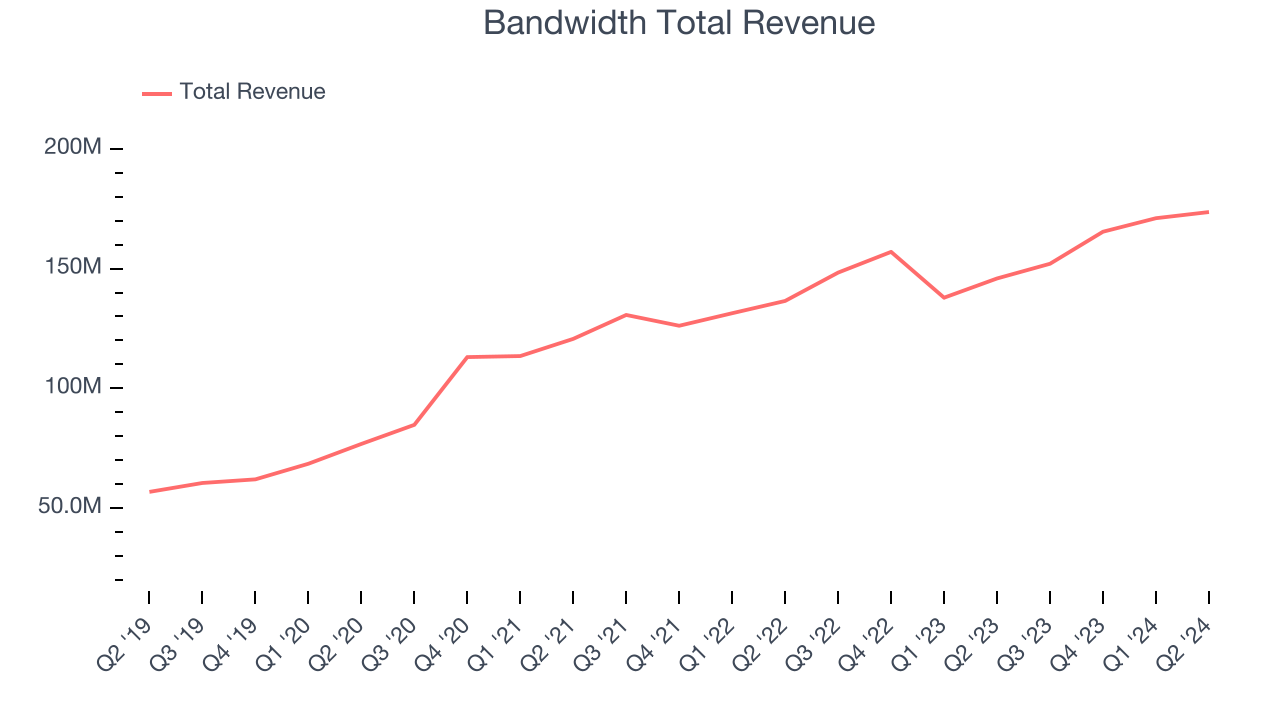

Best Q2: Bandwidth (NASDAQ: BAND)

Started in 1999 by David Morken who was later joined by Henry Kaestner as co-founder in 2001, Bandwidth (NASDAQ: BAND) provides thousands of customers with a software platform that uses its own global network to provide phone numbers, voice, and text connectivity.

Bandwidth reported revenues of $173.6 million, up 19% year on year, in line with analysts’ expectations. The business had a strong quarter with an impressive beat of analysts’ EBITDA estimates and a significant improvement in its net revenue retention rate.

Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 21.2% since reporting. It currently trades at $17.94.

Is now the time to buy Bandwidth? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: PagerDuty (NYSE: PD)

Started by three former Amazon engineers, PagerDuty (NYSE: PD) is a software-as-a-service platform that helps companies respond to IT incidents fast and make sure that any downtime is minimized.

PagerDuty reported revenues of $115.9 million, up 7.7% year on year, in line with analysts’ expectations. It was a slower quarter as it posted underwhelming revenue and earnings guidance for the next quarter.

PagerDuty delivered the weakest full-year guidance update in the group. The company lost 76 customers and ended up with a total of 15,044. As expected, the stock is down 2% since the results and currently trades at $17.92.

Read our full analysis of PagerDuty’s results here.

Datadog (NASDAQ: DDOG)

Named after a database the founders had to painstakingly look after at their previous company, Datadog (NASDAQ: DDOG) is a software-as-a-service platform that makes it easier to monitor cloud infrastructure and applications.

Datadog reported revenues of $645.3 million, up 26.7% year on year. This result topped analysts’ expectations by 3.2%. It was a strong quarter as it also put up an impressive beat of analysts’ billings and EBITDA estimates.

The company added 50 enterprise customers paying more than $100,000 annually to reach a total of 3,390. The stock is up 14.8% since reporting and currently trades at $124.11.

Read our full, actionable report on Datadog here, it’s free.

Cloudflare (NYSE: NET)

Founded by two grad students of Harvard Business School, Cloudflare (NYSE: NET) is a software as a service platform that helps improve security, reliability and loading times of internet applications and websites.

Cloudflare reported revenues of $401 million, up 30% year on year. This result surpassed analysts’ expectations by 1.6%. Taking a step back, it was a mixed quarter as it also recorded an impressive beat of analysts’ EBITDA estimates but a miss of analysts’ billings estimates.

The stock is up 21.5% since reporting and currently trades at $90.43.

Read our full, actionable report on Cloudflare here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.