Lennox has had an impressive run over the past six months as its shares have beaten the S&P 500 by 14.7%. The stock now trades at $614.31, marking a 25.1% gain. This was partly due to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is now the time to buy LII? Or is this a case of a company fueled by heightened investor enthusiasm? Find out in our full research report, it’s free.

Why Does Lennox Spark Debate?

Based in Texas and founded over a century ago, Lennox (NYSE: LII) is a climate control solutions company offering heating, ventilation, air conditioning, and refrigeration (HVACR) goods.

Two Things to Like:

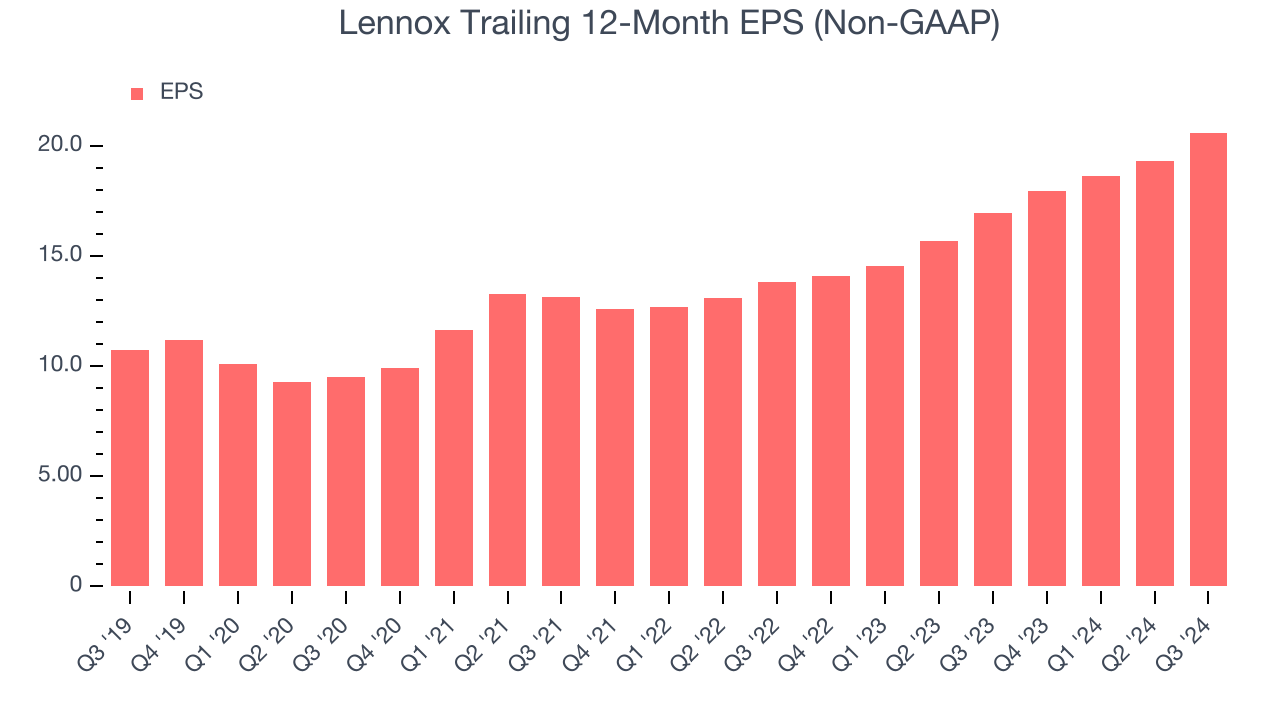

1. Long-Term EPS Growth Is Outstanding

Analyzing the long-term change in earnings per share (EPS) tells us whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Lennox’s EPS grew at a remarkable 14% compounded annual growth rate over the last five years, higher than its 6.8% annualized revenue growth. This tells us the company became more profitable as it expanded.

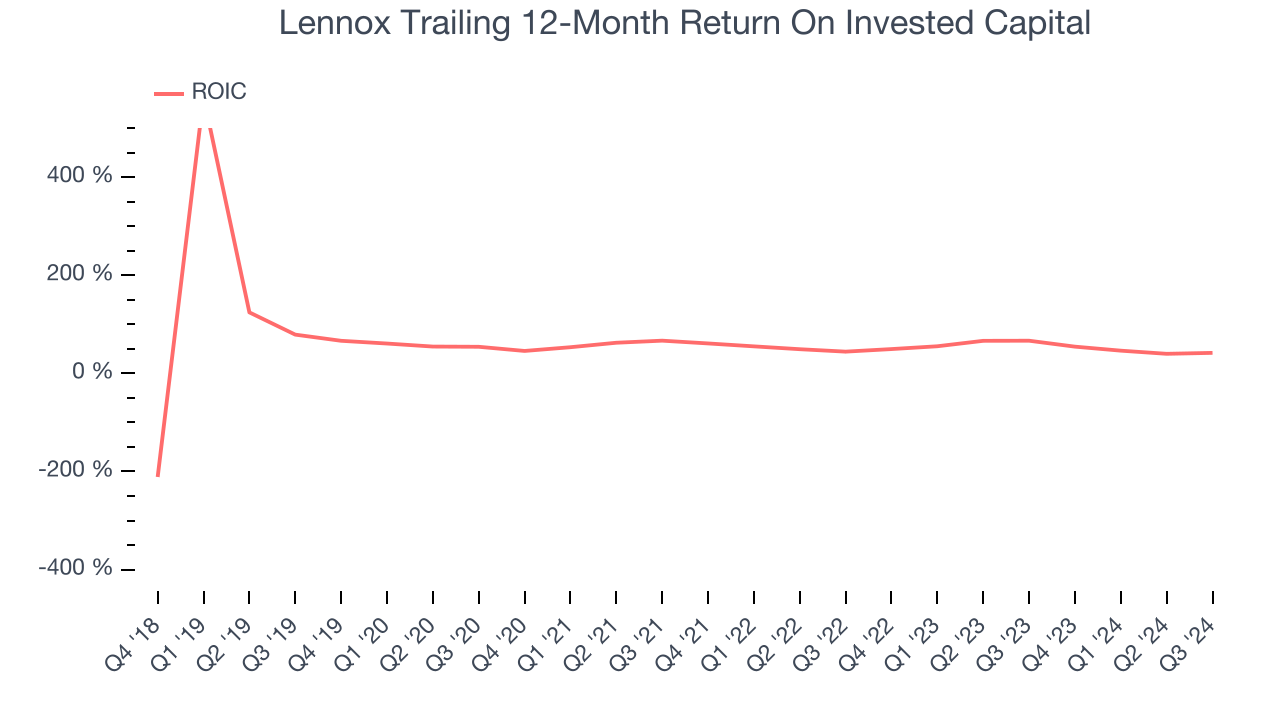

2. Stellar ROIC Showcases Lucrative Growth Opportunities

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Lennox’s five-year average ROIC was 54.8%, placing it among the best industrials companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

One Reason to be Careful:

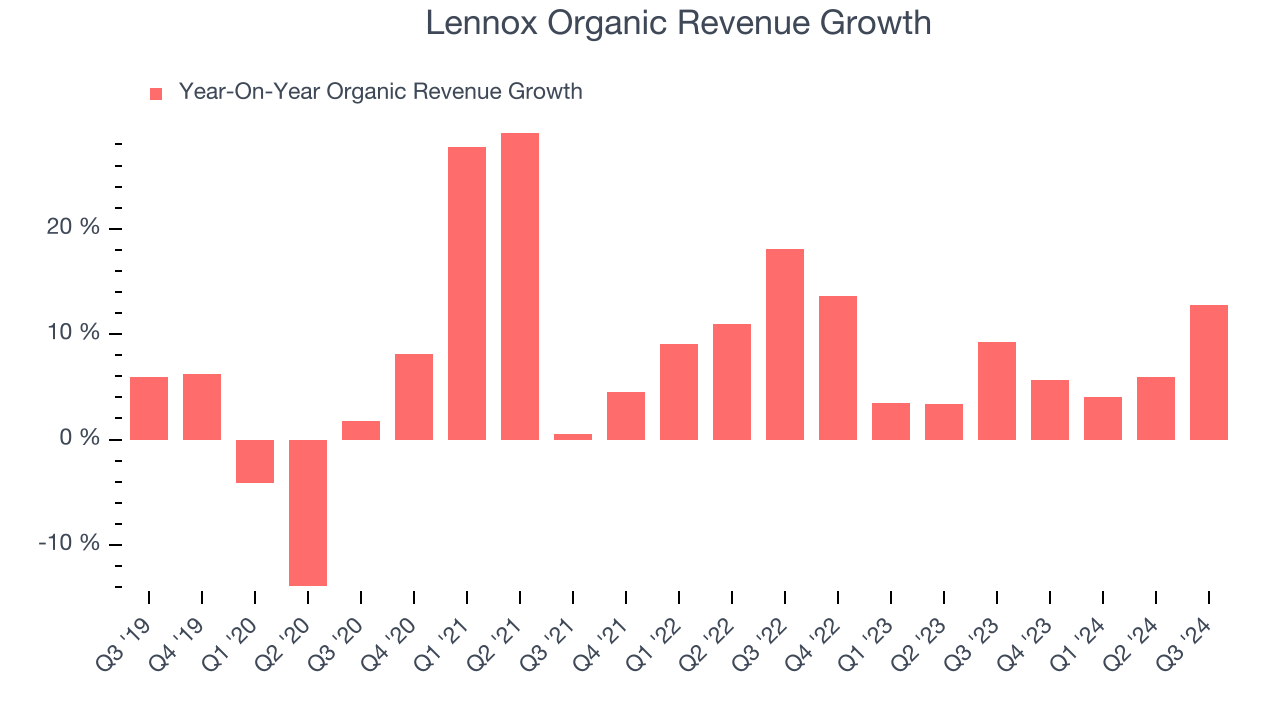

Slow Organic Growth Suggests Waning Demand In Core Business

We can better understand HVAC and Water Systems companies by analyzing their organic revenue. This metric gives visibility into Lennox’s core business as it excludes one-time events such as mergers, acquisitions, and divestitures as well as foreign currency fluctuations.

Over the last two years, Lennox’s organic revenue averaged 7.3% year-on-year growth. This performance slightly lagged the sector and suggests it may need to improve its products, pricing, or go-to-market strategy, which can add an extra layer of complexity to its operations.

Final Judgment

Lennox’s merits more than compensate for its flaws, and with its shares beating the market recently, the stock trades at 27.5x forward price-to-earnings (or $614.31 per share). Is now the right time to initiate a position? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than Lennox

With rates dropping, inflation stabilizing, and the elections in the rear-view mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.