Data-mining and analytics company Palantir (NYSE: PLTR) reported revenue ahead of Wall Street’s expectations in Q3 CY2024, with sales up 30% year on year to $725.5 million. On top of that, next quarter’s revenue guidance ($769 million at the midpoint) was surprisingly good and 3.4% above what analysts were expecting. Its non-GAAP profit of $0.10 per share was also 10.1% above analysts’ consensus estimates.

Is now the time to buy Palantir? Find out by accessing our full research report, it’s free.

Palantir (PLTR) Q3 CY2024 Highlights:

- Revenue: $725.5 million vs analyst estimates of $703.7 million (3.1% beat)

- Adjusted EPS: $0.10 vs analyst estimates of $0.09 (beat by $0.01)

- EBITDA: $283.6 million vs analyst estimates of $244.9 million (15.8% beat)

- Revenue Guidance for Q4 CY2024 is $769 million at the midpoint, above analyst estimates of $744 million

- Gross Margin (GAAP): 79.8%, in line with the same quarter last year

- Operating Margin: 15.6%, up from 7.2% in the same quarter last year

- EBITDA Margin: 39.1%, up from 30.8% in the same quarter last year

- Free Cash Flow Margin: 59.9%, up from 21.9% in the previous quarter

- Billings: $676.9 million at quarter end, up 33.8% year on year

- Market Capitalization: $93.88 billion

“We absolutely eviscerated this quarter, driven by unrelenting AI demand that won’t slow down. This is a U.S.-driven AI revolution that has taken full hold. The world will be divided between AI haves and have-nots. At Palantir, we plan to power the winners,” said Alexander C. Karp, Co-Founder and Chief Executive Officer of Palantir Technologies Inc.

Company Overview

Started by Peter Thiel after seeing US defence agencies struggle in the aftermath of the 2001 terrorist attacks, Palantir (NYSE: PLTR) offers software as a service platform that helps government agencies and large enterprises use data to make better decisions.

Data Analytics

Organizations generate a lot of data that is stored in silos, often in incompatible formats, making it slow and costly to extract actionable insights, which in turn drives demand for modern cloud-based data analysis platforms that can efficiently analyze the siloed data.

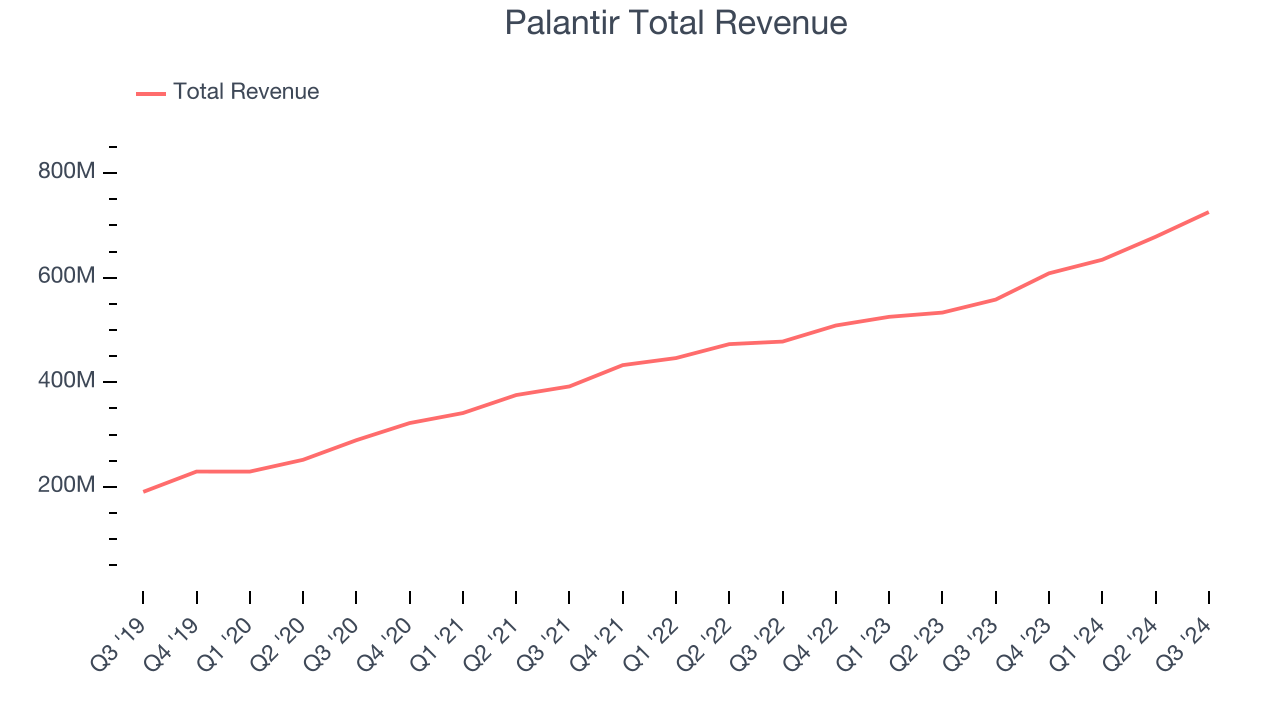

Sales Growth

A company’s long-term performance is an indicator of its overall business quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for multiple years. Over the last three years, Palantir grew its sales at a decent 22.7% compounded annual growth rate. This is a useful starting point for our analysis.

This quarter, Palantir reported robust year-on-year revenue growth of 30%, and its $725.5 million of revenue topped Wall Street estimates by 3.1%. Management is currently guiding for a 26.4% year-on-year increase next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 19.9% over the next 12 months, a slight deceleration versus the last three years. This projection is still commendable and shows the market is factoring in success for its products and services.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

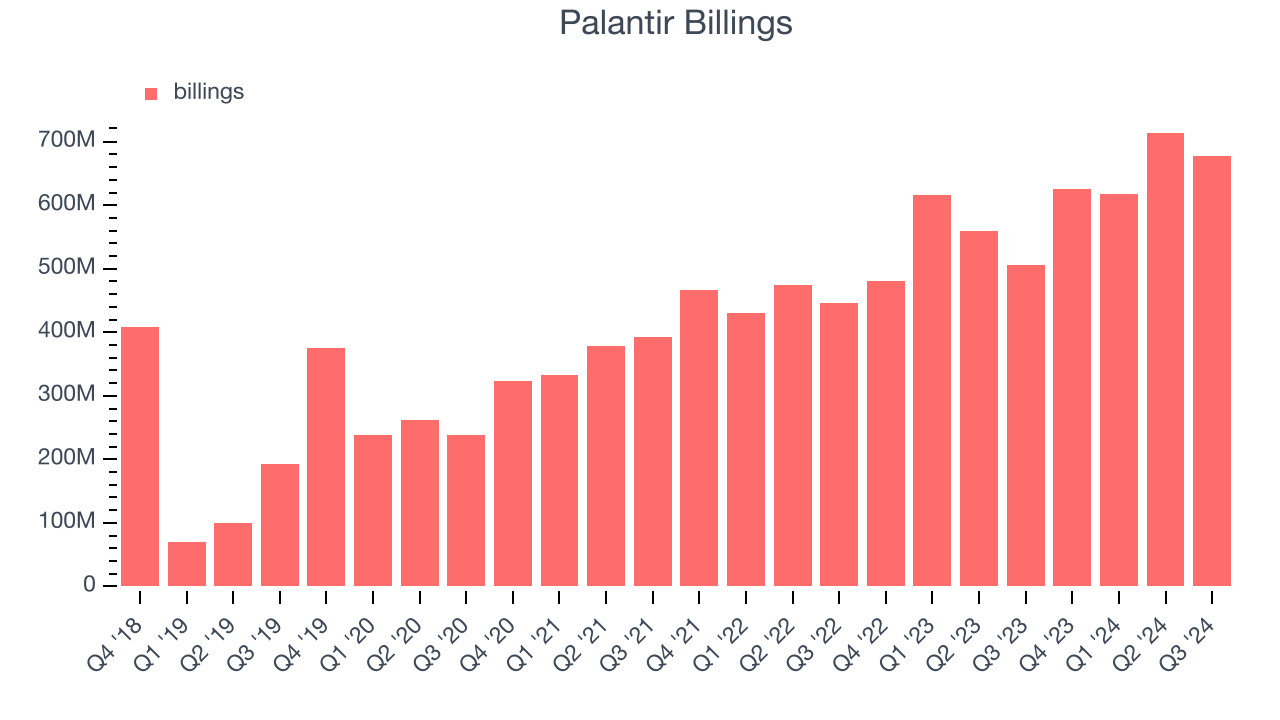

Billings

In addition to revenue, billings is a non-GAAP metric that sheds additional light on Palantir’s business quality. Billings is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Over the last year, Palantir’s billings growth has been impressive, averaging 22.9% year-on-year increases and punching in at $676.9 million in the latest quarter. This performance was in line with its revenue growth, indicating robust customer demand and a strong sales pipeline. The high level of cash collected from customers also enhances liquidity and provides a solid foundation for future investments and growth.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Palantir is extremely efficient at acquiring new customers, and its CAC payback period checked in at 18.2 months this quarter. The company’s efficiency indicates that it has a highly differentiated product offering and strong brand reputation, giving it the freedom to invest resources into new growth initiatives while maintaining optionality.

Key Takeaways from Palantir’s Q3 Results

We were impressed by how significantly Palantir blew past analysts’ revenue and EBITDA expectations this quarter. We were also glad it raised its full-year revenue and adjusted operating income guidance. Overall, this quarter had some key positives. The stock traded up 13.7% to $47.12 immediately following the results.

Indeed, Palantir had a rock-solid quarterly earnings result, but is this stock a good investment here? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.