Let’s dig into the relative performance of Pinterest (NYSE: PINS) and its peers as we unravel the now-completed Q3 social networking earnings season.

Businesses must meet their customers where they are, which over the past decade has come to mean on social networks. In 2020, users spent over 2.5 hours a day on social networks, a figure that has increased every year since measurement began. As a result, businesses continue to shift their advertising and marketing dollars online.

The 5 social networking stocks we track reported a strong Q3. As a group, revenues beat analysts’ consensus estimates by 2.6% while next quarter’s revenue guidance was 0.9% below.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 9.6% since the latest earnings results.

Weakest Q3: Pinterest (NYSE: PINS)

Created with the idea of virtually replacing paper catalogues, Pinterest (NYSE: PINS) is an online image and social discovery platform.

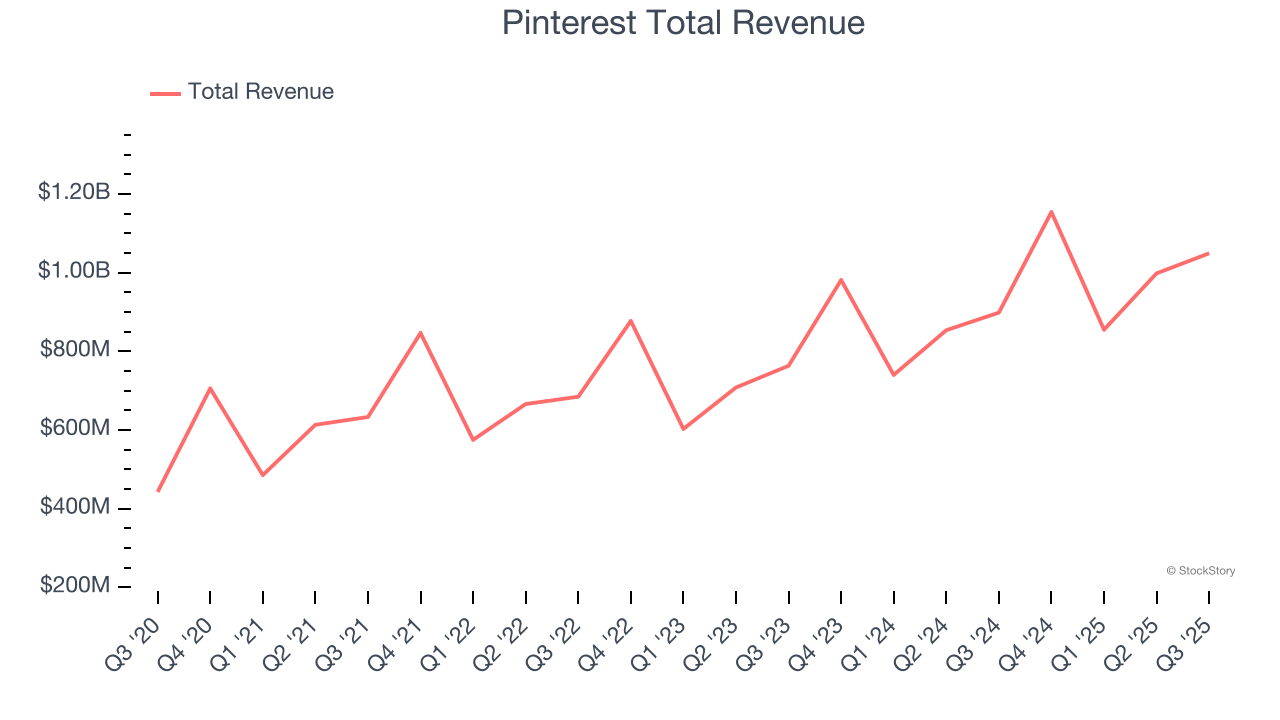

Pinterest reported revenues of $1.05 billion, up 16.8% year on year. This print was in line with analysts’ expectations, but overall, it was a mixed quarter for the company with a decent beat of analysts’ EBITDA estimates but revenue guidance for next quarter slightly missing analysts’ expectations.

Pinterest delivered the weakest performance against analyst estimates of the whole group. The company reported 600 million monthly active users, up 11.7% year on year. Unsurprisingly, the stock is down 21.9% since reporting and currently trades at $25.78.

Is now the time to buy Pinterest? Access our full analysis of the earnings results here, it’s free for active Edge members.

Best Q3: Reddit (NYSE: RDDT)

Founded in 2005 by two University of Virginia roommates, Reddit (NYSE: RDDT) facilitates user-generated content across niche communities (called subreddits) that discuss anything from stocks to dating and memes.

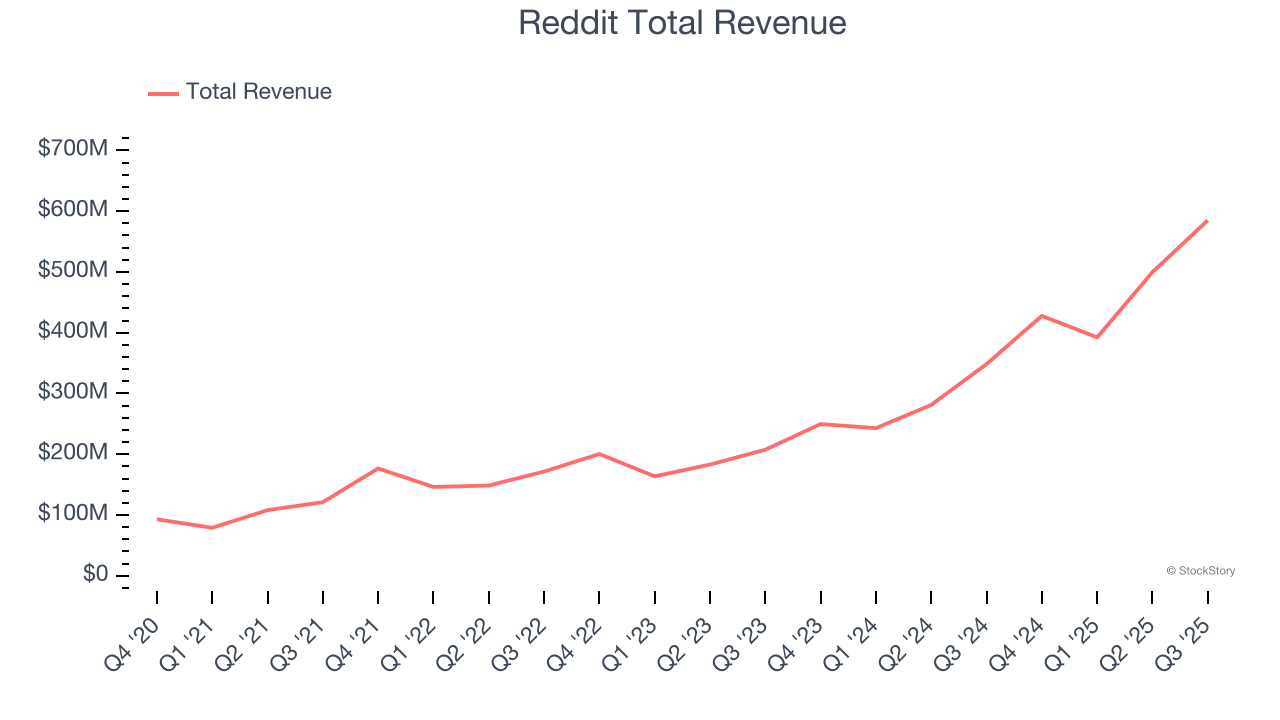

Reddit reported revenues of $584.9 million, up 67.9% year on year, outperforming analysts’ expectations by 6.3%. The business had a very strong quarter with EBITDA guidance for next quarter exceeding analysts’ expectations.

Reddit scored the biggest analyst estimates beat and fastest revenue growth among its peers. The company reported 51.6 million daily active users, up 7.1% year on year. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 5% since reporting. It currently trades at $184.78.

Is now the time to buy Reddit? Access our full analysis of the earnings results here, it’s free for active Edge members.

Meta (NASDAQ: META)

Famously founded by Mark Zuckerberg in his Harvard dorm, Meta Platforms (NASDAQ: META) operates a collection of the largest social networks in the world - Facebook, Instagram, WhatsApp, and Messenger, along with its metaverse focused Reality Labs.

Meta reported revenues of $51.24 billion, up 26.2% year on year, exceeding analysts’ expectations by 3.4%. It may have had the worst quarter among its peers, but its results were still good as it also locked in a solid beat of analysts’ EBITDA estimates and a decent beat of analysts’ revenue estimates.

As expected, the stock is down 21% since the results and currently trades at $595.84.

Read our full analysis of Meta’s results here.

Yelp (NYSE: YELP)

Founded by PayPal alumni Jeremy Stoppelman and Russel Simmons, Yelp (NYSE: YELP) is an online platform that helps people discover local businesses through crowd-sourced reviews.

Yelp reported revenues of $376 million, up 4.4% year on year. This number topped analysts’ expectations by 2.1%. It was a strong quarter as it also produced an impressive beat of analysts’ EBITDA estimates and full-year EBITDA guidance slightly topping analysts’ expectations.

Yelp had the slowest revenue growth among its peers. The stock is down 12.5% since reporting and currently trades at $28.11.

Read our full, actionable report on Yelp here, it’s free for active Edge members.

Snap (NYSE: SNAP)

Founded by Stanford University students Evan Spiegel, Reggie Brown, and Bobby Murphy, and originally called Picaboo, Snapchat (NYSE: SNAP) is an image centric social media network.

Snap reported revenues of $1.51 billion, up 9.8% year on year. This print surpassed analysts’ expectations by 1%. Overall, it was a strong quarter as it also recorded an impressive beat of analysts’ EBITDA estimates and a narrow beat of analysts’ revenue estimates.

The company reported 477 million daily active users, up 7.7% year on year. The stock is up 12.2% since reporting and currently trades at $8.25.

Read our full, actionable report on Snap here, it’s free for active Edge members.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.