Earnings results often indicate what direction a company will take in the months ahead. With Q4 behind us, let’s have a look at Moog (NYSE: MOG.A) and its peers.

Aerospace companies often possess technical expertise and have made significant capital investments to produce complex products. It is an industry where innovation is important, and lately, emissions and automation are in focus, so companies that boast advances in these areas can take market share. On the other hand, demand for aerospace products can ebb and flow with economic cycles and geopolitical tensions, which can be particularly painful for companies with high fixed costs.

The 15 aerospace stocks we track reported a mixed Q4. As a group, revenues along with next quarter’s revenue guidance were in line with analysts’ consensus estimates.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 7.6% since the latest earnings results.

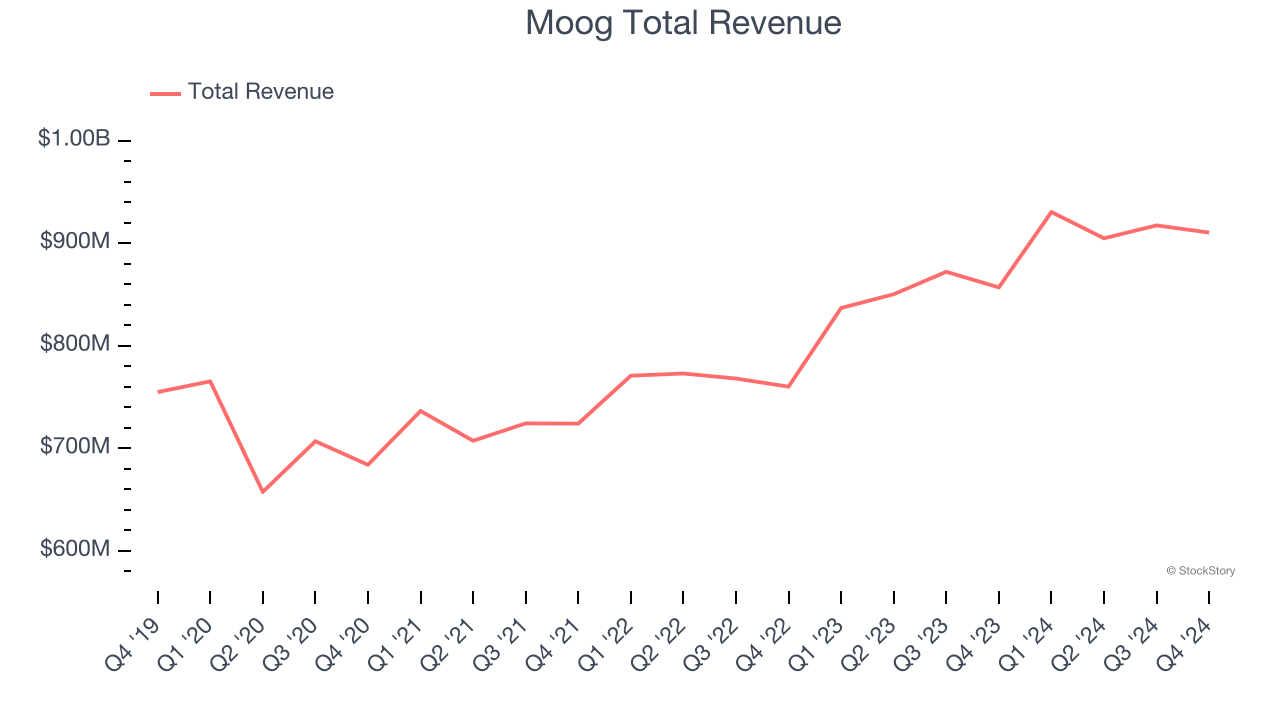

Moog (NYSE: MOG.A)

Responsible for the flight control actuation system integrated in the B-2 stealth bomber, Moog (NYSE: MOG.A) provides precision motion control solutions used in aerospace and defense applications

Moog reported revenues of $910.3 million, up 6.2% year on year. This print exceeded analysts’ expectations by 5.3%. Overall, it was a satisfactory quarter for the company with a solid beat of analysts’ adjusted operating income estimates.

"We have delivered a great quarter with strong sales growth, impressive bookings and solid margin enhancement," said Pat Roche, CEO.

The stock is down 21.1% since reporting and currently trades at $165.49.

Is now the time to buy Moog? Access our full analysis of the earnings results here, it’s free.

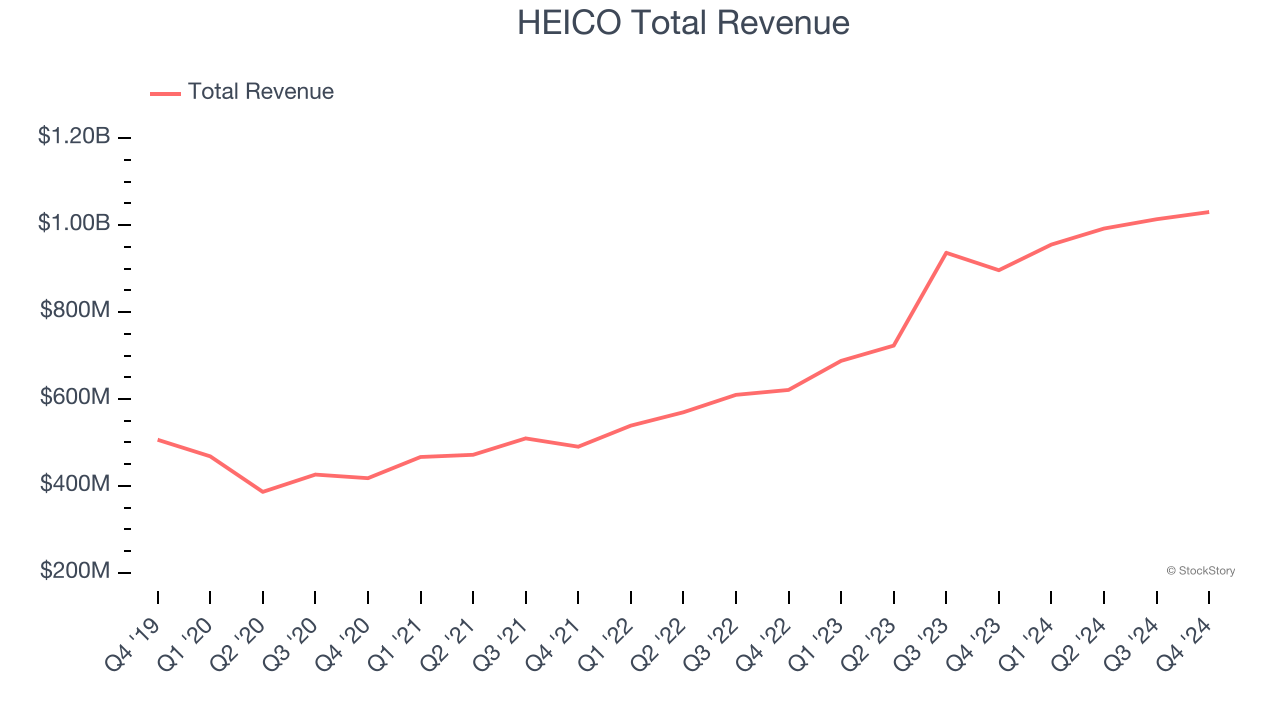

Best Q4: HEICO (NYSE: HEI)

Founded in 1957, HEICO (NYSE: HEI) manufactures and services aerospace and electronic components for commercial aviation, defense, space, and other industries.

HEICO reported revenues of $1.03 billion, up 14.9% year on year, outperforming analysts’ expectations by 5.4%. The business had an incredible quarter with a solid beat of analysts’ organic revenue estimates and an impressive beat of analysts’ EPS estimates.

The market seems happy with the results as the stock is up 10.8% since reporting. It currently trades at $252.45.

Is now the time to buy HEICO? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Boeing (NYSE: BA)

One of the companies that forms a duopoly in the commercial aircraft market, Boeing (NYSE: BA) develops, manufactures, and services commercial airplanes, defense products, and space systems.

Boeing reported revenues of $15.24 billion, down 30.8% year on year, falling short of analysts’ expectations by 6.4%. It was a disappointing quarter as it posted a significant miss of analysts’ adjusted operating income estimates.

Boeing delivered the slowest revenue growth in the group. As expected, the stock is down 11.5% since the results and currently trades at $155.01.

Read our full analysis of Boeing’s results here.

Rocket Lab (NASDAQ: RKLB)

Becoming the first private company in the Southern Hemisphere to reach space, Rocket Lab (NASDAQ: RKLB) offers rockets designed for launching small satellites.

Rocket Lab reported revenues of $132.4 million, up 121% year on year. This result surpassed analysts’ expectations by 1.4%. It was a very strong quarter as it also recorded an impressive beat of analysts’ EBITDA estimates.

Rocket Lab scored the fastest revenue growth among its peers. The stock is flat since reporting and currently trades at $20.

Read our full, actionable report on Rocket Lab here, it’s free.

Astronics (NASDAQ: ATRO)

Integrating power outlets into many Boeing aircraft, Astronics (NASDAQ: ATRO) is a provider of technologies and services to the global aerospace, defense, and electronics industries.

Astronics reported revenues of $208.5 million, up 6.8% year on year. This number beat analysts’ expectations by 7%. Overall, it was an exceptional quarter as it also logged a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

Astronics pulled off the biggest analyst estimates beat among its peers. The stock is up 15.5% since reporting and currently trades at $23.08.

Read our full, actionable report on Astronics here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.