Since April 2020, the S&P 500 has delivered a total return of 87.2%. But one standout stock has more than doubled the market - over the past five years, Live Nation has surged 225% to $122.66 per share. Its momentum hasn’t stopped as it’s also gained 9.9% in the last six months thanks to its solid quarterly results, beating the S&P by 20.4%.

Is now the time to buy Live Nation, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free.

We’re happy investors have made money, but we're cautious about Live Nation. Here are three reasons why there are better opportunities than LYV and a stock we'd rather own.

Why Is Live Nation Not Exciting?

Owner of Ticketmaster and operator of music festival EDC, Live Nation (NYSE: LYV) is a company specializing in live event promotion, venue management, and ticketing services for concerts and shows.

1. Weak Growth in Events Points to Soft Demand

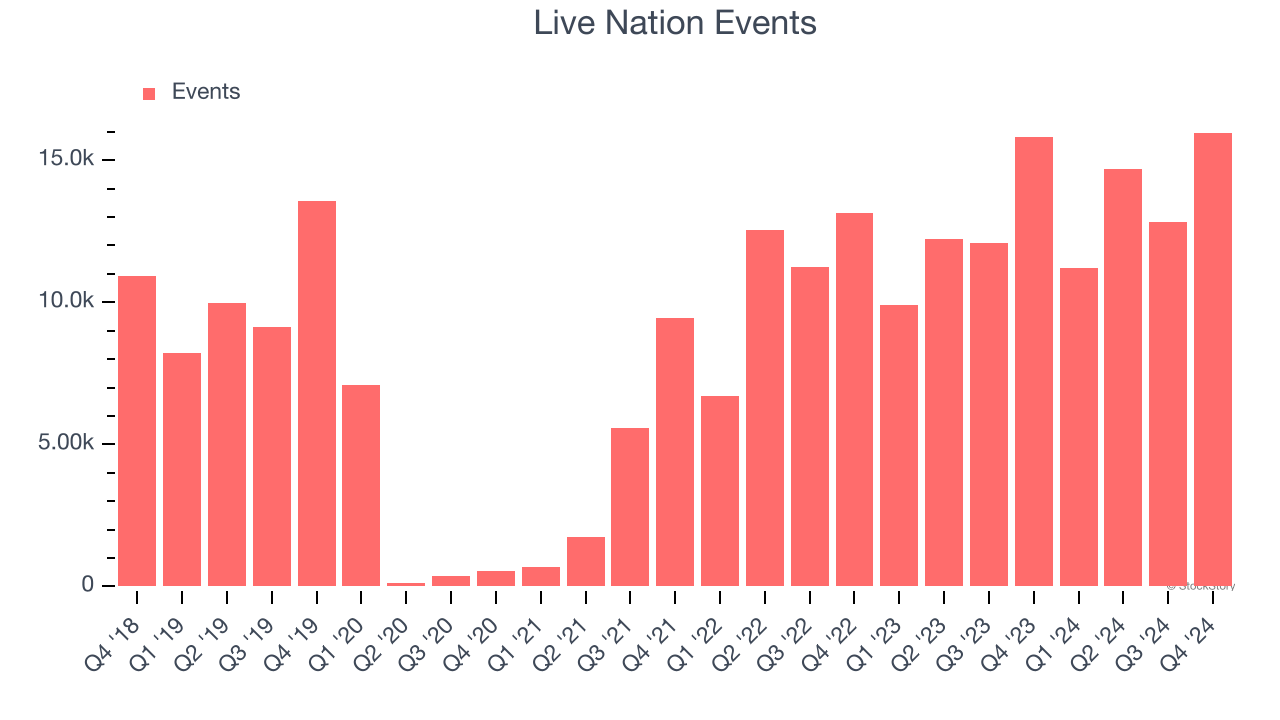

Revenue growth can be broken down into changes in price and volume (for companies like Live Nation, our preferred volume metric is events). While both are important, the latter is the most critical to analyze because prices have a ceiling.

Live Nation’s events came in at 15,972 in the latest quarter, and over the last two years, averaged 14.1% year-on-year growth. This performance was underwhelming and suggests it might have to lower prices or invest in product improvements to accelerate growth, factors that can hinder near-term profitability.

2. Weak Operating Margin Could Cause Trouble

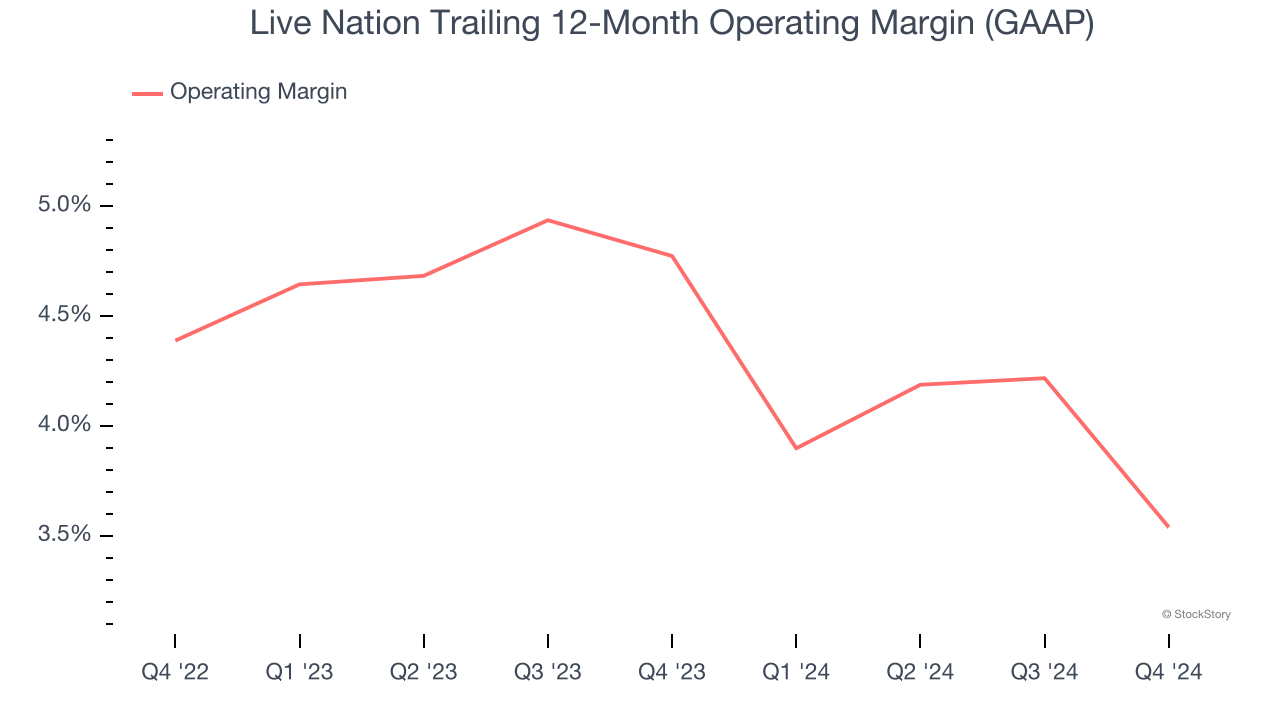

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Live Nation’s operating margin has been trending down over the last 12 months and averaged 4.2% over the last two years. The company’s profitability was mediocre for a consumer discretionary business and shows it couldn’t pass its higher operating expenses onto its customers.

3. Previous Growth Initiatives Haven’t Impressed

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Live Nation historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 8.8%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+.

Final Judgment

Live Nation isn’t a terrible business, but it isn’t one of our picks. With its shares beating the market recently, the stock trades at 37.8× forward price-to-earnings (or $122.66 per share). This valuation tells us a lot of optimism is priced in - we think there are better investment opportunities out there. We’d recommend looking at one of Charlie Munger’s all-time favorite businesses.

Stocks We Would Buy Instead of Live Nation

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.