Since April 2020, the S&P 500 has delivered a total return of 87%. But one standout stock has nearly doubled the market - over the past five years, Potbelly has surged 153% to $9.13 per share. Its momentum hasn’t stopped as it’s also gained 12% in the last six months thanks to its solid quarterly results, beating the S&P by 22.6%.

Is now the time to buy Potbelly, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.

Despite the momentum, we're swiping left on Potbelly for now. Here are three reasons why we avoid PBPB and a stock we'd rather own.

Why Is Potbelly Not Exciting?

With a unique origin story where the company actually started as an antique shop, Potbelly (NASDAQ: PBPB) today is a chain known for its toasty sandwiches.

1. Long-Term Revenue Growth Disappoints

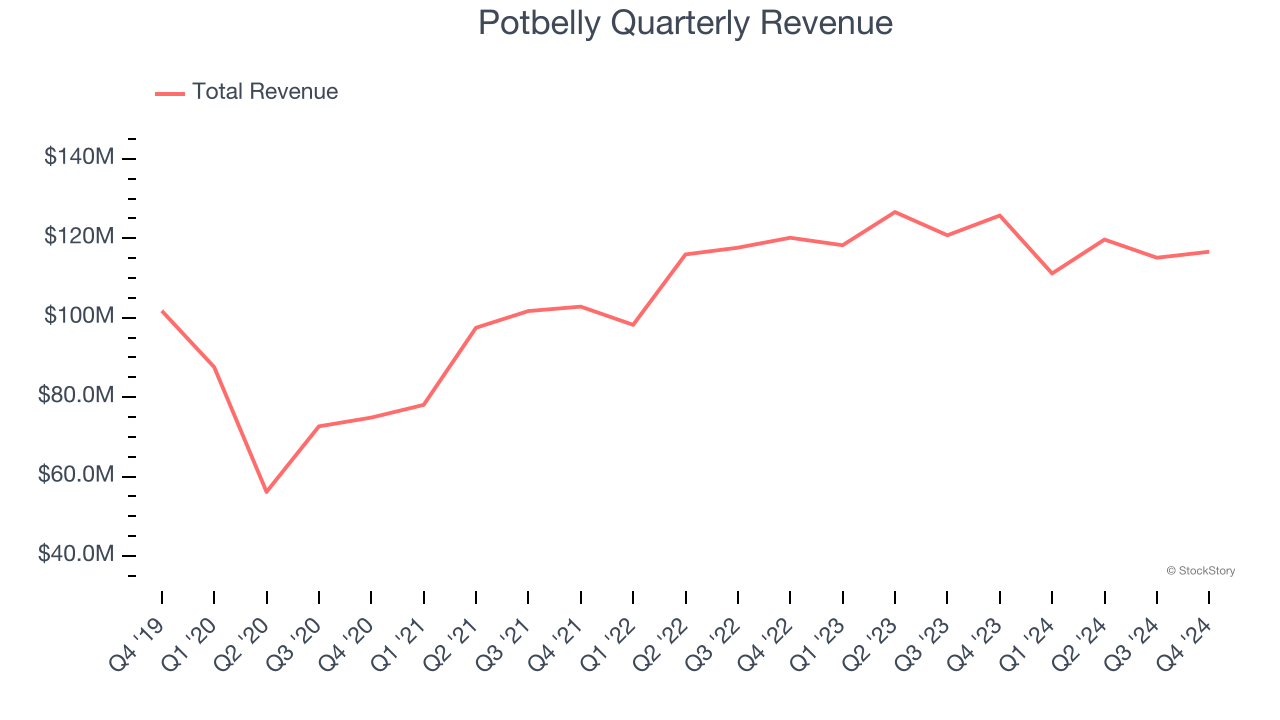

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Regrettably, Potbelly’s sales grew at a weak 2.5% compounded annual growth rate over the last five years. This was below our standards.

2. Fewer Distribution Channels Limit its Ceiling

With $462.6 million in revenue over the past 12 months, Potbelly is a small restaurant chain, which sometimes brings disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale.

3. Previous Growth Initiatives Have Lost Money

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Potbelly’s five-year average ROIC was negative 17%, meaning management lost money while trying to expand the business. Its returns were among the worst in the restaurant sector.

Final Judgment

Potbelly isn’t a terrible business, but it doesn’t pass our bar. With its shares topping the market in recent months, the stock trades at 32× forward price-to-earnings (or $9.13 per share). This valuation tells us a lot of optimism is priced in - we think there are better investment opportunities out there. We’d recommend looking at a fast-growing restaurant franchise with an A+ ranch dressing sauce.

Stocks We Would Buy Instead of Potbelly

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.