Natural food company Hain Celestial (NASDAQ: HAIN) fell short of the market’s revenue expectations in Q1 CY2025, with sales falling 11% year on year to $390.4 million. Its non-GAAP profit of $0.07 per share was 44.5% below analysts’ consensus estimates.

Is now the time to buy Hain Celestial? Find out by accessing our full research report, it’s free.

Hain Celestial (HAIN) Q1 CY2025 Highlights:

- Revenue: $390.4 million vs analyst estimates of $409.4 million (11% year-on-year decline, 4.7% miss)

- Adjusted EPS: $0.07 vs analyst expectations of $0.13 (44.5% miss)

- Adjusted EBITDA: $33.62 million vs analyst estimates of $42.35 million (8.6% margin, 20.6% miss)

- EBITDA guidance for the full year is $125 million at the midpoint, below analyst estimates of $150.1 million

- Operating Margin: -31%, down from 6.9% in the same quarter last year

- Free Cash Flow was -$2.28 million, down from $30.24 million in the same quarter last year

- Organic Revenue fell 5.3% year on year (-3.7% in the same quarter last year)

- Market Capitalization: $250 million

"We are disappointed with our third quarter results, which fell far short of our expectations primarily due to worse-than-expected performance in North America. Despite the shortfall in net sales in the quarter, we are encouraged by a return to organic net sales growth in our international segment and continued progress in reducing net debt,” said Alison Lewis, Interim President and CEO.

Company Overview

Sold in over 75 countries around the world, Hain Celestial (NASDAQ: HAIN) is a natural and organic food company whose products range from snacks to teas to baby food.

Sales Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $1.62 billion in revenue over the past 12 months, Hain Celestial is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers.

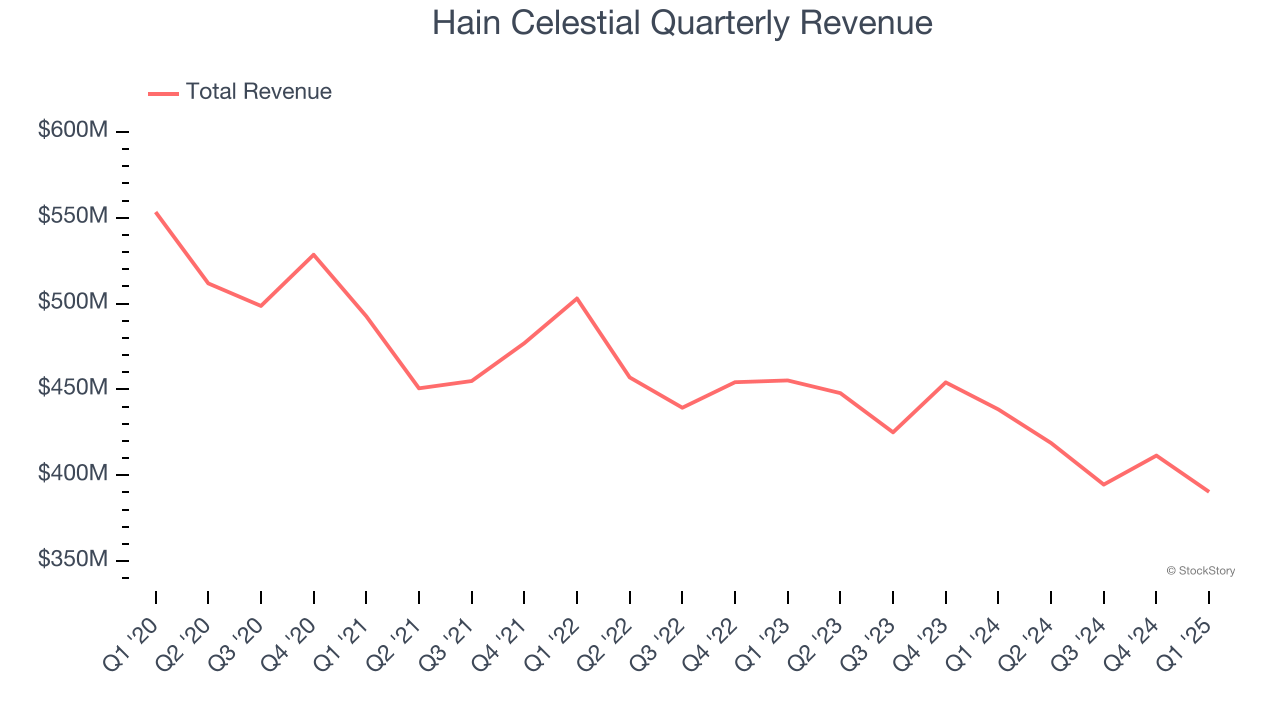

As you can see below, Hain Celestial’s demand was weak over the last three years. Its sales fell by 5% annually, a poor baseline for our analysis.

This quarter, Hain Celestial missed Wall Street’s estimates and reported a rather uninspiring 11% year-on-year revenue decline, generating $390.4 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 1.4% over the next 12 months. Although this projection suggests its newer products will fuel better top-line performance, it is still below the sector average.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Organic Revenue Growth

When analyzing revenue growth, we care most about organic revenue growth. This metric captures a business’s performance excluding one-time events such as mergers, acquisitions, and divestitures as well as foreign currency fluctuations.

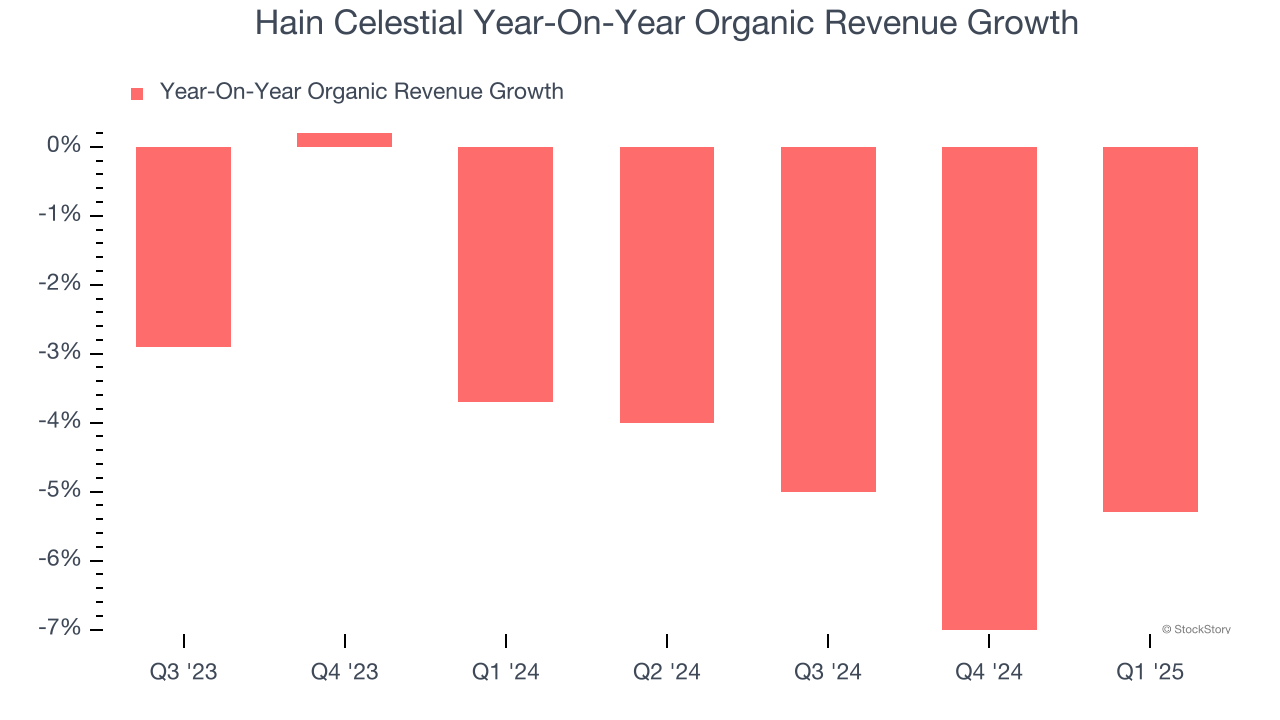

Hain Celestial’s demand has been falling over the last eight quarters, and on average, its organic sales have declined by 4% year on year.

In the latest quarter, Hain Celestial’s organic sales fell by 5.3% year on year. This decrease represents a further deceleration from its historical levels. We hope the business can get back on track.

Key Takeaways from Hain Celestial’s Q1 Results

We struggled to find many positives in these results as it missed across revenue, EPS, and EBITDA. Its full-year EBITDA guidance also fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 17.5% to $2.28 immediately after reporting.

Hain Celestial didn’t show it’s best hand this quarter, but does that create an opportunity to buy the stock right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.