Refrigerant services company Hudson Technologies (NASDAQ: HDSN) reported Q1 CY2025 results topping the market’s revenue expectations, but sales fell by 15.2% year on year to $55.34 million. Its GAAP profit of $0.06 per share was in line with analysts’ consensus estimates.

Is now the time to buy Hudson Technologies? Find out by accessing our full research report, it’s free.

Hudson Technologies (HDSN) Q1 CY2025 Highlights:

- Revenue: $55.34 million vs analyst estimates of $52.23 million (15.2% year-on-year decline, 6% beat)

- EPS (GAAP): $0.06 vs analyst estimates of $0.05 (in line)

- Operating Margin: 5.6%, down from 19.6% in the same quarter last year

- Free Cash Flow was $12.75 million, up from -$1.89 million in the same quarter last year

- Market Capitalization: $295.1 million

Brian F. Coleman, President and Chief Executive Officer of Hudson Technologies commented, “First quarter 2025 revenue reflected a slight increase in refrigerant sales volume, which was more than offset by lower overall refrigerant market pricing as compared to last year’s first quarter. First quarter 2025 sequential market pricing declined slightly from the fourth quarter of 2024, contributing to gross margin of 22%. We expect to be on track for our mid-twenty percent expected gross margin as we move through the core portion of the nine-month selling season. Additionally, we saw continued strength in the refrigerant recovery activities that feed our reclamation business, bolstered by our strengthened capabilities from the strategic acquisition of USA Refrigerants last year. We are pleased with the start to 2025 and remain focused on successfully executing on the elements of our business that we can control – most importantly by ensuring that our customers have the refrigerants they need as the weather turns warmer and the cooling season gets fully underway.

Company Overview

Founded in 1991, Hudson Technologies (NASDAQ: HDSN) specializes in refrigerant services and solutions, providing refrigerant sales, reclamation, and recycling.

Sales Growth

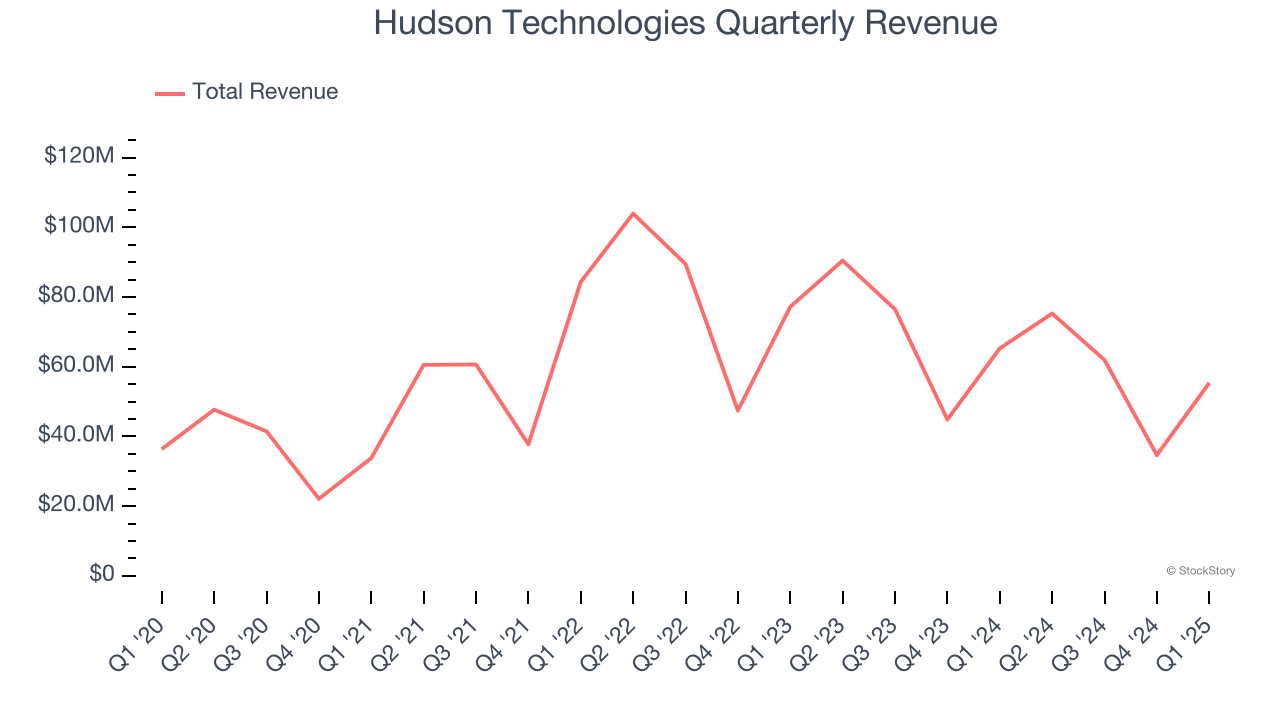

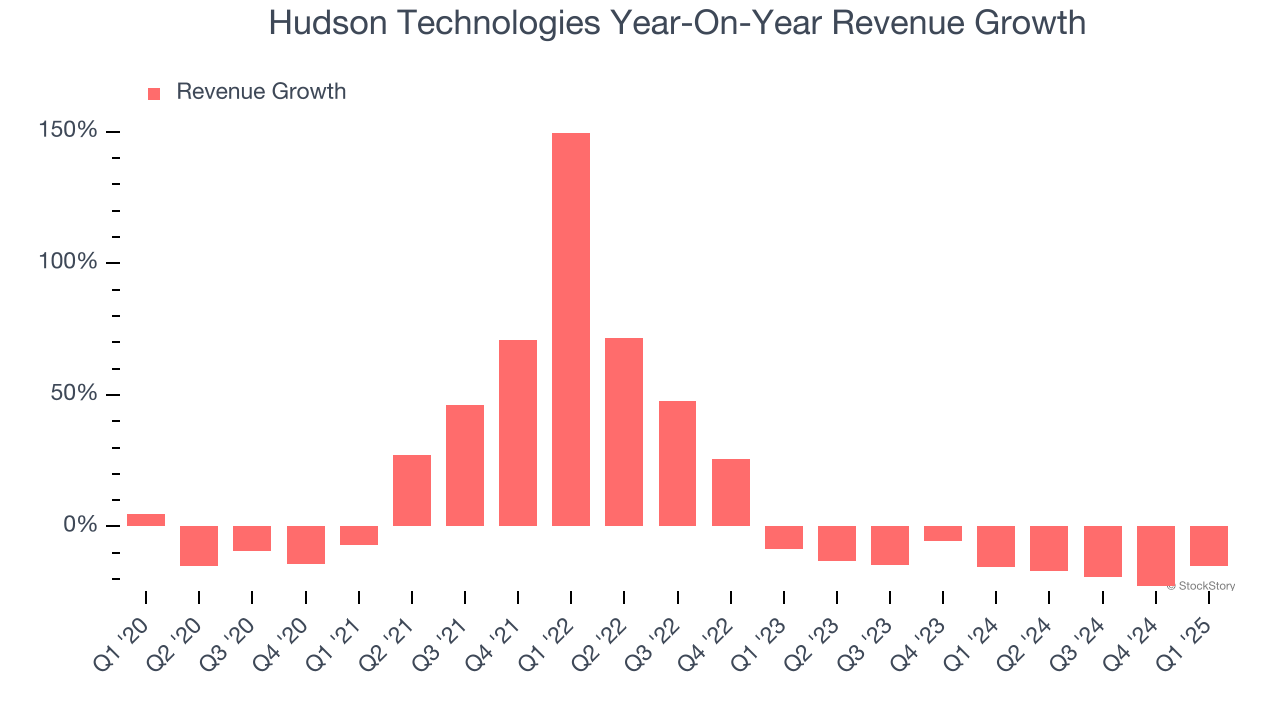

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Regrettably, Hudson Technologies’s sales grew at a mediocre 6.8% compounded annual growth rate over the last five years. This fell short of our benchmark for the industrials sector and is a tough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Hudson Technologies’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 15.5% annually.

This quarter, Hudson Technologies’s revenue fell by 15.2% year on year to $55.34 million but beat Wall Street’s estimates by 6%.

Looking ahead, sell-side analysts expect revenue to grow 5.7% over the next 12 months. Although this projection implies its newer products and services will spur better top-line performance, it is still below the sector average.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

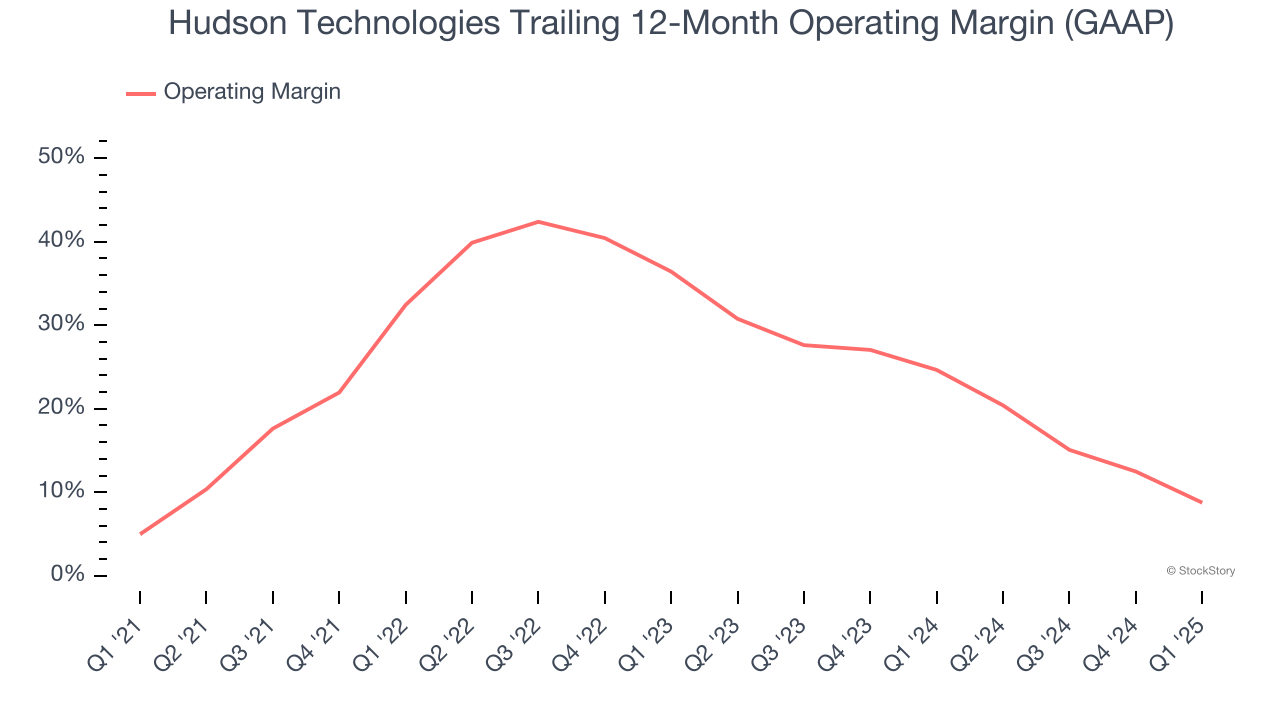

Operating Margin

Hudson Technologies has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 24%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Hudson Technologies’s operating margin rose by 3.8 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q1, Hudson Technologies generated an operating profit margin of 5.6%, down 14 percentage points year on year. Since Hudson Technologies’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

Earnings Per Share

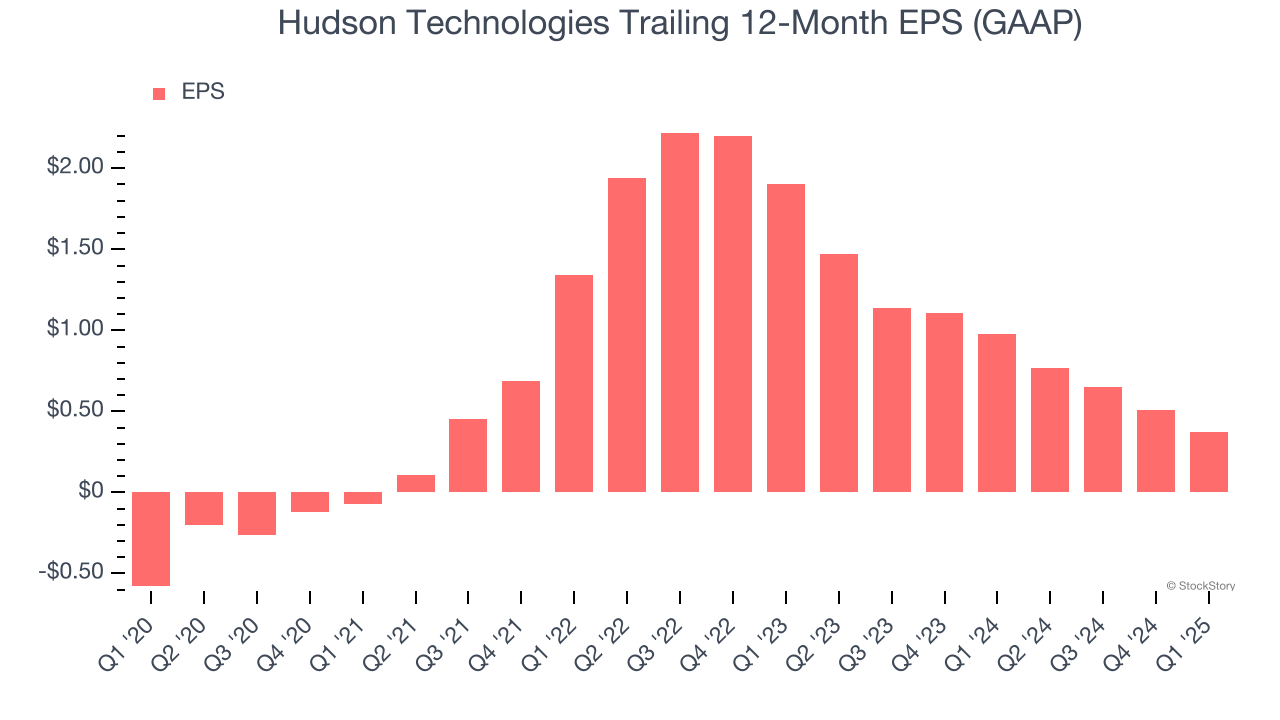

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Hudson Technologies’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

Sadly for Hudson Technologies, its EPS declined by more than its revenue over the last two years, dropping 55.9%. This tells us the company struggled to adjust to shrinking demand.

We can take a deeper look into Hudson Technologies’s earnings to better understand the drivers of its performance. Hudson Technologies’s operating margin has declined by 23.8 percentage points over the last two years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q1, Hudson Technologies reported EPS at $0.06, down from $0.20 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects Hudson Technologies to perform poorly. Analysts forecast its full-year EPS of $0.37 will hit $0.50.

Key Takeaways from Hudson Technologies’s Q1 Results

We were impressed by how significantly Hudson Technologies blew past analysts’ revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Zooming out, we think this was a solid print. The stock traded up 1.3% to $6.80 immediately after reporting.

Sure, Hudson Technologies had a solid quarter, but if we look at the bigger picture, is this stock a buy? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.