Recreational boats manufacturer Malibu Boats (NASDAQ: MBUU) reported Q1 CY2025 results beating Wall Street’s revenue expectations, with sales up 12.4% year on year to $228.7 million. Its non-GAAP profit of $0.72 per share was 2.4% below analysts’ consensus estimates.

Is now the time to buy Malibu Boats? Find out by accessing our full research report, it’s free.

Malibu Boats (MBUU) Q1 CY2025 Highlights:

- Revenue: $228.7 million vs analyst estimates of $223.3 million (12.4% year-on-year growth, 2.4% beat)

- Adjusted EPS: $0.72 vs analyst expectations of $0.74 (2.4% miss)

- Adjusted EBITDA: $28.32 million vs analyst estimates of $26.29 million (12.4% margin, 7.7% beat)

- Operating Margin: 7.6%, up from -36.8% in the same quarter last year

- Market Capitalization: $584.3 million

“Our team executed effectively in the third quarter, navigating ongoing market challenges by leveraging our strong brands, disciplined operational performance, and continued focus on dealer health,” commented Steve Menneto, Chief Executive Officer of Malibu Boats,

Company Overview

Founded in California in 1982, Malibu Boats (NASDAQ: MBUU) is a manufacturer of high-performance sports boats and luxury watercrafts.

Sales Growth

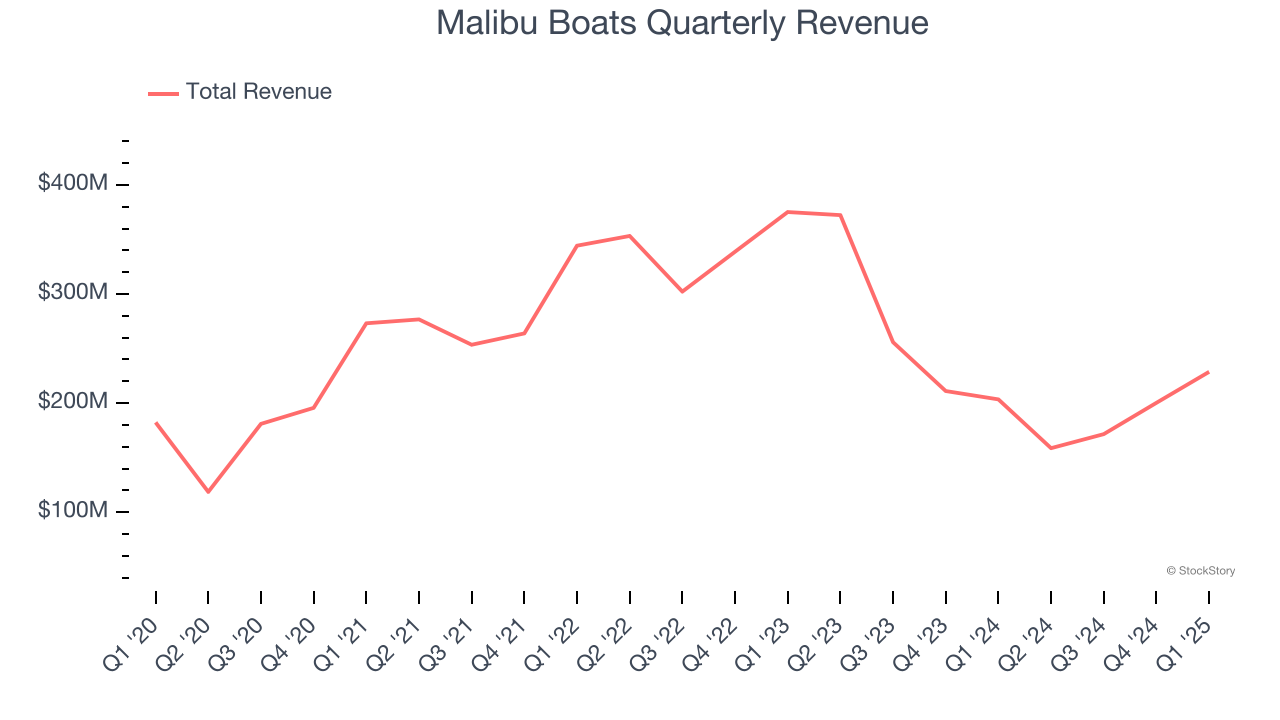

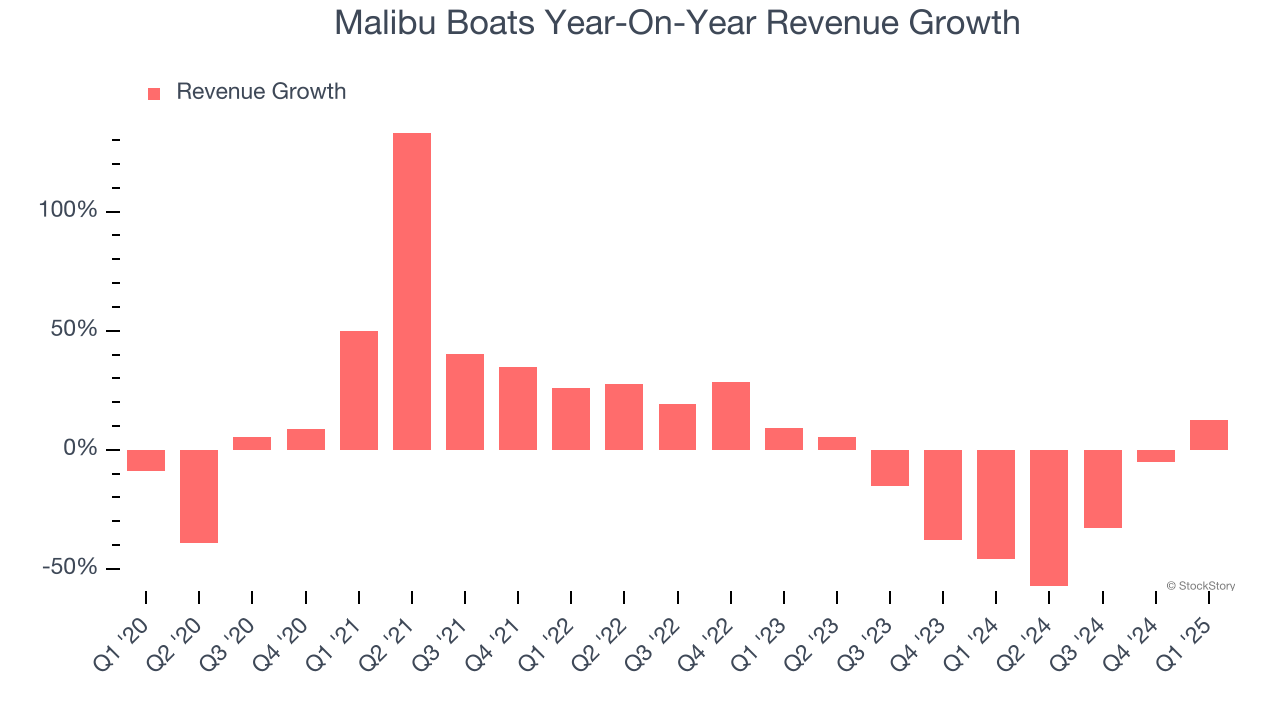

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Unfortunately, Malibu Boats struggled to consistently increase demand as its $759.2 million of sales for the trailing 12 months was close to its revenue five years ago. This was below our standards and is a sign of poor business quality.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Malibu Boats’s recent performance shows its demand remained suppressed as its revenue has declined by 25.5% annually over the last two years.

This quarter, Malibu Boats reported year-on-year revenue growth of 12.4%, and its $228.7 million of revenue exceeded Wall Street’s estimates by 2.4%.

Looking ahead, sell-side analysts expect revenue to grow 16.5% over the next 12 months, an improvement versus the last two years. This projection is noteworthy and implies its newer products and services will fuel better top-line performance.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

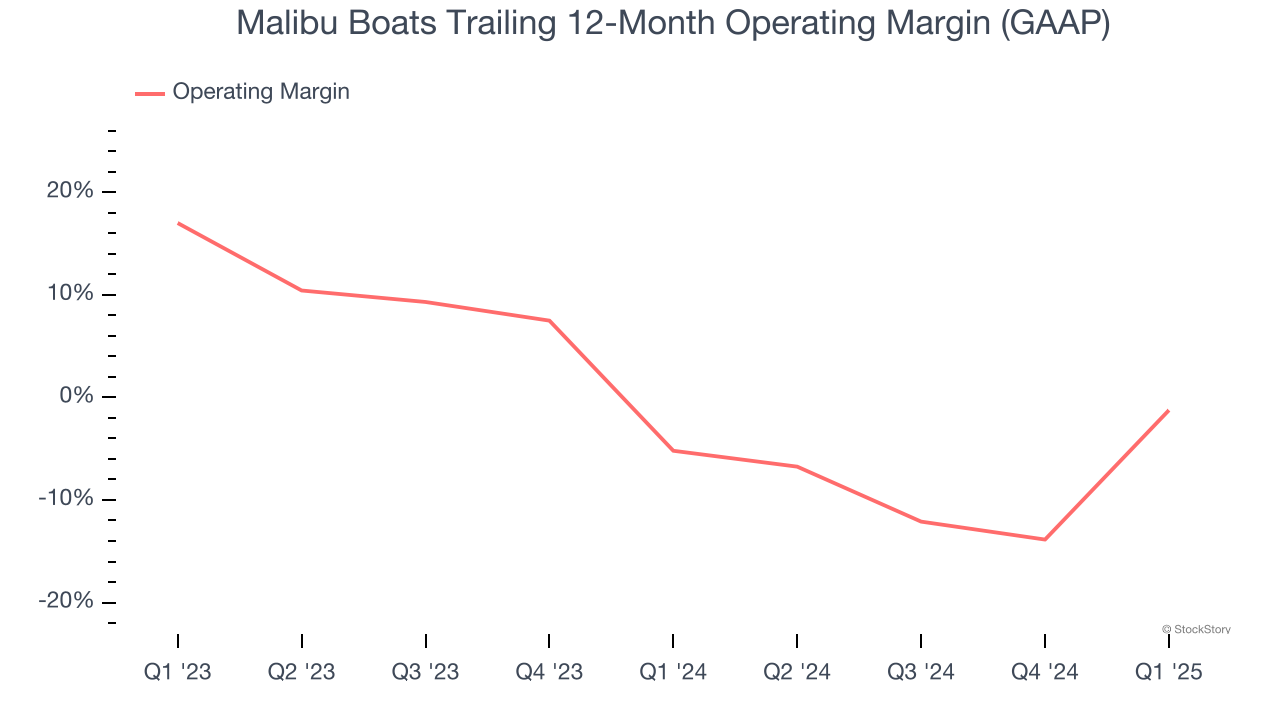

Malibu Boats’s operating margin has been trending up over the last 12 months, but it still averaged negative 3.5% over the last two years. This is due to its large expense base and inefficient cost structure.

This quarter, Malibu Boats generated an operating profit margin of 7.6%, up 44.4 percentage points year on year. This increase was a welcome development and shows it was more efficient.

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

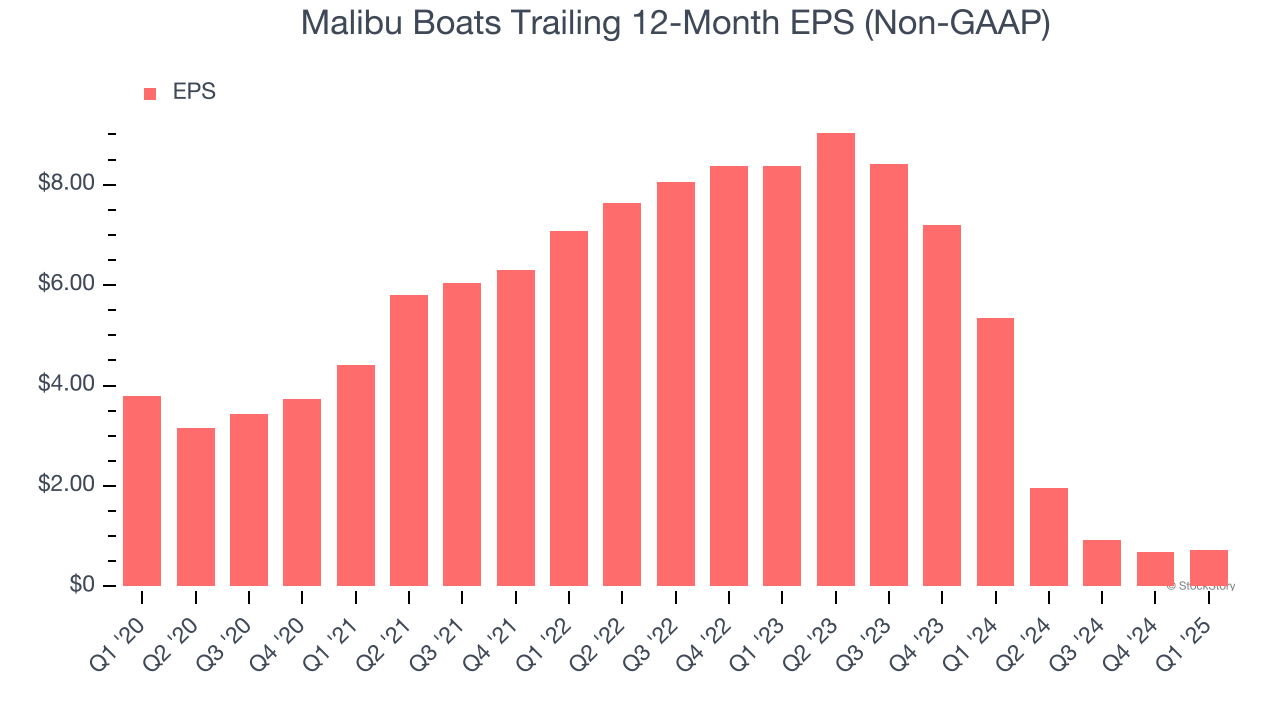

Sadly for Malibu Boats, its EPS declined by 28.1% annually over the last five years while its revenue was flat. This tells us the company struggled because its fixed cost base made it difficult to adjust to choppy demand.

In Q1, Malibu Boats reported EPS at $0.72, up from $0.67 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. Over the next 12 months, Wall Street expects Malibu Boats’s full-year EPS of $0.73 to grow 306%.

Key Takeaways from Malibu Boats’s Q1 Results

It was encouraging to see Malibu Boats beat analysts’ revenue expectations this quarter. On the other hand, its EPS missed. Overall, this print was mixed. The market seemed to be hoping for more, and the stock traded down 4.4% to $28.36 immediately following the results.

Big picture, is Malibu Boats a buy here and now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.