Over the last six months, e.l.f. Beauty’s shares have sunk to $106.01, producing a disappointing 17.4% loss - a stark contrast to the S&P 500’s 5.4% gain. This might have investors contemplating their next move.

Following the pullback, is now a good time to buy ELF? Find out in our full research report, it’s free.

Why Does e.l.f. Beauty Spark Debate?

Short for "eyes, lips, face", e.l.f. Beauty (NYSE: ELF) is a developer of high-quality beauty products at accessible price points.

Two Positive Attributes:

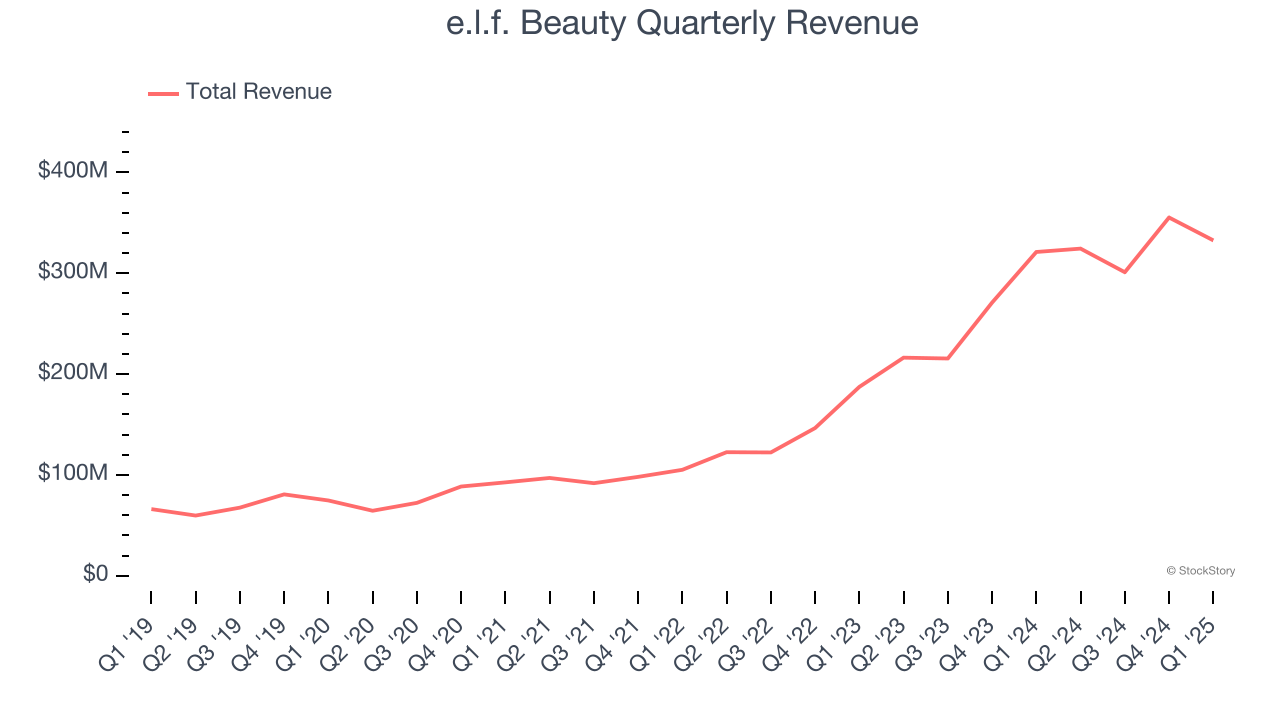

1. Skyrocketing Revenue Shows Strong Momentum

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Thankfully, e.l.f. Beauty’s 49.6% annualized revenue growth over the last three years was incredible. Its growth surpassed the average consumer staples company and shows its offerings resonate with customers.

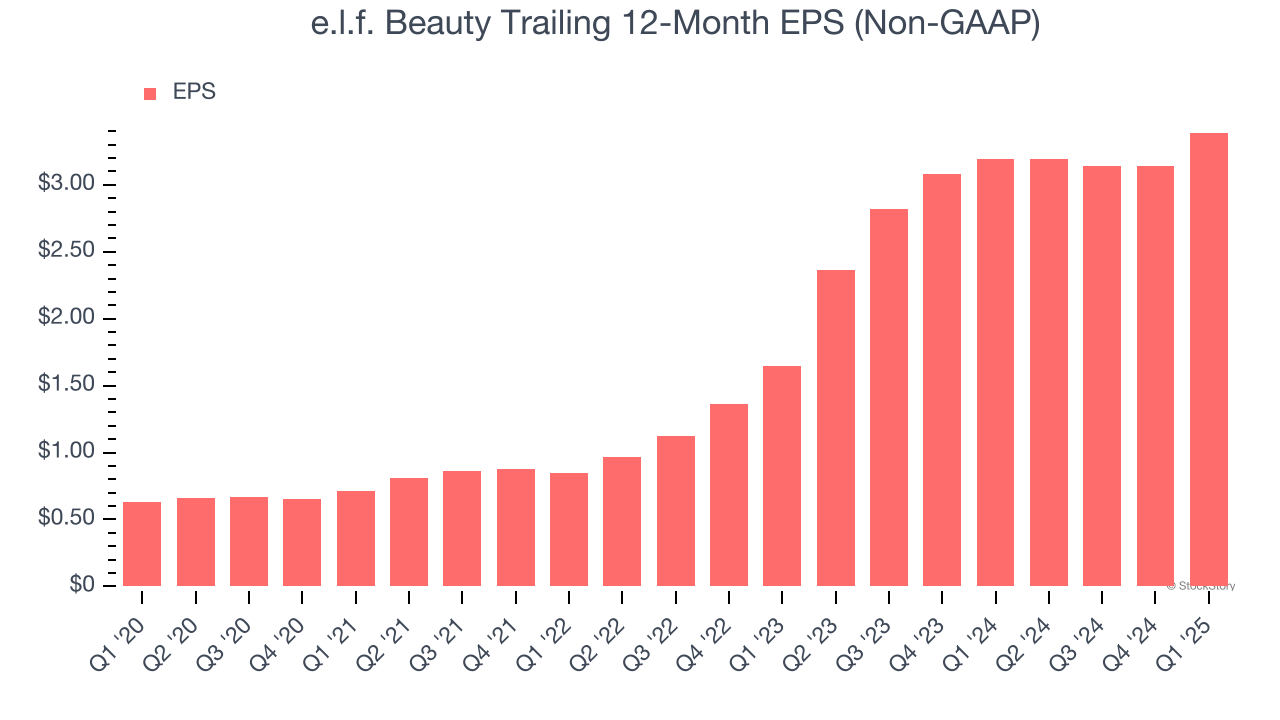

2. Outstanding Long-Term EPS Growth

Analyzing the change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

e.l.f. Beauty’s EPS grew at an astounding 58.6% compounded annual growth rate over the last three years, higher than its 49.6% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

One Reason to be Careful:

Fewer Distribution Channels Limit its Ceiling

With $1.31 billion in revenue over the past 12 months, e.l.f. Beauty is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers. On the bright side, it can grow faster because it has a longer list of untapped store chains to sell into.

Final Judgment

e.l.f. Beauty’s merits more than compensate for its flaws. After the recent drawdown, the stock trades at 29.6× forward P/E (or $106.01 per share). Is now the time to initiate a position? See for yourself in our in-depth research report, it’s free.

High-Quality Stocks for All Market Conditions

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.