Amalgamated Financial currently trades at $33.95 per share and has shown little upside over the past six months, posting a small loss of 4%. The stock also fell short of the S&P 500’s 5.4% gain during that period.

Is now the time to buy AMAL? Find out in our full research report, it’s free.

Why Are We Positive On AMAL?

Founded in 1923 by labor unions seeking a financial institution aligned with worker values, Amalgamated Financial (NASDAQGM:AMAL) operates a values-oriented bank that provides commercial banking, trust services, and investment management to socially responsible organizations and individuals.

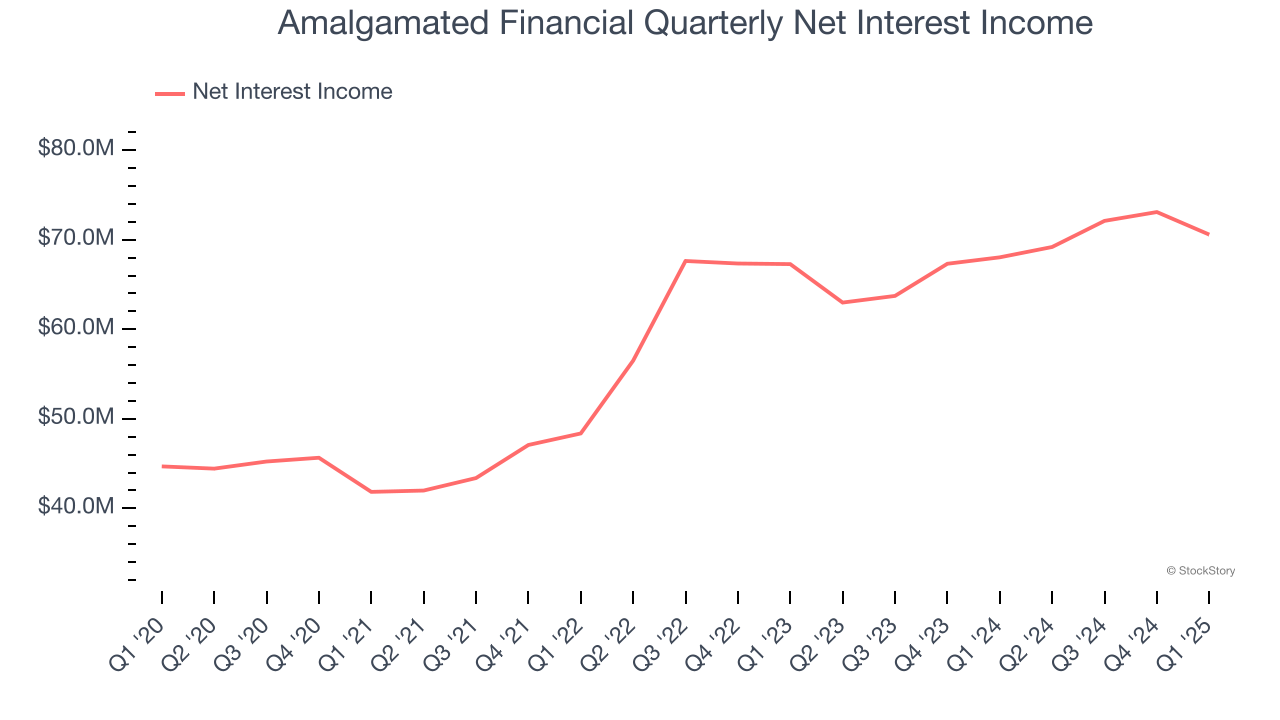

1. Net Interest Income Skyrockets, Fueling Growth Opportunities

Our experience and research show the market cares primarily about a bank’s net interest income growth as non-interest income is considered a lower-quality and non-recurring revenue source.

Amalgamated Financial’s net interest income has grown at a 12.6% annualized rate over the last four years, better than the broader bank industry. Its growth was driven by an increase in its net interest margin, which represents how much a bank earns in relation to its outstanding loans, as its loan book shrank throughout that period.

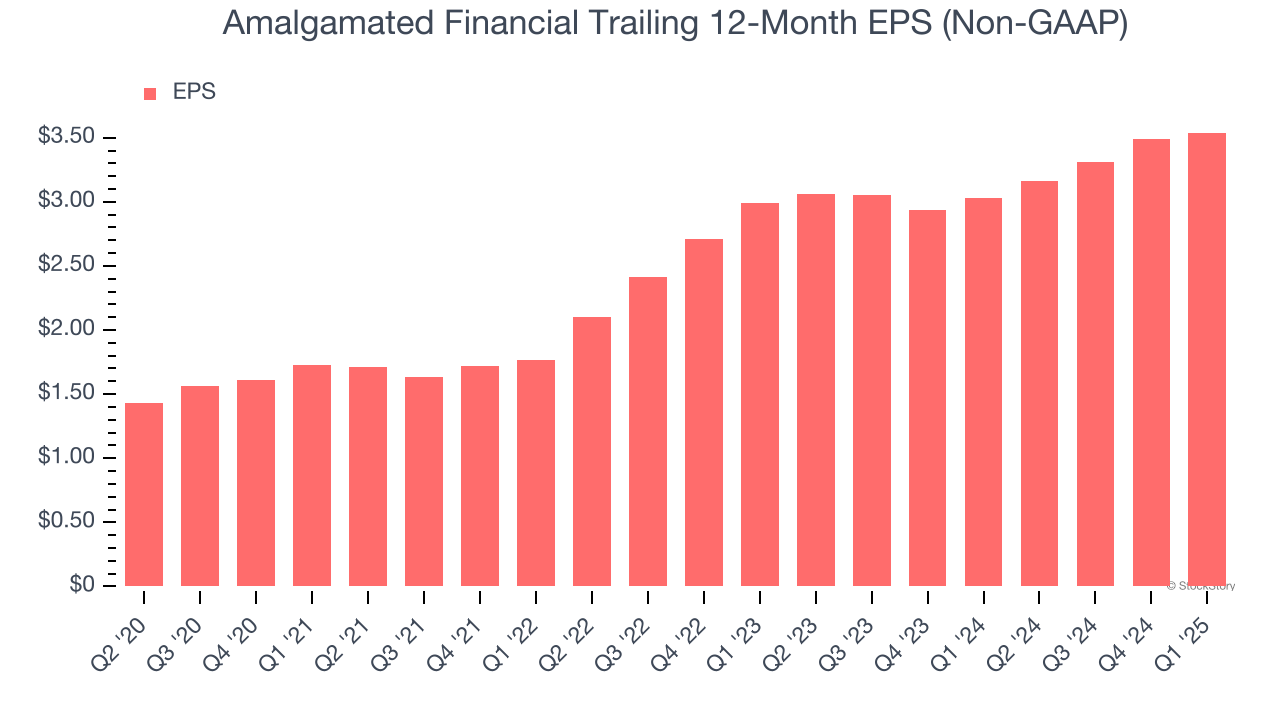

2. Outstanding Long-Term EPS Growth

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Amalgamated Financial’s EPS grew at an astounding 19.8% compounded annual growth rate over the last five years, higher than its 9.5% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

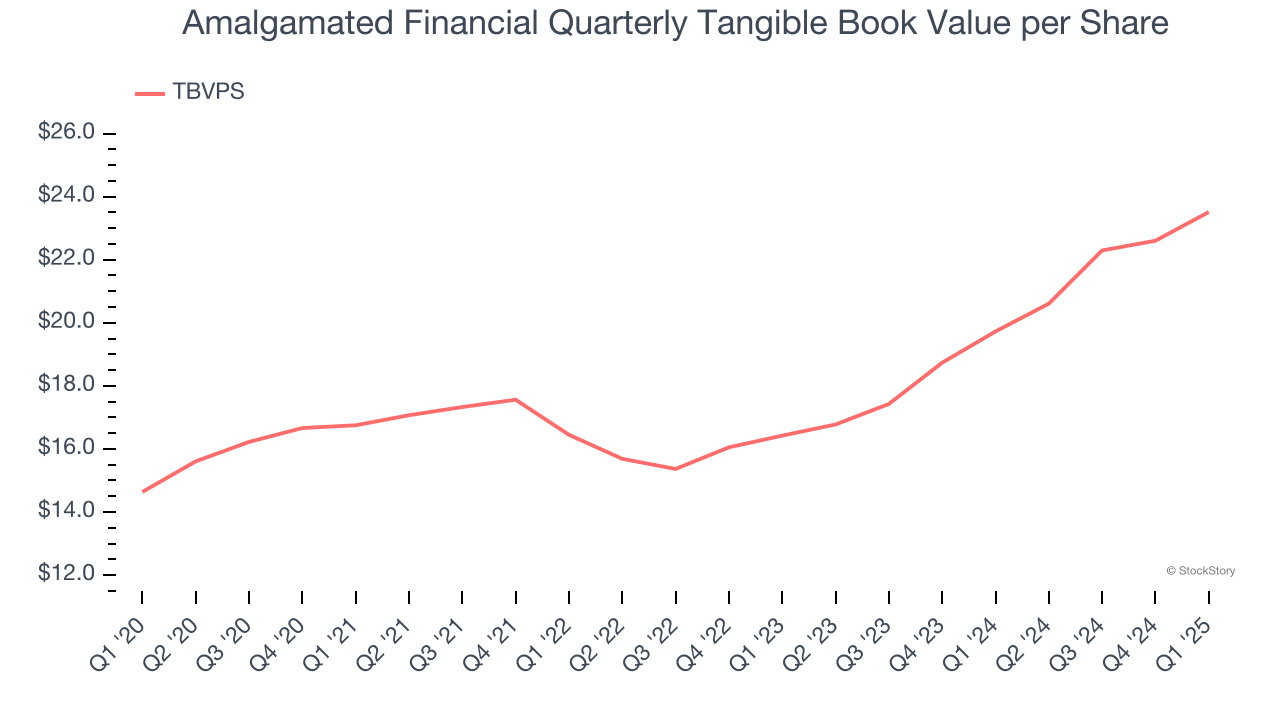

3. Growing TBVPS Reflects Strong Asset Base

In the banking industry, tangible book value per share (TBVPS) provides the clearest picture of shareholder value, as it focuses on concrete assets while excluding intangible items that may not hold value during challenging times.

Amalgamated Financial’s TBVPS increased by 9.9% annually over the last five years, and growth has recently accelerated as TBVPS grew at an exceptional 19.7% annual clip over the past two years (from $16.42 to $23.51 per share).

Final Judgment

These are just a few reasons Amalgamated Financial is a high-quality business worth owning. With its shares lagging the market recently, the stock trades at 1.3× forward P/B (or $33.95 per share). Is now a good time to initiate a position? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than Amalgamated Financial

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.