The past six months have been a windfall for REV Group’s shareholders. The company’s stock price has jumped 49%, hitting $50.25 per share. This was partly due to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is now the time to buy REV Group, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Why Is REV Group Not Exciting?

We’re happy investors have made money, but we don't have much confidence in REV Group. Here are three reasons why we avoid REVG and a stock we'd rather own.

1. Long-Term Revenue Growth Flatter Than a Pancake

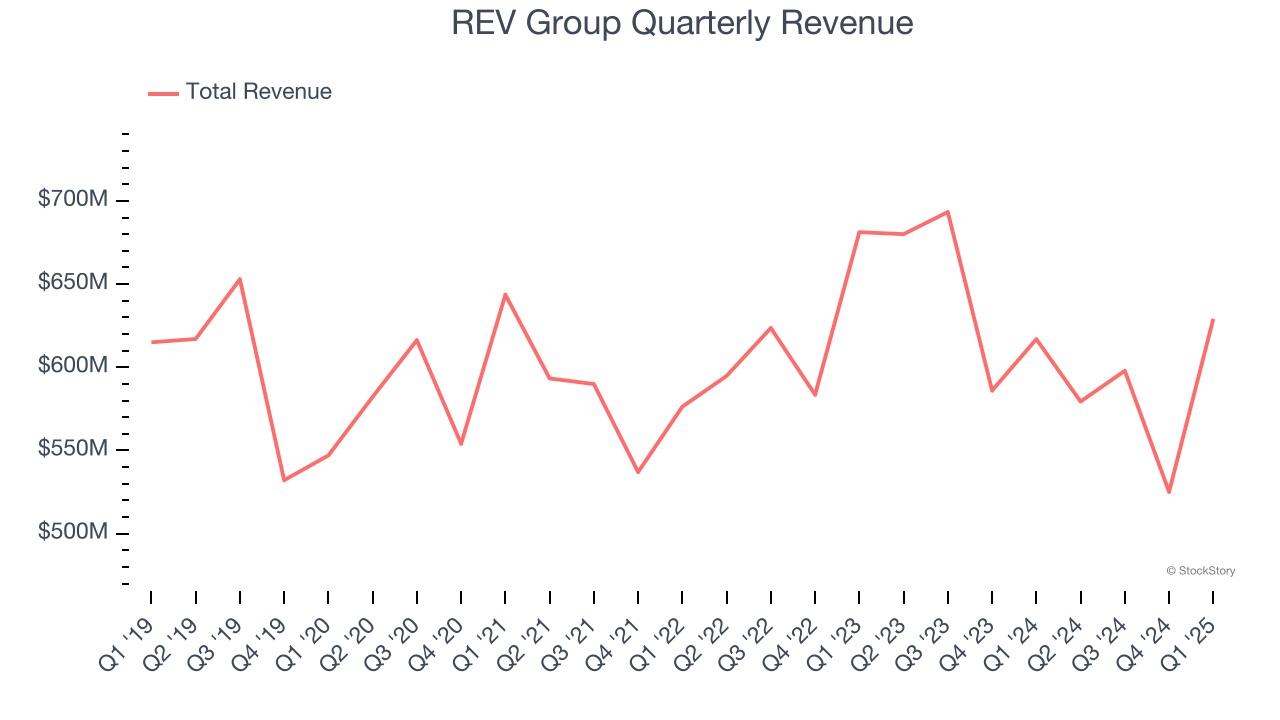

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Unfortunately, REV Group struggled to consistently increase demand as its $2.33 billion of sales for the trailing 12 months was close to its revenue five years ago. This was below our standards and signals it’s a lower quality business.

2. Low Gross Margin Reveals Weak Structural Profitability

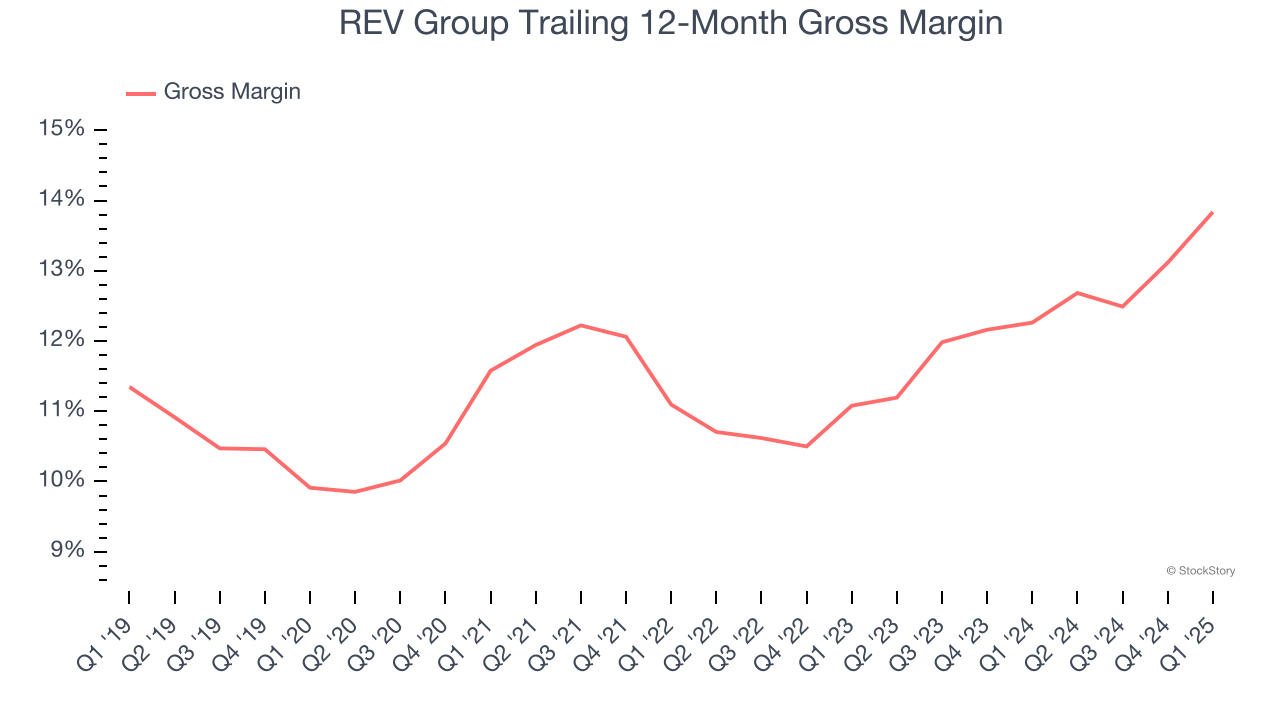

For industrials businesses, cost of sales is usually comprised of the direct labor, raw materials, and supplies needed to offer a product or service. These costs can be impacted by inflation and supply chain dynamics in the short term and a company’s purchasing power and scale over the long term.

REV Group has bad unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a 12% gross margin over the last five years. That means REV Group paid its suppliers a lot of money ($88.03 for every $100 in revenue) to run its business.

3. Weak Operating Margin Could Cause Trouble

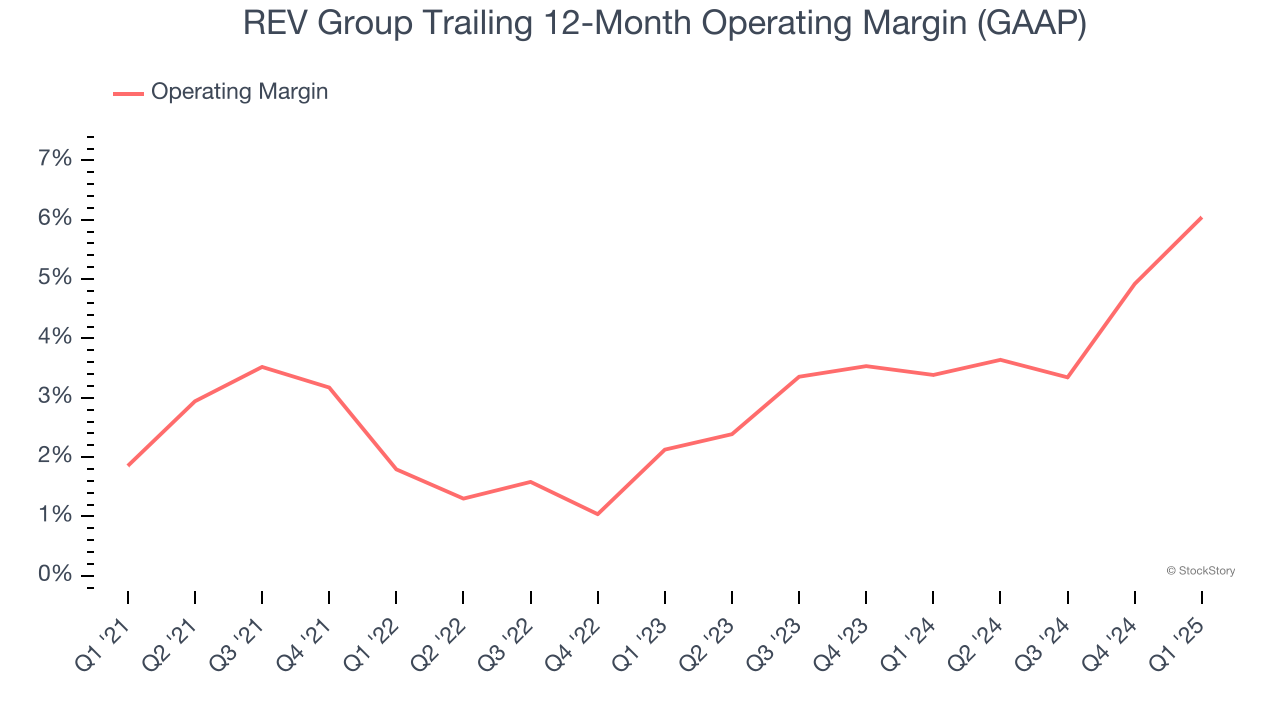

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

REV Group was profitable over the last five years but held back by its large cost base. Its average operating margin of 3% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

Final Judgment

REV Group’s business quality ultimately falls short of our standards. Following the recent surge, the stock trades at 18× forward P/E (or $50.25 per share). This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're pretty confident there are more exciting stocks to buy at the moment. We’d recommend looking at a fast-growing restaurant franchise with an A+ ranch dressing sauce.

Stocks We Like More Than REV Group

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.