Photo from Unsplash

Photo from Unsplash

Originally Posted On: https://quickbooks.intuit.com/r/pricing-strategy/6-different-pricing-strategies-which-is-right-for-your-business/

Small businesses play a vital role in the U.S. economy. However, revenue for small businesses can be scarce.

Data has shown that small businesses with no employees average just $44,000 a year in annual revenue, with two-thirds of these companies earning less than $25,000 per year. While various factors can affect a business’s revenue potential, one of the most important factors is its pricing strategy.

To get this right, it’s critical to use financial reporting and insights to guide your decisions. You also need a good understanding of the many different pricing strategies that you can choose from for your product or service. We look at 14 common pricing strategies in detail below.

- Definition and importance

- 14 different pricing strategies

- Pricing strategy best practices

- Pricing strategy FAQ

Review: What is a pricing strategy and why is it important?

In short, a pricing strategy refers to all of the various methods that small businesses use when setting prices for their goods or services. It’s an all-encompassing term that can account for things like:

- Market conditions

- Actions that competitors take

- Account segments

- Trade margins

- Input costs

- Consumers’ ability to pay

- Production and distribution costs

- Variable costs

Pricing strategies are useful for numerous reasons, though those reasons can vary from company to company. Choosing the right price for a product will allow you to maximize profit margins if that’s what you want to do. Contrary to popular belief, pricing strategies aren’t always about profit margins. For instance, you may opt to set the cost of a good or service at a low price to maintain your hold on market share and prevent competitors from encroaching on your territory.

In these cases, you may be willing to sacrifice profit margins in order to focus on competitive pricing, but you must be careful when engaging in an action like this. Although it could be useful for your business, it also could end up crippling your company.

A good rule of thumb to remember when pricing products is that your customer base won’t purchase your product if it’s set too high, but your business won’t be able to cover expenses if you price it too low.

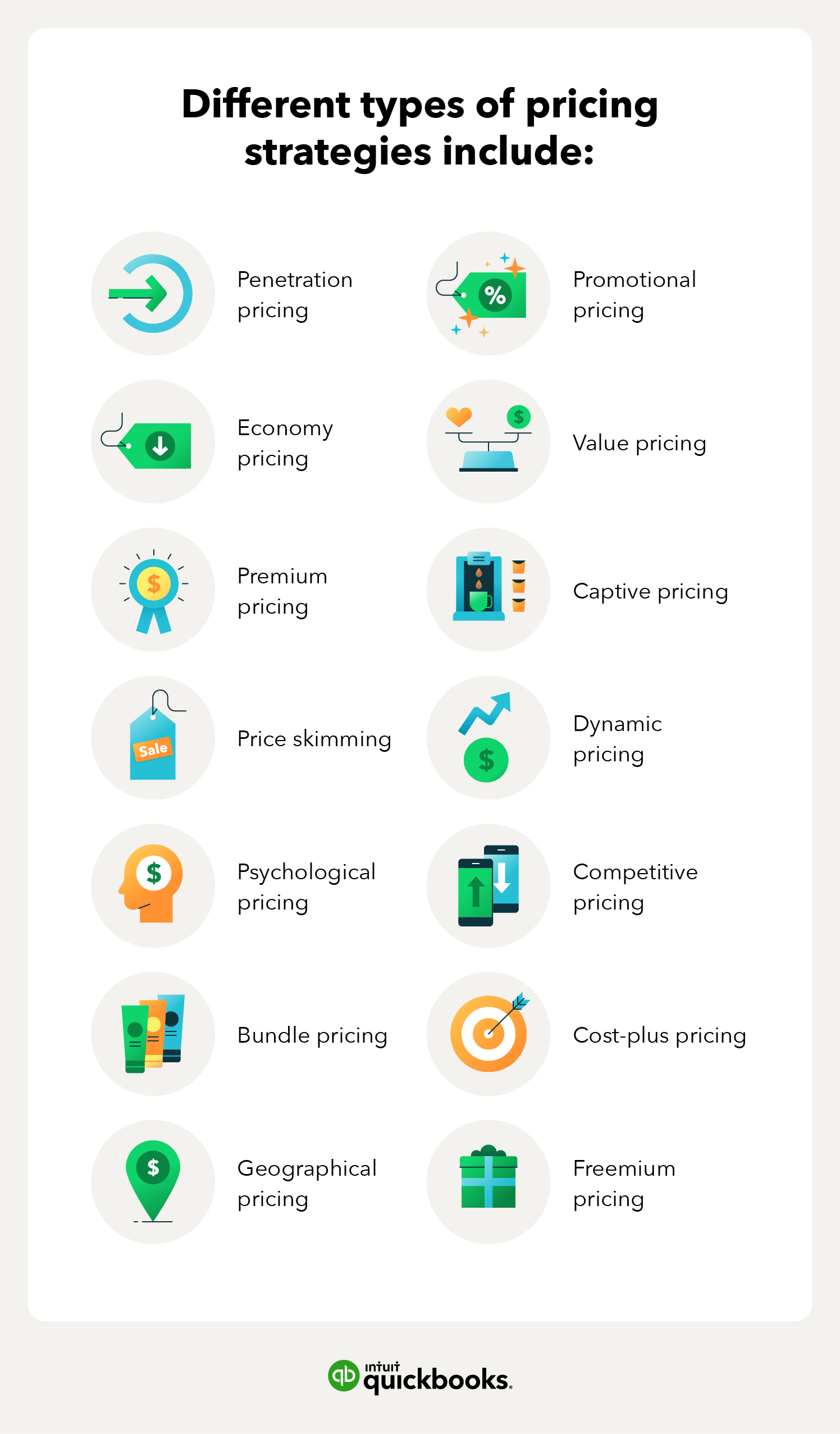

14 different pricing strategies for your small business to consider

As we’ve just identified, project management and strategic, actionable decisions go into setting the price of a product. Here are 14 different pricing strategies that you should consider as a small business owner.

1. Penetration pricing

Penetration pricing strategy aims to attract buyers by offering lower prices on goods and services than competitors. This strategy draws attention away from other businesses and can help increase brand awareness and loyalty, which can then lead to long-term contracts.

Penetration pricing can be risky because it can result in an initial loss of income for the business. Over time, however, the increase in brand awareness can drive profits and help small businesses stand out from the crowd.

In the long run, after penetrating a market, business owners can increase prices to better reflect the status of the product’s position within the market.

Best for: Small businesses with the main goal of building brand loyalty and reputation

Pros:

- Allows a product to be quickly adopted and accepted by customers

- Generates a high sales quantity

- Creates a large inventory turnover rate since demand will be higher

- Encourages positive word of mouth

Cons:

- Can create pricing expectations for customers—meaning they might always expect a low price and be dissatisfied if the price rises

- May reduce customer loyalty since most will be bargain hunters

- Can trigger price wars

- May hurt brand image as customers could perceive discounted products as cheap or bad quality

Penetration pricing example

Imagine a competitor selling a product for $100. You decide to sell the same product for $97, even if it means you’re going to take a loss on the sale.

2. Economy pricing

Economy pricing is a pricing strategy that aims to attract the most price-conscious consumers. A wide range of businesses use this strategy, including generic food suppliers and discount retailers.

This is a no-frills approach that involves minimizing marketing and production expenses as much as possible. Because of the lower cost of expenses, companies can set a lower sales price and still turn a slight profit.

Best for: Small businesses that want to keep their overhead costs low and that sell commodity goods

Pros:

- Easy to implement

- Keeps customer acquisition costs low

- Attracts price-sensitive customers

- Best strategy to use during an economic downturn or recession

Cons:

- Can be challenging to cut production costs

- Small businesses may not have enough brand awareness to forgo custom branding

- Works only if there’s a steady stream of customers

- Potential to negatively impact brand perception

Economy pricing examples

Businesses that utilize the economy pricing strategy include budget airlines and supermarkets. Budget airlines will use economy pricing to fill any empty seats and lower the cost per unit.

This strategy also applies to generic food brands that are sold in supermarkets—they’re priced lower because they require minimal promotion and marketing expenses.

3. Premium pricing

With premium pricing, businesses set costs higher because they have a unique product or brand that no one can compete with. You should consider using this strategy if you have a considerable competitive advantage and know that you can charge a higher price without being undercut by a product of similar quality.

Because customers need to perceive products as being worth the higher price tag, a business has to work hard to create the perception of value. Along with creating a high-quality product, business owners should ensure that the product’s packaging, the store’s decor, and the marketing strategy associated with the product all combine to support the premium price.

Best for: Small businesses that have a considerable competitive advantage and know that they can charge a higher price without being undercut by a product of similar quality

Pros:

- Makes your brand appear more desirable

- Higher profit margins

- Provides a competitive advantage

Cons:

- Higher cost of production and marketing

- Smaller target audience

- Reduced sales volume

Premium pricing examples

Examples of this strategy can be seen in the luxury car and tech industries. Car companies like Tesla can get away with higher prices because they’re offering products, like autonomous cars, that are more unique than anything else on the market.

Additionally, tech giants like Apple can sell their products at a premium price compared to their competitors because of their name.

New Businesses

Feel confident from day one

You’re never too small, and it’s never too soon to know you’re on track for success.

4. Price skimming

Price skimming is a type of dynamic pricing strategy that is designed to help businesses maximize sales on new products and services. This involves setting rates high during the initial phase of a product, then gradually lowering prices as competitor goods appear on the market.

Best for: Small businesses that have products that are in high demand, like tech companies

Pros:

- Allows businesses to maximize profits through early adopters

- Helps small businesses recoup development costs

- Creates an illusion of exclusivity and quality

Cons:

- Excess inventory may occur if this strategy fails

- The quality of the new service or product must justify the higher cost to be effective

- Won’t work if your competitors are creating similar products

Price skimming examples

An example of price skimming strategy is seen with tech companies with the introduction of new technology. An 8K TV would benefit from a higher marked price when only 4K TVs and HDTVs currently exist on the market.

This also works well with iPhones—the expected sales volume and speed of developing new products is so high that lowering prices throughout the skimming cycle will have very minimal effects on overall sales volume.

5. Psychological pricing

Psychological pricing refers to techniques that marketers use to encourage customers to respond based on emotional impulses, rather than logical ones.

One explanation for this strategy is that consumers tend to give more attention to the first number on a price tag than the last. The goal of psychology pricing is to increase demand by creating an illusion of enhanced value for the consumer.

Best for: Small businesses aiming toward short-term goals and quick wins

Pros:

- May offer a high return on investment

- Allows for cost transparency

- Simplifies the decision-making process for customers

Cons:

- Could cause customers to feel as though they’re being manipulated

- Doesn’t set you apart from competitors since it’s a popular strategy

- Requires consistent demand for your product

Psychological pricing example

Psychological pricing is often seen in retail. For example, setting the price of a watch at $199 is likely to attract more new customers than setting it at $200, even though the actual price difference is quite small.

Other tactics retailers use is the use of “buy one get one free” language versus “50% off two items.” This strategy relies on the customer favoring one wording over another even though they’re the exact same deal.

6. Bundle pricing

With bundle pricing, small businesses sell multiple products for a lower rate than selling each item individually.

Customers feel as though they’re receiving more bang for their buck. Many small businesses choose to implement this strategy at the end of a product’s life cycle, especially if the product is slow-selling.

Small business owners should keep in mind that the profits they earn on the higher-value items must make up for the losses they take on the lower-value product. They should also consider how much they’ll save in overhead and storage space by pushing out older products.

Best for: Small businesses that want to create large margins while offering a lower price than competitors

Pros:

- Increases the value perception in the eyes of your customers

- An effective way to reduce inventory

- Lowers marketing and selling costs

Cons:

- May affect products that may be selling better than the other if they’re bundled (product cannibalization)

- Some customers may not want all products offered in the bundle, resulting in an unwanted or unused product

- May cause a negative perception of the brand due to customers assuming the product is of lower quality since it’s bundled

Bundle pricing examples

An example of bundle pricing occurs at your local fast food restaurant where it’s cheaper to buy a meal than it is to buy each item individually.

Internet service providers will also use this strategy and take advantage of cable TV packages and bundled mobile plans.

7. Geographical pricing

Geographical pricing involves setting a price point based on the location where a product or service is sold. Factors for the changes in prices include:

- Taxes

- Tariffs

- Shipping costs

- Location-specific rent

- Supply and demand

If you expand your business across state or international lines, you’ll need to consider geographical pricing.

Best for: Small businesses that have markets in many different locations

Pros:

- Allows you to gain local appeal

- Can boost perceived value in certain locations

Cons:

- Local regulations need to be considered, such as pricing laws

- Accounting and bookkeeping can become more complicated since there are different regions to be accounted for

Geographical pricing example

Geographical pricing applies to retailers or service providers who charge different prices in different states. For example, a gym may charge a higher price for membership in California than they would at the same location in Louisiana.

8. Promotional pricing

Promotional pricing is another competitive pricing strategy that involves offering discounts on a particular product. These strategies are often run during a holiday, like Memorial Day weekend. By offering these deals as short-term offers, business owners can generate buzz and excitement about a product.

Promotional pricing campaigns often consist of short-term efforts and incentivizes customers to act now before it’s too late. This pricing strategy plays to a consumer’s fear of missing out.

Best for: Small businesses that want to generate quick demand for their products or services

Pros:

- Increases sales volume in the short term

- Increased inventory turnover

- Promotions can build customer loyalty

Cons:

- More calculations are required to ensure the sales volume compensates for the discounted prices

- Lowered perception by customers due to “cheaper” prices

- Customers may be reluctant to purchase again if you don’t keep offering promotions

Promotional pricing examples

An example of promotional pricing can apply to a retail store that implements a “Buy One Get One” campaign during a holiday weekend, like Black Friday or Cyber Monday. Loyalty programs also apply here as well—retailers will offer rewards to their loyal customers for a limited time.

9. Value pricing

Value pricing is a way of setting your prices based on your customer’s perceived value of what you’re offering. This occurs when external factors, like a sharp increase in competition or a recession, encourage the small business to further provide additional value to its customers to maintain sales.

This pricing strategy works because customers feel as though they are receiving an excellent value for the good or service. The approach recognizes that customers don’t care how much a product costs a company to make, so long as the consumer feels they’re getting an excellent value by purchasing it.

Best for: Small businesses that specialize in SaaS or subscriptions

Pros:

- Potential for high profit margins

- Increased perceived value in your brand and services

- Increased customer loyalty

Cons:

- Requires additional market research to determine what is of value to your audience

- Markets that work well with this strategy tend to be very niche since they’re high-end

- Goods will cost more to produce

Value pricing examples

An example of value pricing can be seen in the fashion industry. A company may produce a product line of high-end dresses that they sell for $1,000. They then make umbrellas that they sell for $100.

The umbrellas may cost more than the dresses to make. However, the dresses are set at a higher price point because customers feel as though they are receiving much more value for the product. Would you pay $1,000 for an umbrella? Probably not. Thus, external factors like customer perceptions guide the value pricing strategy.

10. Captive pricing

Captive pricing is a strategy used to attract a high volume of customers to a product intended for a one-time purchase. The method behind captive pricing is to generate profits from added accessories that go along with the core product you’re selling. Small businesses can implement price increases so long as the cost of the secondary product does not exceed the cost that customers would pay a competitor.

Best for: Small businesses that have a product that customers will continually renew or update

Pros:

- Increases flow of traffic to the core product

- Boosts sales each time the upgraded accessory is released

- Customer loyalty increases

Cons:

- Customers may begin to feel unsatisfied with having to update their products repeatedly

- High-priced accessories can lead to a loss of sales

- You’ll need to continuously offer new and improved products each time to maintain revenue and customer interest

Captive pricing examples

A perfect example of a captive pricing strategy is seen with a company like Dollar Shave Club. With Dollar Shave Club, customers make a one-time purchase for a razor. Then, every month, they purchase new razor blades to replace the existing one on the head of the razor.

Because the customer purchased a DSC razor handle, they have no choice but to buy blades from the company as well. The company holds customers “captive” until they decide to break away and buy a razor handle from another company.

11. Dynamic pricing

Dynamic pricing is when you charge different prices depending on who is buying your product or service or when they buy it. It’s a flexible pricing strategy that takes many factors into account—particularly changes in supply and demand.

You might have heard dynamic pricing referred to as:

- Demand pricing

- Surge pricing

- Time-based pricing

While dynamic pricing is relatively common in e-commerce and the transportation industry, it doesn’t work for every type of business. The greatest risks can come when variable prices are applied to products or services that are typically bought by price-sensitive customers.

Best for: Small businesses looking to maximize their profit margins and boost declining sales

Pros:

- Allows for pricing to reflect the market demand for the product or service

- Provides more insight into customer demand and purchase patterns

- Enables you to maximize your profits by matching your price to the demand

Cons:

- Customers may be scared off by prices that are always fluctuating

- Higher risk of price wars

- Increases competition within the industry

Dynamic pricing example

A good example of dynamic pricing comes from the airline industry. If you’ve ever noticed how much flight prices can change depending on when you book, you’ve experienced dynamic pricing firsthand.

12. Competitive pricing

Competitive pricing is when your prices either match or beat those of similar products that are sold by competitors. Oftentimes this simply means selling your products or services at a better price, but you could choose to offer better payment terms instead.

To determine if this strategy is right for you, gather as much information as possible about your target market and what your competition is doing. If you combine this with the assistance of advanced pricing software solutions, you can analyze and update price data continuously.

Best for: Small businesses that are just starting out

Pros:

- Simple implementation

- Can be combined with other strategies such as cost-plus pricing to make efforts more rewarding

Cons:

- Not good to use long-term since competitors will catch on and modify their strategy

- Not a strategy to use if you want to stand out since your competitors are likely using the same methods

Competitive pricing examples

An example of a company that takes advantage of competitive pricing is Amazon. Amazon will compare the prices of products sold on their platform and utilize that information to offer the lowest price in the market.

This can also be seen in the tech industry with Apple and Samsung using competitive pricing for their phones.

13. Cost-plus pricing

Cost-plus pricing is a strategy of marking up (adding a fixed percentage) the cost of services and goods to arrive at your selling price.

As a seller, you would use a calculation that includes fixed and variable costs that will be incurred in manufacturing your product and then apply the markup percentage to that cost. This strategy is widely used since it’s easy to justify and is typically fair and nondiscriminatory.

Best for: Small businesses with a cost advantage or an interest in using price transparency as a differentiator

Pros:

- May lead to positive differentiation and customer trust

- Reduced risk of price wars

- Can provide predictable profits

- Simple to implement

Cons:

- Discourages efficiency and cost containment

- Potential for customers to perceive the product negatively

- Not guaranteed to cover all costs since much of the calculation is a guesstimation

- Can be difficult to change prices when needed

Cost-plus pricing example

Grocery stores and supermarkets work on a cost-plus basis to determine the prices of items such as eggs and milk. Oftentimes, these businesses will purchase from a wholesaler or producer and then apply a markup price for the product sold at their store.

14. Freemium pricing

Freemium pricing is a strategy in which a service or product is given to a customer free of charge unless they want to access premium features or services within that product.

Best for: Small businesses that intend to offer both free and paid versions of their product and those that offer free trials

Pros:

- Potential to unlock viral growth

- Creates a no-risk environment that attracts customers who want to try something for free

- Opportunity to monetize on advertising

Cons:

- A higher percentage of free users may never convert

- Cash reserves can be depleted quickly due to a large number of non-paying users

- May require additional customer service support for freemium users, which can be costly

Freemium pricing examples

Freemium pricing examples include free apps that require customers to pay a premium price if they want an ad-free experience.

This also includes online magazine and newspaper subscriptions that only give you a certain amount of free articles until you have to pay to receive unlimited access.

Pricing strategy best practices

After learning about the 14 pricing strategy options, consider these best practices before you implement one into your business’s process:

- Ensure your pricing manager is experienced: For the most success, it’s important that whoever is driving this strategy is experienced and skilled enough to handle a large pricing strategy roadmap.

- Define KPIs ahead of time: Setting your KPIs before implementing will help you have a more clear vision and will allow you to easily monitor progress.

- Start small: Change doesn’t happen in a day — as you roll out your new strategy, be sure to start small so you can easily pivot if you make mistakes. Then, gradually ramp up your strategy.

Pricing strategy FAQ

Below are several important considerations to know when choosing the right pricing strategy for your small business.

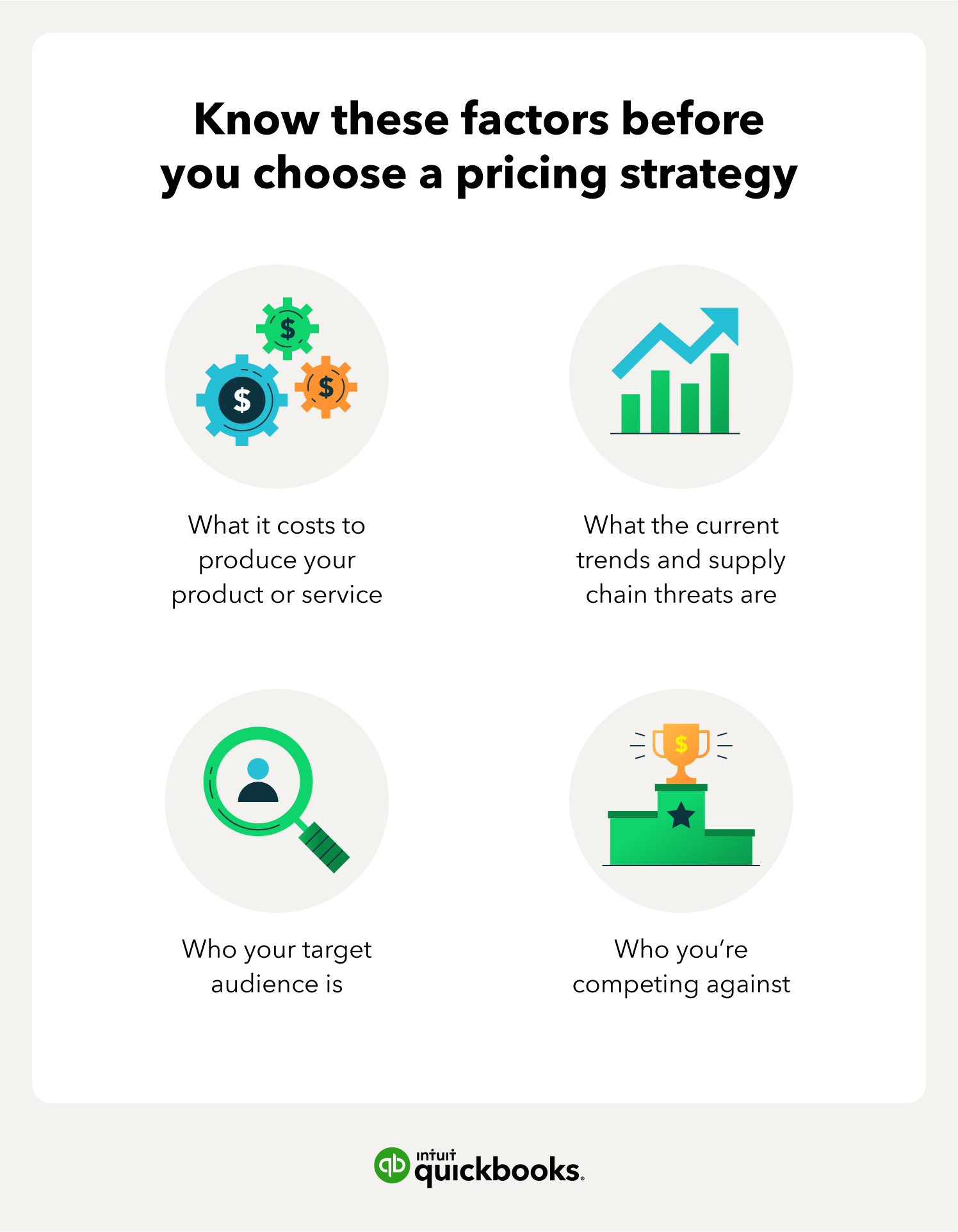

What is the most effective pricing strategy?

The most important factors influencing your pricing strategy are rooted in your business’s unique financial data and external conditions. This includes:

- Knowing what it costs to produce your products or provide your services

- Continuously monitoring these costs so you can quickly react to changes and maintain long-term profitability

- Knowing your market, your competition, and your customers

- Staying on top of emerging trends, supply chain threats, and consumers’ perceptions of your brand

Finally, if you are selling premium goods and want to drive up demand, consider your longer-term revenue goals, such as:

- Whether discounts will do more harm than good by damaging the perceived value of your product

- The amount of time you can sustain your chosen pricing strategy before cash flow becomes too stretched

Should I charge more or less than my competitors?

This depends on what you’re selling and your target market. You have to think about all factors before setting a price. For example, if you want your business to expand into a new market, then you may want to charge lower prices to attract new customers.

If your competitors end up increasingly charging more, then you may want to consider increasing your own prices. It all comes down to what your competitors are doing and the goals your business is trying to obtain.

How often should I review my pricing strategy?

You should review your strategy at least once a year. However, you may want to review earlier in the case of:

- A new competitor

- Changes in legislation or laws that affect your product or service

- A need to quickly boost dropping sales

It’s also wise to keep an eye on your competitors’ pricing to avoid any overlooked changes in the market.

What is a pricing curve?

A pricing curve is a graph that shows you the number of people who are willing to pay a certain price for a service or product. This can help you determine how to price your product.

What is the most simple pricing strategy?

The most simple pricing model is cost-plus pricing due to the fact that you only need to take the cost and add a marked-up percentage to it.

What is keystone pricing?

Keystone pricing is a method that businesses use that marks up all merchandise by twice what the wholesale cost was. If a business isn’t quite sure what kind of pricing strategy to use, keystone pricing can be an easy starting point that can drive some profits.

Keep track of business revenues

Once you determine the best pricing strategy for your business model, your profit margins could increase. You’ll want to make sure you’re using reliable accounting software to keep track of relevant data.

QuickBooks makes it easy for you to monitor relevant sales data and manage cash flow in one place. This allows you to continually evaluate your pricing method so that you can make price changes in real time, grow your business, and improve customer success.

To further fast-track and simplify your business growth, be sure to utilize tools such as QuickBooks to help you organize and run your business.