Vanguard FTSE Developed Markets ETF (NY:VEA)

All News about Vanguard FTSE Developed Markets ETF

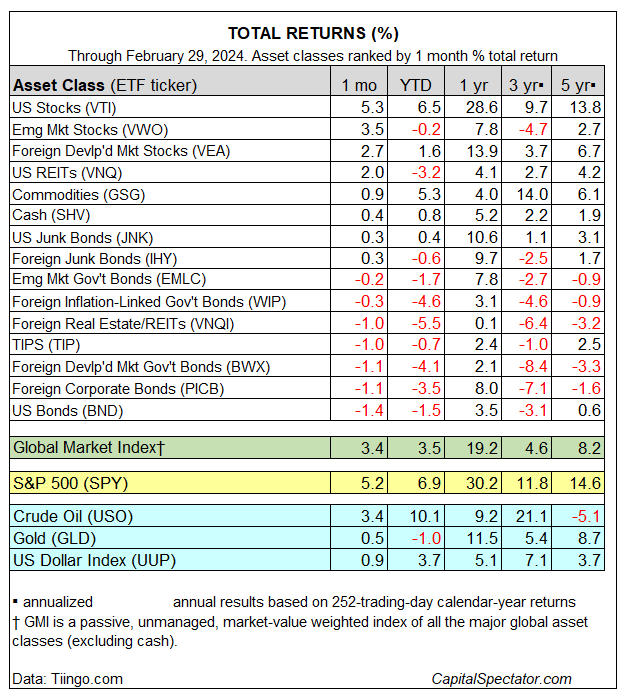

Major Asset Classes Performance Review - March 2024 ↗

April 01, 2024

Via Talk Markets

Topics

Bonds

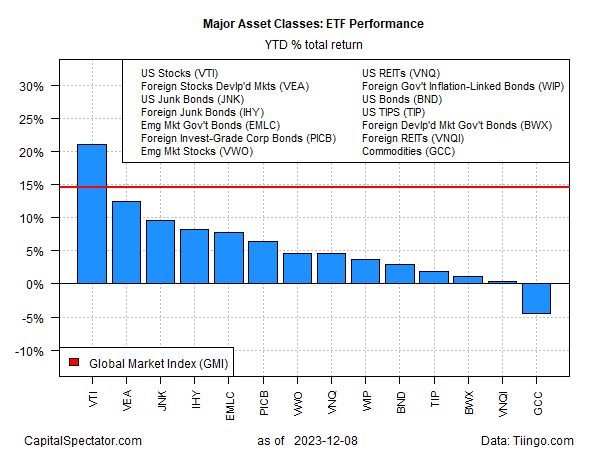

All Major Asset Classes (Except Commodities) Set For 2023 Gains ↗

December 11, 2023

Via Talk Markets

Topics

ETFs

Globally Diversified Portfolios On Track For Solid 2023 Gain ↗

November 13, 2023

Via Talk Markets

Topics

Economy

Major Asset Classes: September 2023 - Performance Review ↗

October 02, 2023

Via Talk Markets

Topics

ETFs

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.