iShares 7-10 Year Treasury Bond ETF (NQ:IEF)

All News about iShares 7-10 Year Treasury Bond ETF

Ahead Of Fed Rate Decision, El-Erian Warns Central Bank May Not 'Validate' More Cuts ↗

October 29, 2025

Via Stocktwits

Topics

Economy

Mortgage Rates Fall To Lowest Levels In 2025 ↗

October 23, 2025

Via Stocktwits

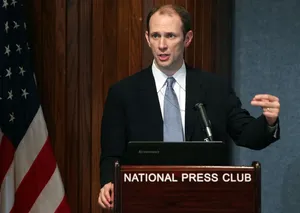

Fed's Miran Says US Is 'Probably' Set For Three 25 Bps Rate Cuts This Year: Report ↗

October 16, 2025

Via Stocktwits

Topics

Economy

Fed’s Miran Says Rate Cuts Are ‘More Urgent’ Now Due To Recent Trade Tensions: Report ↗

October 15, 2025

Via Stocktwits

Topics

Economy

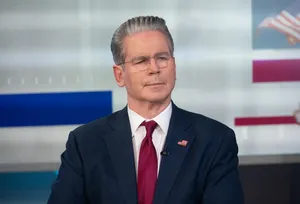

Jerome Powell Says Fed’s Tightening Program May Be Approaching The End In ‘Coming Months’ ↗

October 14, 2025

Via Stocktwits

Topics

Economy

Via The Motley Fool

Via The Motley Fool

Fed’s Bowman Says Proposals To Improve Stress Testing For Lenders Coming Soon: Report ↗

October 14, 2025

Via Stocktwits

Topics

Economy

Fed’s Waller Favors More Rate Cuts, But Warns Against Moving ‘Aggressively And Fast’: Report ↗

October 10, 2025

Via Stocktwits

Topics

Economy

Fed's Barr Says Trump-Era Big Bank Deregulation Leaves Community Banks Exposed To Fallout ↗

October 08, 2025

Via Stocktwits

Topics

Economy

Via Stocktwits

Topics

Economy

Fed Minutes Show Nearly Half Of Its Officials Expect Two More Rate Cuts By End Of 2025 ↗

October 08, 2025

Via Stocktwits

Topics

Economy

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.