Valued at $27.4 billion by market cap, Hewlett Packard Enterprise Company (HPE) is a Texas-based global enterprise technology provider specializing in servers, storage, networking, cloud infrastructure, and data-management solutions. The company supports large enterprises, government institutions, and data-driven industries as they modernize IT systems and advance digital-transformation initiatives.

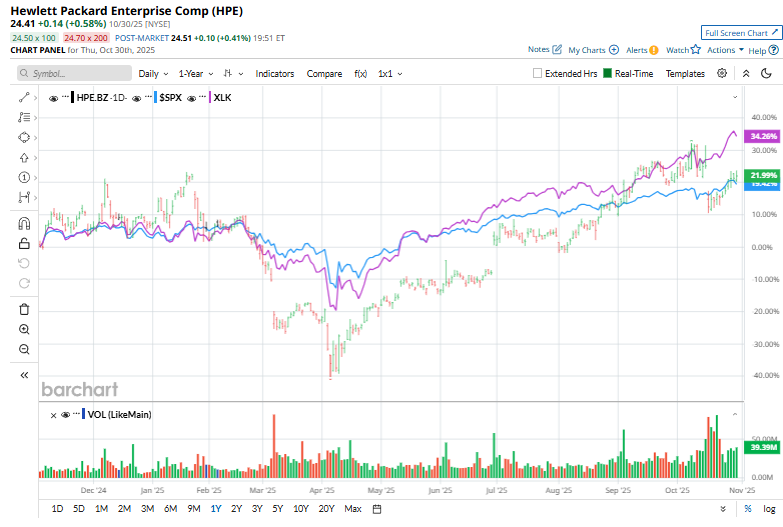

Shares of this global technology leader have outperformed the broader market over the past year. HPE has gained 20% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 17.4%. However, in 2025, HPE stock is up 14.3% trailing SPX’s 16% rise.

Narrowing the focus, HPE has lagged behind the Technology Select Sector SPDR Fund (XLK). The exchange-traded fund has gained 30.8% over the past year and 29.2% gains on a YTD basis.

Shares of Hewlett Packard Enterprise slid 10.9% on Oct. 16 after the company issued a weaker-than-expected fiscal 2026 outlook. At its analyst meeting, HPE forecast revenue growth of 5%–10%, which is well below the roughly 17% analysts had expected, and guided adjusted EPS to $2.20–$2.40, compared to a $2.42 consensus. The conservative forecast, described by some analysts as underwhelming, disappointed investors despite the company highlighting plans to expand its presence across servers, storage, and networking.

For the current fiscal year, ending in October, analysts expect HPE’s EPS to decline 12.1% year over year to $1.52 on a diluted basis. The company’s earnings surprise history is mixed. It beat the consensus estimates in two of the last four quarters while missing the forecast on two other occasions.

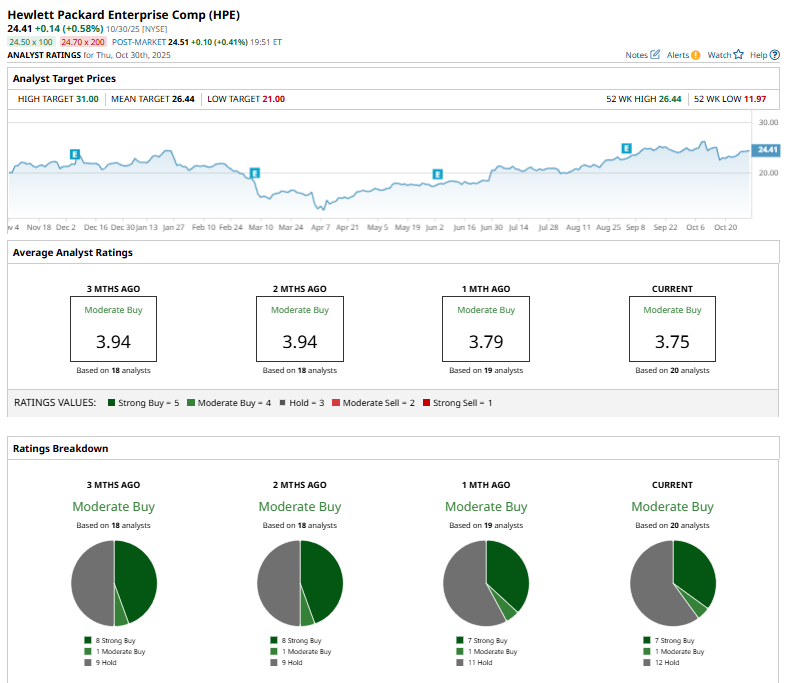

Among the 20 analysts covering HPE stock, the consensus is a “Moderate Buy.” That’s based on seven “Strong Buy” ratings, one “Moderate Buy,” and 12 “Holds.”

This configuration is bearish than two months ago, with eight analysts suggesting a “Strong Buy.”

On Oct. 17, Evercore ISI’s Amit Daryanani reiterated his “Buy” rating on Hewlett Packard Enterprise and kept the price target at $28.

The mean price target of $26.44 represents an 8.3% premium to HPE’s current price levels. The Street-high price target of $31 suggests an ambitious upside potential of 27%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart