3M (MMM) shares are slipping on Tuesday after the multinational conglomerate reported mixed results for its fiscal Q4 and issued muted guidance for the future.

The company earned $1.83 a share (adjusted), handily beating experts’ forecast, but its adjusted sales at $6 billion came in slightly shy of expectations.

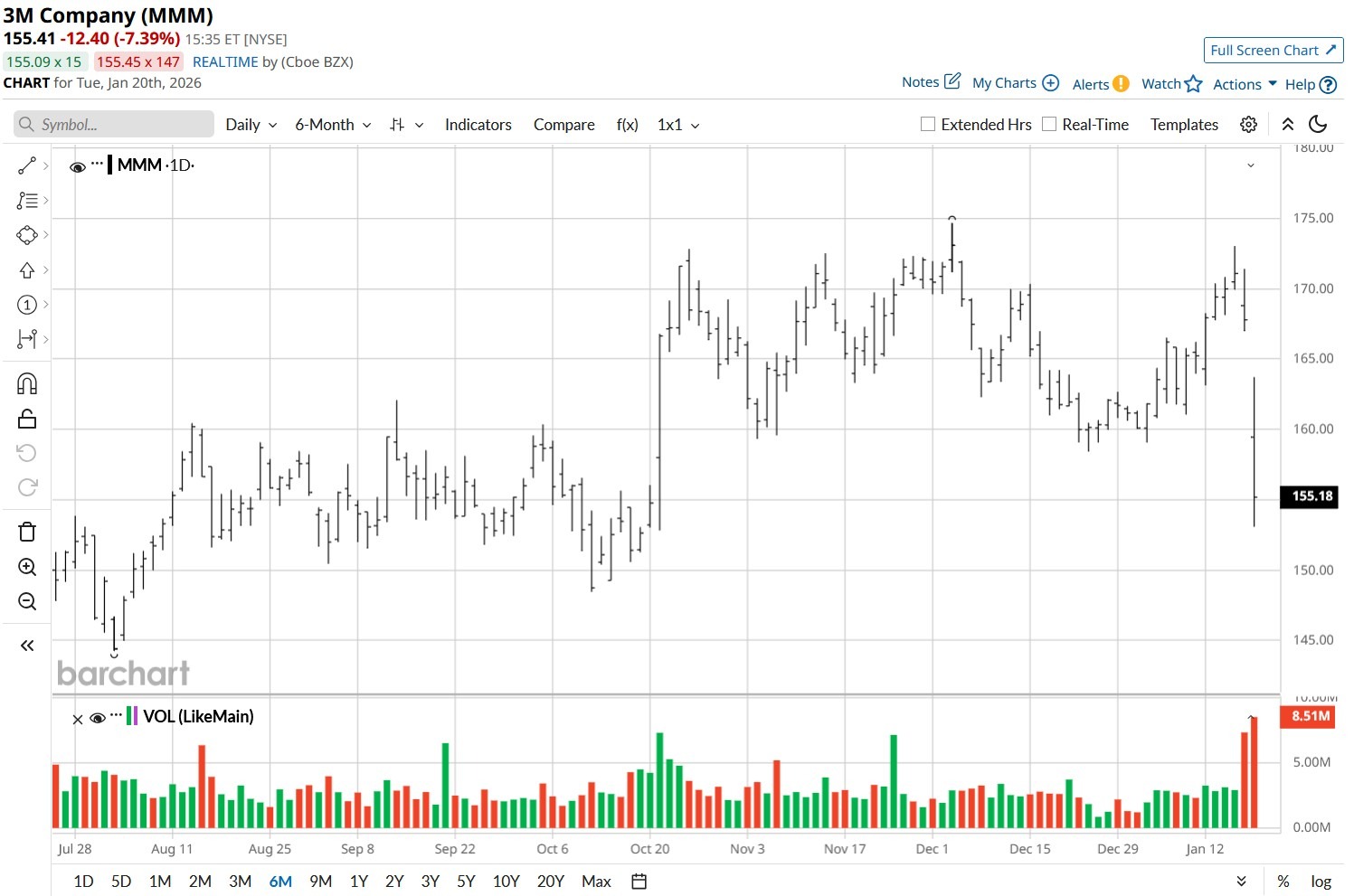

Following the post-earnings decline, 3M stock is down nearly 10% versus its year-to-date high.

Is It Worth Buying 3M Stock on the Post-Earnings Dip?

Investors should practice caution in buying the dip in MMM stock mostly because the company’s full-year outlook came in short of Wall Street estimates on Jan. 20.

Its management now sees earnings per share (EPS) printing at about $8.60 this year, compared to $8.64 a share that analysts had called for.

3M attributed this expected weakness to “escalated tariffs” under President Donald Trump, noting the new levies could hurt its bottom line by as much as $40 million in 2026.

In its earnings release, the NYSE-listed firm also warned that this number could increase further to about $70 million if the White House ended up raising tariff rates to 25%.

Margin Compression Could Hurt MMM Shares in 2026

3M shares remain unattractive also because the company’s consumer segment represents a notable structural headwind, having missed experts’ forecasts for five consecutive quarters.

In Q4, that segment posted a sales decline of another 1.2% year-over-year amidst weaker consumer sentiment and sluggish retail traffic.

Additionally, a 360 basis points quarter-on-quarter contraction in margin, substantially exceeding typical seasonality, raises concerns about near-term profitability as well.

Finally, at a forward price-to-earnings (P/E) ratio of a little under 20x, MMM appears fairly priced rather than offering exceptional value.

On Tuesday, the stock dipped below its 100-day moving average (MA), reinforcing that the bearish momentum could hold in the near term.

Wall Street Remains Bullish on 3M

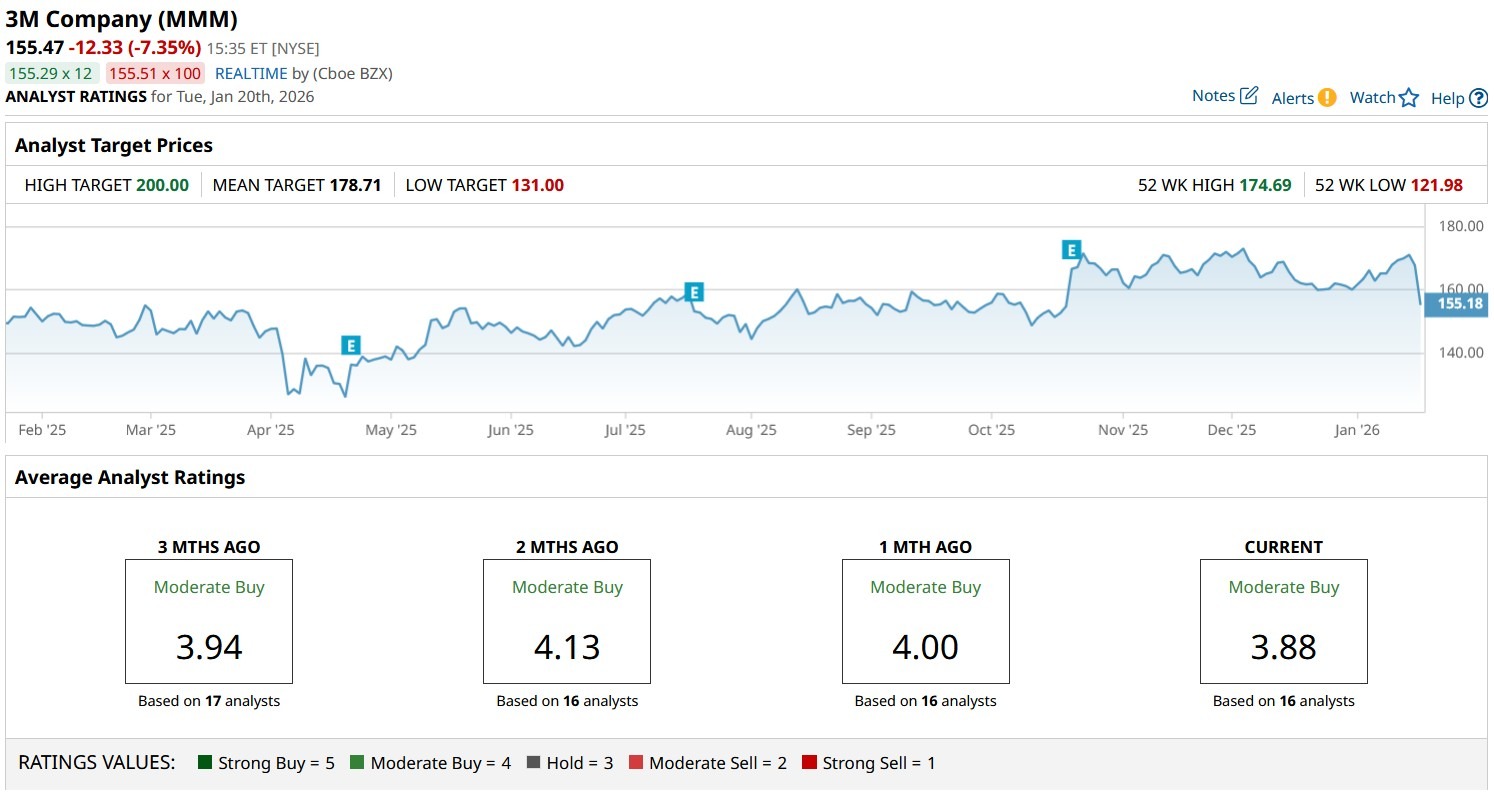

Despite aforementioned challenges, Wall Street analysts remain bullish as ever on MMM shares for the long term.

According to Barchart, the consensus rating on 3M stock sits at “Moderate Buy” currently with the mean target of about $179 indicating potential upside of another 16% from here.

This article was created with the support of automated content tools from our partners at Sigma.AI. Together, our financial data and AI solutions help us to deliver more informed market headline analysis to readers faster than ever.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Should You Buy the Dip in 3M Stock Today?

- Is Ryanair Stock a Buy, Sell, or Hold as Elon Musk Proposes Buying the Discount Airline?

- This Little-Known Fertility Stock Is Up 215% in the Past 5 Days. Should You Chase the Mysterious Penny Stock Rally Here?

- Intel Stock Is Already Up 19% in 2026. Can Q4 Earnings Propel It Higher in 2026?