The S&P 500 ($SPX) is flirting with the psychologically significant 7,000 level after setting a fresh intraday record above 6,988 on Tuesday. The flagship index has continued its impressive rally in 2026, driven by strong corporate earnings and resilient economic data.

Yet beneath this broad market strength, pockets of weakness are emerging that could present opportunities for contrarian investors. While the benchmark index pushes higher, several quality names have been left behind in the rally, with their relative strength index readings dropping into oversold territory.

Technical analysts typically view RSI levels below 30 as oversold conditions that may signal a potential buying opportunity, especially when fundamentally strong companies experience temporary setbacks.

According to a Seeking Alpha report, three S&P 500 components stand out as particularly oversold:

- Roper Technologies (ROP) has an RSI of just 12.37.

- Abbott Laboratories (ABT) at 20.37.

- Humana (HUM) at 23.66.

Each of these companies is an established industry leader with a proven track record.

- Roper Technologies is a diversified industrial conglomerate focused on software and technology-enabled products, serving markets including healthcare, transportation, and water utilities through its portfolio of niche vertical software businesses.

- Abbott Laboratories is a global healthcare giant spanning medical devices, diagnostics, nutrition products, and branded generic pharmaceuticals.

- Humana operates as one of America's largest health insurance providers, primarily focused on Medicare Advantage plans serving seniors, along with Medicaid and commercial insurance offerings.

Let's dig a little more into each of these oversold S&P 500 stocks.

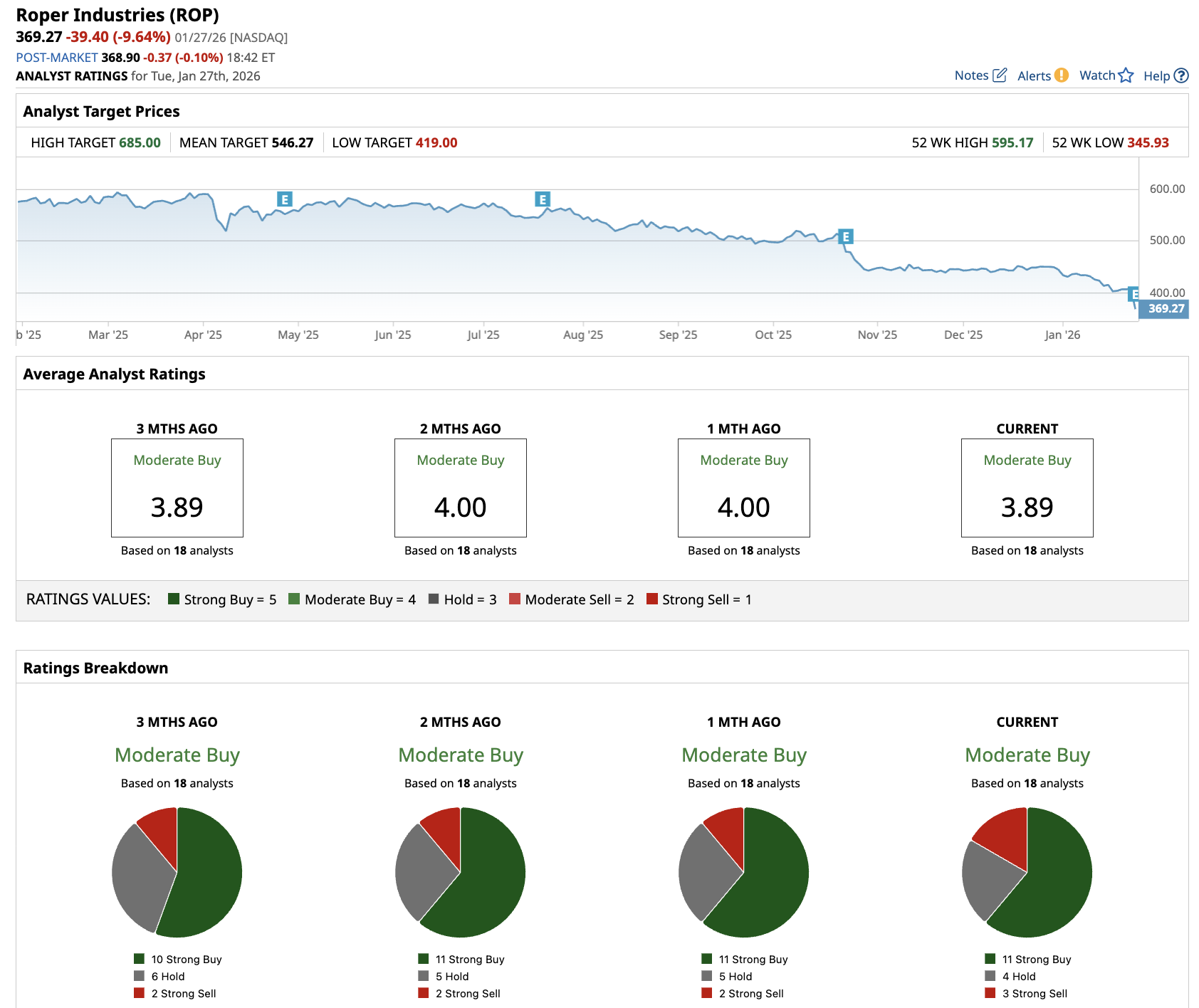

Top Oversold S&P 500 Stocks #1: Roper Industries (ROP)

In fiscal 2025, Roper Technologies reported revenue growth of 12% while free cash flow was up 8% year-over-year (YoY). However, organic growth fell short of estimates, coming in at 5.5%.

Roper’s portfolio of vertical-market software businesses enables it to generate a recurring revenue stream. It offers enterprise-facing, mission-critical workflows across sectors such as legal, healthcare, and government contracting.

Enterprise software bookings grew in the low double digits in 2025. The company is excited about AI opportunities and recently hired specialized leadership to accelerate AI product development across its 21 software businesses.

Management took a conservative approach to 2026 guidance, projecting organic growth of 5% to 6% while assuming no improvement in challenged areas, such as the government contracting business at Deltek or the freight market impacting DAT.

The company deployed $3.3 billion toward acquisitions in 2025 and opportunistically repurchased $500 million in stock during the fourth quarter when shares traded around $446. With over $6 billion in capital deployment capacity and net leverage at a comfortable 2.9 times, Roper maintains significant financial flexibility.

Out of the 18 analysts covering ROP stock, 11 recommend “Strong Buy,” four recommend “Hold,” and three recommend “Strong Sell.” The average ROP stock price target is $546.27, above the current price of $369.

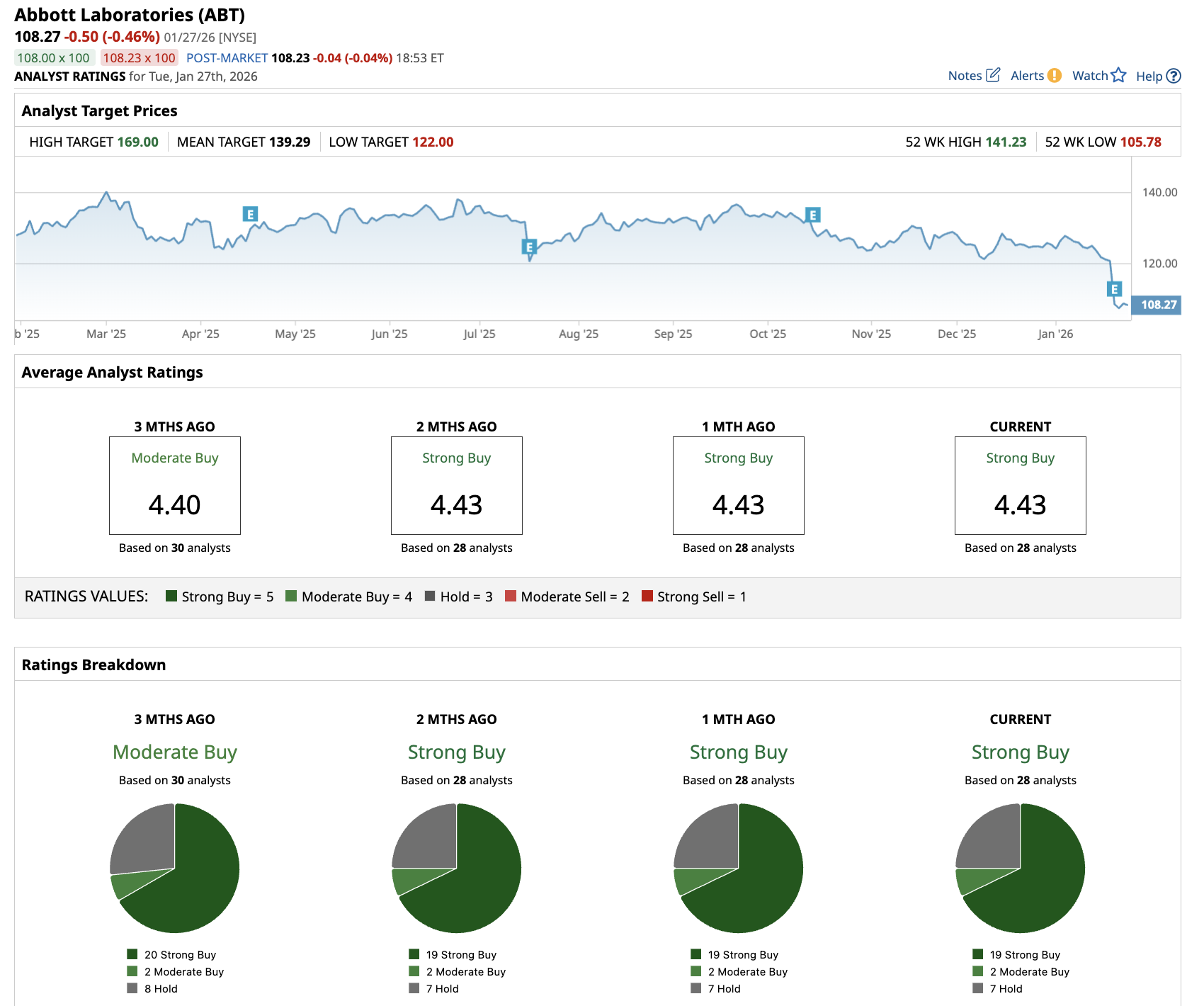

Top Oversold S&P 500 Stocks #2: Abbott Laboratories (ABT)

In 2025, Abbott's continuous glucose monitoring business reported sales of over $7.5 billion. This segment added more than $1 billion in annual sales for the third consecutive year.

Management expects this momentum to persist with growth tracking in the low to mid-teens range for 2026. The Medical Devices segment overall posted an impressive 10.5% growth in the fourth quarter, driven by double-digit expansion across Electrophysiology, Structural Heart, and Rhythm Management.

However, Abbott is navigating market share losses in the Nutrition segment. Notably, it has shifted to a volume-driven growth strategy after years of price increases. Management expects the transition to pressure results in the first half of 2026 before returning to growth in the second half. The company began implementing pricing and promotional initiatives in the fourth quarter and plans to launch at least eight new products over the next year.

Abbott maintained its 2026 guidance, with organic sales growth of 7% at the midpoint and 10% earnings-per-share growth, demonstrating confidence despite the Nutrition reset. The pending acquisition of Exact Sciences adds another strategic growth driver in cancer diagnostics.

Out of the 28 analysts covering ABT stock, 19 recommend “Strong Buy,” two recommend “Moderate Buy,” and seven recommend “Hold.” The average ABT stock price target is $139.29, above the current price of $108.

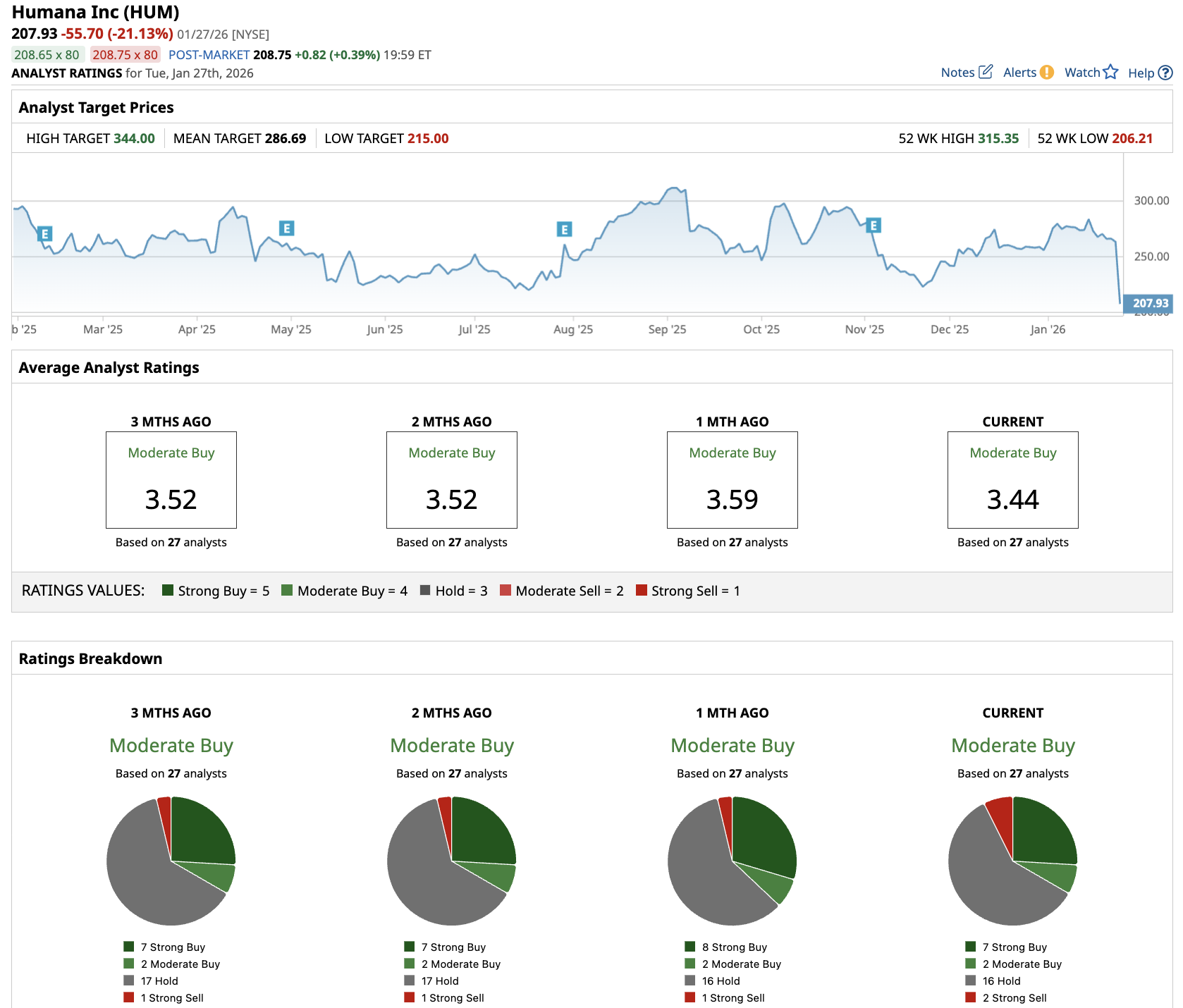

Top Oversold S&P 500 Stocks #3: Humana (HUM)

Humana is navigating a challenging period marked by significant revenue headwinds and an uncertain membership outlook during the critical annual enrollment period. The company faces over $3 billion in revenue headwinds in 2026, primarily stemming from lower star ratings that affect bonus payments from the Centers for Medicare & Medicaid Services.

CFO Celeste Mellet emphasized the company's focus on lifetime value rather than simply chasing membership growth, noting they've parted ways with their largest call center and thousands of brokers who weren't delivering high-quality enrollments. Over the last two years, Humana exited unprofitable plans and repriced products to boost the bottom line.

Out of the 27 analysts covering Humana stock, seven recommend “Strong Buy,” two recommend “Moderate Buy,” 16 recommend “Hold,” and two recommend “Strong Sell.” The average HUM stock price target is $287, above the current price of $208.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- As Enphase Energy Cuts 5% of Its Staff, Should You Buy, Sell, or Hold the Solar Stock?

- 2 Top-Rated Nuclear Energy Stocks to Buy as Trump Talks Nuclear Waste

- These Are the 3 Top Oversold S&P 500 Stocks. Should You Buy the Dip?

- Carvana Stock Was Just Hit With a New Short Report. Should You Buy the Dip?