Sharp rise in gas prices continue to put pressure on middle-income households

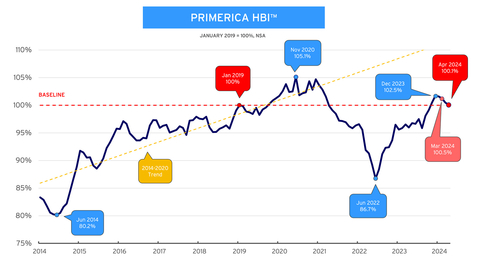

Primerica, Inc. (NYSE: PRI), a leading provider of financial services and products in the United States and Canada, announced today the release of the Primerica Household Budget Index™ (HBI™), a monthly index illustrating the purchasing power of middle-income households with income between $30,000 and $130,000. In April 2024, the average purchasing power for middle-income households was 100.1%, down from 100.5% in March 2024. This marks the fourth month in a row that the index has declined from its recent high of 102.5% set in December 2023. The primary driver for the decline is the sharp rise in gas prices, which increased 12% cumulatively over the past two months.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240529975513/en/

Primerica Household Budget Index™ - In April 2024, the average purchasing power for middle-income households was 100.1%, down from 100.5% in March 2024. This marks the fourth month in a row that the index has declined from its recent high of 102.5% set in December 2023. (Graphic: Business Wire)

For more information on the Primerica Household Budget Index™, visit www.householdbudgetindex.com.

About the Primerica Household Budget Index™ (HBI™)

The Primerica Household Budget Index™ (HBI™) is constructed monthly on behalf of Primerica by its chief economic consultant Amy Crews Cutts, PhD, CBE®. The index measures the purchasing power of middle-income families with household incomes from $30,000 to $130,000 and is developed using data from the U.S. Bureau of Labor Statistics, the US Bureau of the Census, and the Federal Reserve Bank of Kansas City. The index looks at the cost of necessities including food, gas, utilities, and health care and earned income to track differences in inflation and wage growth.

The HBI™ is presented as a percentage. If the index is above 100%, the purchasing power of middle-income families is stronger than in the baseline period and they may have extra money left over at the end of the month that can be applied to things like entertainment, extra savings, or debt reduction. If it is under 100%, households may have to reduce overall spending to levels below budget, reduce their savings or increase debt to cover expenses. The HBI™ uses January 2019 as its baseline. This point in time reflects a recent “normal” economic time prior to the COVID-19 pandemic.

Periodically, prior HBI™ values may be revised due to revisions in the CPI series and Consumer Expenditure Survey releases by the U.S. Bureau of Labor Statistics (BLS). Beginning with the October 2023 release of the HBI™ data, health insurance costs will no longer be included in the calculation of the HBI™ data as part of the healthcare component because of some newly acknowledged methodology that has been used by the BLS to calculate the health insurance CPI. The health insurance CPI, as calculated by BLS, does not measure consumer costs of health insurance such as the cost of premiums paid or a combination of premiums and deductibles, but rather premium values retained by health insurers we do not believe it accurately reflects consumer experiences. The healthcare component will continue to include medical services, prescription drugs and equipment. Prior published values have been adjusted to reflect this change. For more information visit householdbudgetindex.com.

About Primerica, Inc.

Primerica, Inc., headquartered in Duluth, GA, is a leading provider of financial products and services to middle-income households in North America. Independent licensed representatives educate Primerica clients about how to better prepare for a more secure financial future by assessing their needs and providing appropriate solutions through term life insurance, which we underwrite, and mutual funds, annuities and other financial products, which we distribute primarily on behalf of third parties. We insured approximately 5.7 million lives and had approximately 2.9 million client investment accounts on December 31, 2023. Primerica, through its insurance company subsidiaries, was the #2 issuer of Term Life insurance coverage in the United States and Canada in 2023. Primerica stock is included in the S&P MidCap 400 and the Russell 1000 stock indices and is traded on The New York Stock Exchange under the symbol “PRI”.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240529975513/en/

Contacts

Public Relations

Gana Ahn, 678-431-9266

gana.ahn@primerica.com

Investor Relations

Nicole Russell, 470-564-6663

nicole.russell@primerica.com