![]()

The semiconductor industry had been peaceful for several years before the COVID-19 pandemic. The biggest and most powerful players shared a level playing field regarding supply chains, market share, and intellectual property barriers. That was the case until the presidential term of 2016-2020, which initiated some duly raised red flags about foreign technology concerns, mainly from China and the rapidly expanding firm Huawei.

Huawei has been accused of espionage in several nations. This conflict ended with a settlement as the U.S. and other countries banned Huawei from selling, operating, or accessing their networks. This put an end to any hopes of Huawei becoming a global conglomerate. Surprisingly, the Chinese government did nothing directly to prevent Huawei's fall.

Such an instance put some technology CEOs - particularly those reliant on semiconductors based in Asia - on high alert, raising concerns to higher offices that the U.S. must become more competitive in the Asia-dependent landscape for semiconductors.

Whoever controls the chip supply chain will eventually have the strongest armies and most powerful insights into various markets and opportunities as higher computing power is ultimately achieved.

TSMC has the chips, and now it has to choose which dip

As geopolitical tensions and competition in intellectual property and semiconductor advancement escalated between the U.S. and China, a particular company called Taiwan Semiconductor Manufacturing (NYSE: TSM) finds itself in a bit of a pinch, like a child having to choose a favorite parent during an argument. The company allegedly derives 65% of its revenues from North America, as stated in its 2021 annual report. If anything ever makes business sense, it would be to retain a healthy relationship with the hand —or region— that feeds you.

Such relationships have been forged and maintained by TSMC with its biggest customer region by adopting airtight customer data practices to encourage the government and engaging in university collaboration programs with institutions like MIT and UC Berkeley. This includes boosting professor recruitment and funding R&D to further expand on their leadership strategy.

On the other side of the coin, China lands. While the region has the greatest growth potential, it still has a long way to go if it wants to match U.S.-based tech firms in demand volume and technological patented advancements. TSMC may see a potential decoupling from China as a bearable risk, given that the country represented only 10% of TSMC's revenues in 2021.

As the U.S. places more sanctions and export limits for semiconductor manufacturing intellectual property against China, TSMC may have to choose where to focus its manufacturing output capacities, especially with scenarios pointing to a possible—and highly speculative—Taiwan invasion from China.

A race with mixed market sentiment

Warren Buffett broke character in the latest filings reporting a sale of his stake in TSMC, a rather unusual move. While trying to guess the motives behind the sale would be highly speculative and vague at best, investors can point to the political environment as one of the causes for this hit-and-run behavior.

Market influencers such as Tim Cook and the POTUS have taken a different stance toward TSMC's future potential. As TSMC initiated the construction of a second plant in Phoenix, a pool of CEOs and the POTUS attended the event to showcase their support for 'a future built-in America' with chips potentially having a 'Made in America' stamp from now on. Major chip customers have allegedly pushed for TSMC to begin manufacturing a larger share of semiconductors onshore in the U.S., citing that they would source the chips primarily from such domestic fabs.

Can't have your cake and eat it too

As TSMC takes on the initiative to manufacture an increasing share of its semiconductors in the U.S. rather than Taiwan and China, a few economic problems may arise for future profitability.

Taiwan's government has supported devaluing the local currency to make its exports more attractive to other nations with superior buying power. As a result, labor costs and other items, such as insurance and benefits, come in significantly lower than a hypothetical operation based in a more developed nation like the U.S.

This may be the case that pushed Buffett to exit. Increased foreign exchange costs, along with labor and materials, could have a significant negative impact on the operating and net margins for the company. There is a very important event that took place in the 2020-2022 period that may have confirmed these fears:

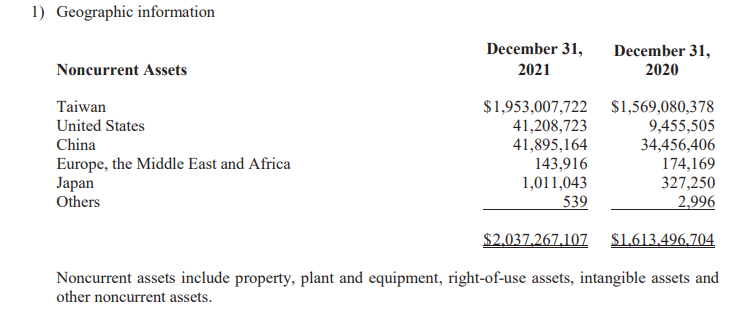

A complete restructure of geographical non-current asset base taken from their 2021 annual report, namely PP&E. As seen in 2020, China shadowed the U.S. in its capital allocation for hard assets. However, 2021 showcased an aggressive message, one that may confirm the choice in the hypothetical fight between the two nations. Looks like analysts and investors will have to get ready to model lower margins after all.

Set on watchlist, go back to bed

While the valuation may be a bit rich, and analyst consensus upside quite lean, this does not mean that the above developments may catch markets off guard and send the stock price crashing to a more favorable acquisition range.

With strong support levels starting in the $72-$76 range (falling in the Fibonacci retracement "Golden Ratio"), a secondary level of $58-$62 and a far-off but not impossible range within $40-$44, this stock may very well pose a lucrative opportunity for the patient.