Investors have been pouring into sports betting stocks like DraftKings Inc. (NASDAQ: DKNG) and Fan Duel's parent, Flutter Entertainment plc (NYSE: FLUT). Streaming giants like Amazon Inc. (NASDAQ: AMZN) and Netflix Inc. (NASDAQ: NFLX) are jockeying to keep and sign lucrative broadcasting deals with major sports leagues like the NFL, MLB, Formula One and NASCAR.

Skin in the Game Makes it More Fun.

The global sports industry generated over $159 billion in 2023, and analysts expect it to reach $260 billion by 2033. Sports is a big business, and the legalization of online sports betting has accelerated its growth. Watching a football game is much more exciting when you have "skin in the game," right?

The Wizard Behind the Curtains

Sportsradar Group AG (NASDAQ: SRAD) collects and processes data for a vast number of official sports leagues and distributes sports data to media companies, bookmakers, state authorities and sports federations. Its artificial intelligence (AI) and machine learning (ML) powered platform automates data collection and analysis, provides predictive models and analytics, and generates summaries and highlights.

Sportsradar's partners and clients include major sports leagues, media companies and sports betting platforms. In fact, their clients include sports leagues like the NBA, NHL, AFL, FIFA, NASCAR, MotoGP, and UEFA and media like The Walt Disney Co. (NYSE: DIS) owned ESPN, The Associated Press and sports book operators DraftKings, Fan Duel and Caesars Entertainment Inc. (NASDAQ: CZR) Caesars Sportsbook.

The consumer discretionary sector leader competes with Genius Sports Ltd (NYSE: GENI) and Endeavor Group Inc. (NYSE: EDR) owned IMG Arena.

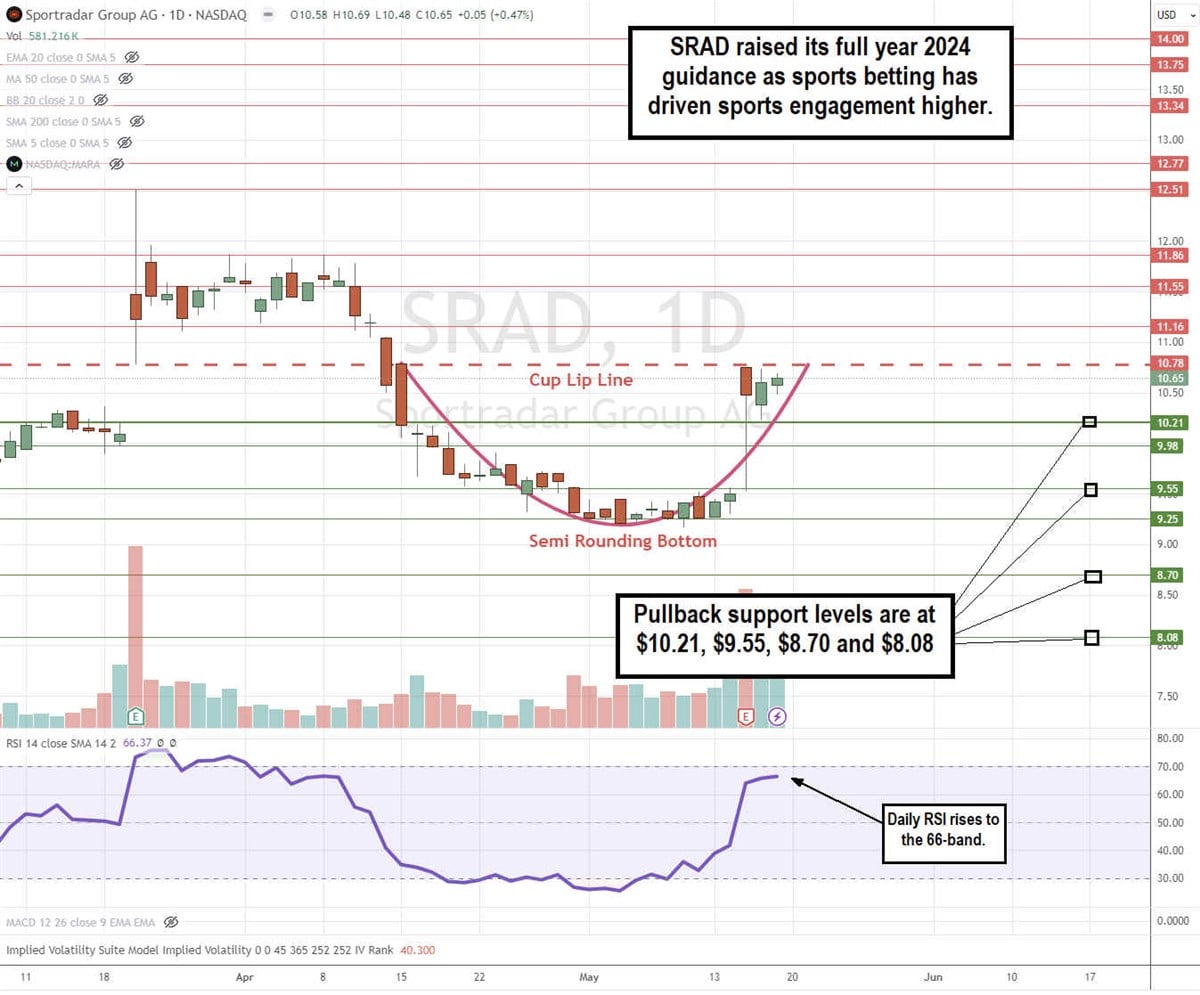

Daily Cup Pattern

SRAD formed a daily ascending cup pattern. The cup lip line formed at $10.78 before SRAD fell to the $9.25 level to form a semi-rounding bottom into Q1 2024 earnings. The strong results and raised guidance shot share back up to retest the lip line and complete the cup pattern. The daily relative strength index (RSI) rose to the 66-band. Pullback support levels are at $10.21, $9.55, $8.70, and $8.08.

Robust Business

Sportsradar reported Q1 2024 EPS of one cent, missing estimates by five cents. Revenues rose 28% YoY to $289.14 million, beating consensus estimates for $268.60 million. Betting Technology & Solutions revenues rose 35% YoY to $238 million, accounting for 82% of total revenue. Sports Content, Technology & Solutions revenues rose 5% YoY to $51.22 million, accounting for 18% of total revenue.

Rest of World (ROW) revenue rose 19% representing 75% of total revenue. United States revenue rose 65% YoY, representing 25% of total revenue. Adjusted EBITDA rose 29% YoY to $51.33 million due to strong revenue growth and operating efficiencies, which offset higher sports rights costs. The company had a total liquidity of $537.87 million, up from $500 million in the year-ago period.

The Board of Directors approved a $200 million stock buyback program.

Raises Full Year 2024 Guidance

Sportsradar raised its full-year 2024 revenue guidance to $1.15 billion compared to $1.14 billion consensus estimates. The company expected adjusted EBITDA of at least $219.65 million compared to $217.48 million consensus estimates.

CEO Insights

Sportsradar Group CEO Carsten Koerl commented that the company was laser-focused on driving efficiencies, delivering 18% adjusted EBITDA margins. The company also raised guidance, reflecting a 21% full-year revenue growth for the fiscal 2024. Koerl noted that Sportsradar's competitive advantage lies in its differentiated and commanded sports ecosystem. Its resources are unmatched, with over 800 pairing operations, 900 media partners and 400 sports leagues covering almost a million sports matches annually.

The company has generated profitable revenue growth of at least 20% in each of the last three years, outpacing all competitors. Sportsradar also derived tangible and significant benefits from its ATP and NBA partnerships. Over 50% of its clients are signing up for its core audio-visual product.

Koerl commented, "One of the exciting products we recently launched is Alpha Odds, a game-changing offering which builds on our market-leading for Odds solutions by generating Odds data for individual sports books based on their real-time liquidity and deep data. It has proven to generate a higher margin for sports books on their betting ticket."

Sportsradar Group analyst ratings and price targets are on MarketBeat.