Darden Restaurant’s (NYSE: DRI) stock has numerous advantages for investors, as seen in the price action. The stock has been volatile in recent years, but each downswing is met by an upswing, and momentum is building in H2 2024. Among the drivers of market sentiment, today is a new partnership with Uber that promises to drive growth across the network over the long term.

Darden’s partnership with Uber exclusively provides delivery services integrated with Darden’s existing digital infrastructure. The initial test will be at Olive Garden, which needs a boost and is expected to roll out nationwide by May 2025.

Consumers will access the service through Olive Garden’s interface, keeping the team-member/client experience intact, with Uber connecting to provide the delivery service. Darden says demand for delivery is high, with many benefits, including increased traffic and improved restaurant-level operating leverage.

Growing Darden Builds Value in Tough Economic Conditions

Darden had a weaker-than-expected quarter yet built leverage for itself and investors with 42 net new stores. The result was $1.75 billion in revenue, a gain of 1% year over year that missed the consensus estimate by 140 basis points. The bad news is that comps are down 1.1% but offset by the increased store count. Long Horn Steakhouse is the single area of strength, up 3.7% compared to 2.9%, 6%, and 0.7% declines in Olive Garden, Fine Dining, and Other sales. Long Horn results are impacted by a higher store count, up 2.9%, and higher comps.

Margin news is mixed and includes the impact of Chuy’s acquisition costs. That deal is expected to close in the current quarter and be neutral to the earnings outlook this fiscal year. Earnings from continuing operations are up, but adjusted for Chuy’s costs were $1.75, down 1.7%.

The margin is expected to rebound as store traffic improves, which management said is already happening. The CFO, Raj Vennam, attributed the underperformance to weakness in the first portion of the quarter but said trends had improved sufficiently to reaffirm the full-year guidance. Guidance expects earnings to range with a mid-point of $9.50 or above the consensus reported by MarketBeat.com.

Analysts Respond Favorably to Darden’s Q1 Report

The analysts have responded favorably to Darden’s Q1 report, issuing numerous price target increases following the release. MarketBeat tracks over a dozen revisions, all of which raised their targets. Notably, Evercore ISI Group upgraded the stock from In-Line to Outperform, with a target of $205, one of the highest issued. The range of fresh targets runs from $136 to $209, with 75% of them above the consensus, which is rising. Consensus assumes the stock is fairly-valued after the earnings-driven price pop: the high-end range forecasts another new all-time high, well above the current.

Capital returns also aid the stock price advance. The company’s mixed result for Q1 was still a solid quarter financially, which allowed it to sustain its healthy balance sheet while paying dividends and buying back shares. Share repurchases topped $170 million, helping reduce the count by 2.3% on average compared to last year, and the dividend is attractive even at the current highs.

The $1.40 in quarterly distribution annualizes to 3.2% with shares near $170 and is less than 70% of earnings. The balance sheet shows some shifting since last year, with cash and assets flat and debt up, but leverage remains low, providing considerable flexibility for this restaurant chain. Long-term debt is 0.65x equity and about 0.12x assets.

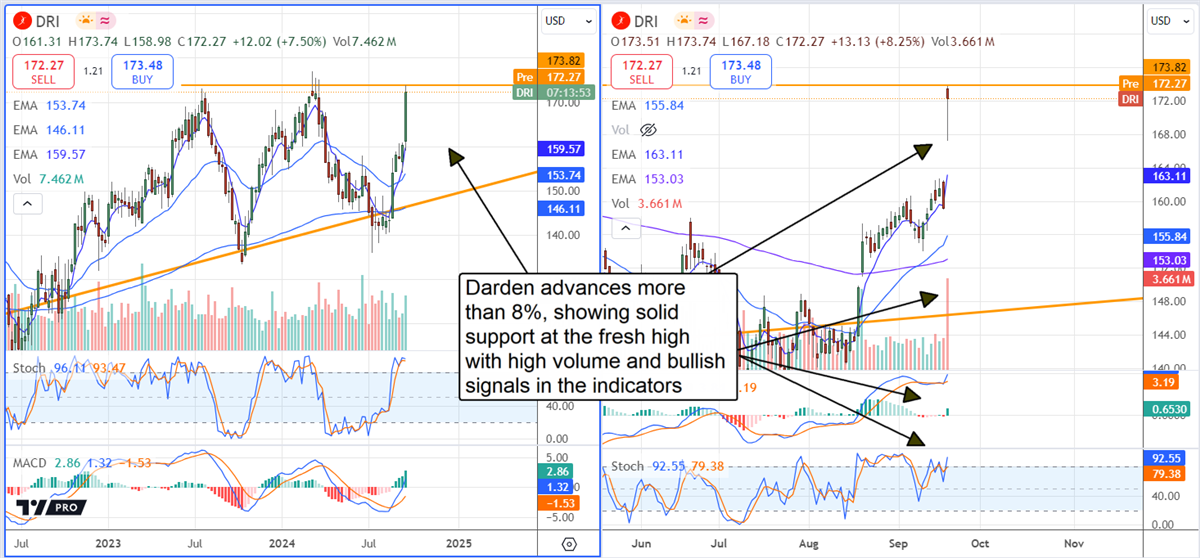

Darden Restaurants Is on the Verge of a Breakout

Darden Restaurants' stock price is on the verge of a significant technical breakout. The market advanced nearly 10% on the news to trade at the top of a long-term range, just below the all-time high, with high volume sustaining the price action. Suppose the market breaks the critical resistance line and confirms it as support. In that case, it will also confirm a flat-top triangle and potentially advance $35, the magnitude of the summer rally, and hit the $205 target soon after.