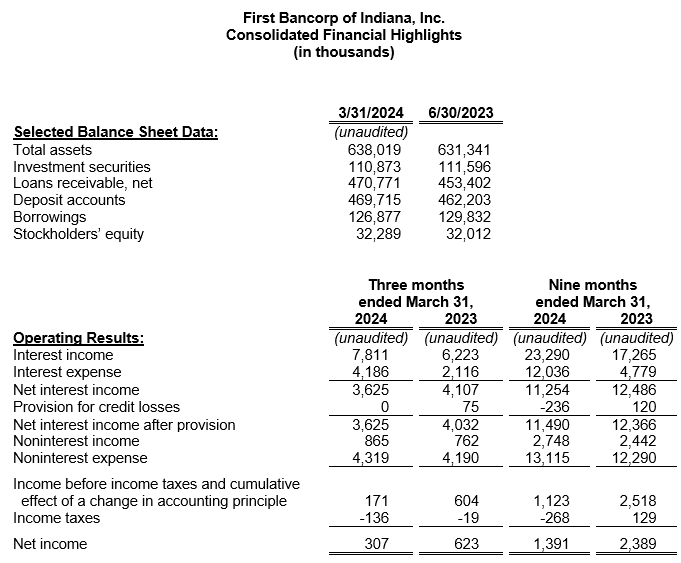

EVANSVILLE, Ind. - May 13, 2024 - PRLog -- First Bancorp of Indiana, Inc. (OTCPK:FBPI), the holding company (the "Company") for First Federal Savings Bank (the "Bank"), reported earnings of $307,000 ($0.18 per diluted common share) for the third fiscal quarter ended March 31, 2024, compared to $623,000 ($0.37 per diluted common share) for the same quarter a year ago. Likewise, earnings for the first three quarters of Fiscal 2024 totaled $1.39 million ($0.83 per diluted common share), compared to $2.39 million ($1.42 per diluted common share) last fiscal year-to-date. Earnings for the nine-month period equate to an annualized return on average assets (ROA) of 0.29% and a return on average equity (ROE) of 6.15%. This compares to an annualized ROA of 0.57% and an annualized ROE of 10.25% for the corresponding period last fiscal year.

Net interest income contracted from the prior year. Improved yields on earning assets, provided by higher interest rates on newly originated loans and adjustable-rate loans that have repriced upward, were outpaced by higher funding costs. The Company's Net Interest Margin (NIM), as a percentage of average interest-earning assets, was 2.47% for the quarter ended March 31, 2024, and 2.55% for the first nine months of the fiscal year. Noninterest income improved for both periods, led by higher gains on loan sales. Total non-interest expenses, higher for both the quarter and the nine-month periods, were largely the result of increased personnel costs, occupancy expenses, and FDIC insurance premiums due to growth in the Bank's geographic footprint and asset size.

In Fiscal 2022, the board of directors approved a leveraging strategy to increase earnings. The liquidity at the time was used to increase investment securities holdings and fund loan demand. Proceeds from the Company's $12 million subordinated debt offering and wholesale deposits acquired by the Bank funded additional growth. The securities portfolio, primarily composed of investment-grade municipal bonds or obligations of US government agencies, totaled $110.9 million on March 31, 2024.

Despite the rising interest rate environment, net loans outstanding have increased $17.4 million, or 3.83%, during the first nine months of the fiscal year. Commercial loan production, including $2.0 million participated with other banks, totaled $48.3 million for the nine-month period. Single-family mortgage loan production added $54.7 million during the same period. A lack of housing supply in the local market has resulted in increased housing construction activity. Consumer lending originations, which included auto loans, personal loans, and home equity loans and lines of credit, totaled $10.8 million. The $470.8 million of net loans on March 31, 2024, included $721,000 of loans committed for sale to either Fannie Mae or the Federal Home Loan Bank.

Effective July 1, 2023, the Bank adopted ASU 2016-13, Financial Instruments – Credit Losses (Topic 326), commonly referred to as the current expected credit loss (CECL) methodology, to determine the required Allowance for Credit Losses (ACL) on the Bank's loans, investments, and unfunded commitments. The adoption increased the allowance by $1.9 million and, on a tax-effected basis, reduced retained earnings by $1.4 million.

No provision for loan losses was recorded in the quarter ended March 31, 2024, as no loans were charged off. Moreover, a reverse provision was recorded in the September quarter due to a $286,000 recovery for a loan previously charged off. The ratio of nonperforming loans 90 days or more delinquent to total loans was 0.35% on March 31, 2024, compared to 0.25% a year ago. Overall, the Allowance for Credit Losses, including reserves for investment securities and unfunded commitments, stood at $5.65 million at quarter end. The portion of the allowance attributed to the loan portfolio represented 1.14% of at-risk loans. Although management believes that the allowance is adequate, a slowing economy and persistent inflation may have an adverse effect on the credit quality of the loan portfolio. Management remains in close contact with our most vulnerable borrowers and will make additional provisions to the allowance, as necessary.

Deposit accounts, totaling $469.7 million on March 31, 2024, have increased 1.63% since the beginning of the fiscal year. Competition for funding, both in local markets and at the wholesale level, has driven deposit rates upward and pushed the Bank's cost of deposits to an annualized 2.74% for the quarter. Similarly, the Company's total cost of funds, including FHLB advances and debt of the holding company, increased to an annualized 2.85% for the same period.

As a part of the Bank's Liquidity Management Plan, contingency funding sources are available and liquidity stress tests determine adequacy. First Federal Savings Bank maintains lines of credit at multiple institutions and additional borrowing capacity at FHLB. The Bank also has access to, but has not utilized, the Federal Reserve's discount window.

Stockholders' equity totaled $32.3 million on March 31, 2024, which includes a $9.5 million fair value reduction to the available for sale securities portfolio given the rapid rise in market interest rates. This securities portfolio adjustment is not a part of the regulatory capital calculations. Gains or losses in the securities portfolio are recognized when a security is sold. Based on the 1,680,624 outstanding common shares on March 31, 2024, the book value per share of FBPI stock was $19.21.

At 8.23%, First Federal's tier one capital ratio exceeded the five percent regulatory standard for "well-capitalized" financial institutions. The bank's other capital measurements also continue to comfortably exceed "well-capitalized" standards.

This news release may contain forward-looking statements within the meaning of the federal securities laws. Statements in this release that are not strictly historical are forward-looking and are based upon current expectations that may differ materially from actual results. These forward-looking statements, identified by words such as "will," "expected," "believe," and "prospects," involve risks and uncertainties that could cause actual results to differ materially from those anticipated by the statements made herein. These risks and uncertainties involve general economic trends and changes in interest rates, increased competition, changes in consumer demand for financial services, the possibility of unforeseen events affecting the industry generally, the uncertainties associated with newly developed or acquired operations, market disruptions and the potential effects of the COVID-19 pandemic on the local and national economic environment, on our customers and on our operations as well as any changes to federal, state and local government laws, regulations and orders in connection with the pandemic. The Company undertakes no obligation to release revisions to these forward-looking statements publicly to reflect events or circumstances after the date hereof or to reflect the occurrence of unforeseen events, except as required to be reported by applicable law.

Photos: (Click photo to enlarge)

Source: First Bancorp of Indiana Inc (OTCPK:FBPI)

Read Full Story - First Bancorp of Indiana, Inc. Announces Financial Results March 2024 | More news from this source

Press release distribution by PRLog