Health and wellness products company Herbalife (NYSE: HLF) missed Wall Street’s revenue expectations in Q3 CY2024, with sales falling 3.2% year on year to $1.24 billion. Its non-GAAP profit of $0.57 per share was 89.4% above analysts’ consensus estimates.

Is now the time to buy Herbalife? Find out by accessing our full research report, it’s free.

Herbalife (HLF) Q3 CY2024 Highlights:

- Revenue: $1.24 billion vs analyst estimates of $1.25 billion (1% miss)

- Adjusted EPS: $0.57 vs analyst estimates of $0.30 (89.4% beat)

- EBITDA: $166.5 million vs analyst estimates of $140.4 million (18.6% beat)

- Gross Margin (GAAP): 45.6%, up from 43.9% in the same quarter last year

- Operating Margin: 10.2%, up from 8.3% in the same quarter last year

- EBITDA Margin: 13.4%, in line with the same quarter last year

- Free Cash Flow Margin: 5.8%, up from 3.8% in the same quarter last year

- Organic Revenue was flat year on year (-1.5% in the same quarter last year)

- Sales Volumes fell 5.4% year on year, in line with the same quarter last year

- Market Capitalization: $701 million

Company Overview

With the first products sold out of the trunk of the founder’s car, Herbalife (NYSE: HLF) today offers a portfolio of shakes, supplements, personal care products, and weight management programs to help customers reach their nutritional and fitness goals.

Personal Care

While personal care products products may seem more discretionary than food, consumers tend to maintain or even boost their spending on the category during tough times. This phenomenon is known as "the lipstick effect" by economists, which states that consumers still want some semblance of affordable luxuries like beauty and wellness when the economy is sputtering. Consumer tastes are constantly changing, and personal care companies are currently responding to the public’s increased desire for ethically produced goods by featuring natural ingredients in their products.

Sales Growth

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

Herbalife carries some recognizable products but is a mid-sized consumer staples company. Its size could bring disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale.

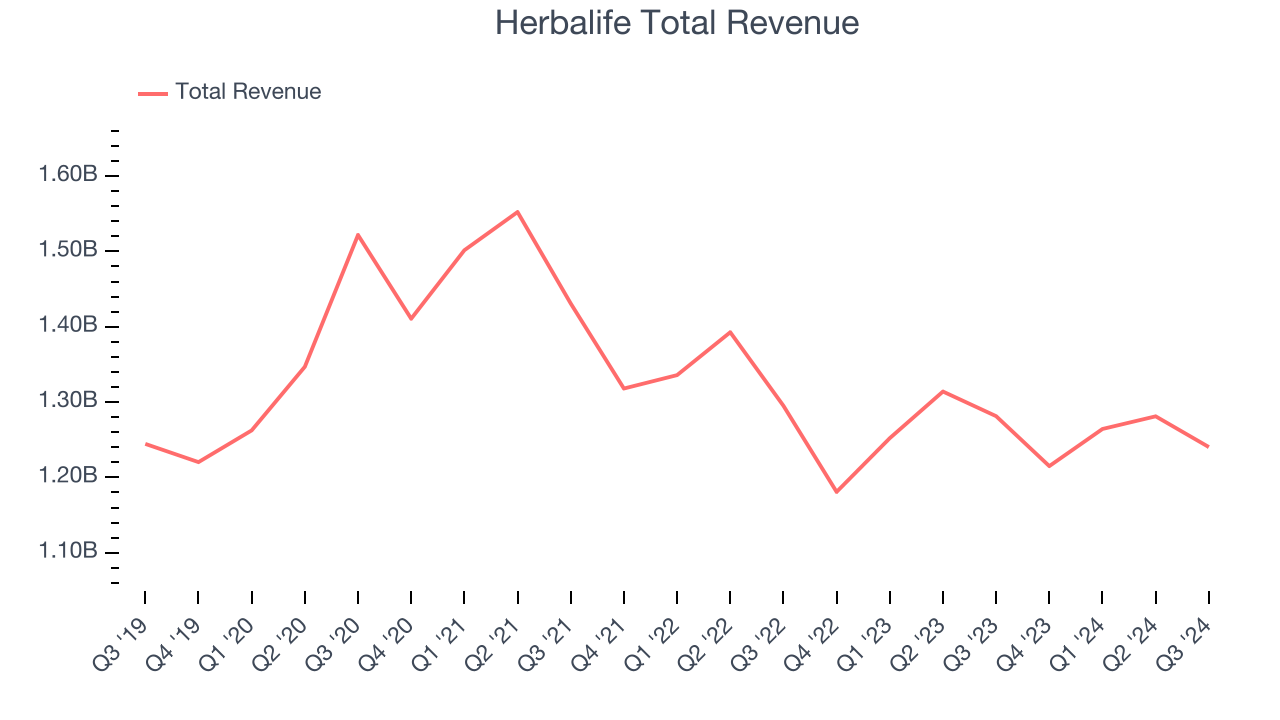

As you can see below, Herbalife’s revenue declined by 5.3% per year over the last three years as consumers bought less of its products.

This quarter, Herbalife missed Wall Street’s estimates and reported a rather uninspiring 3.2% year-on-year revenue decline, generating $1.24 billion of revenue.

Looking ahead, sell-side analysts expect revenue to grow 3.4% over the next 12 months, an acceleration versus the last three years. Although this projection illustrates the market thinks its newer products will spur better performance, it is still below the sector average.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Volume Growth

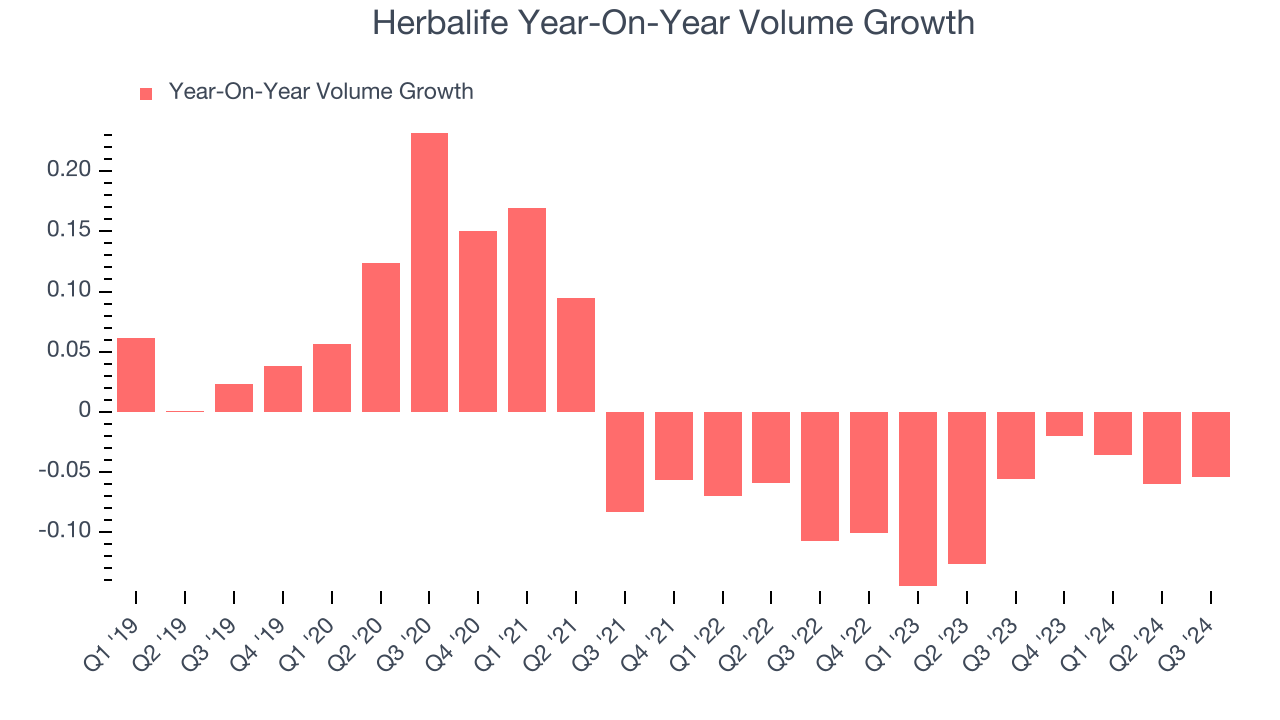

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

To analyze whether Herbalife generated its growth (or lack thereof) from changes in price or volume, we can compare its volume growth to its organic revenue growth, which excludes non-fundamental impacts on company financials like mergers and currency fluctuations.

Over the last two years, Herbalife’s average quarterly sales volumes have shrunk by 7.5%. This isn’t ideal for a consumer staples company, where demand is typically stable.

In Herbalife’s Q3 2024, sales volumes dropped 5.4% year on year. This result was a further deceleration from the 5.6% year-on-year decline it posted 12 months ago, showing the business is struggling to push its products.

Key Takeaways from Herbalife’s Q3 Results

We were impressed by how significantly Herbalife blew past analysts’ EBITDA and EPS expectations this quarter. On the other hand, its gross margin and revenue missed Wall Street’s estimates. Overall, we think this was still a decent quarter with some key metrics above expectations. The stock traded up 6% to $7.25 immediately following the results.

Herbalife put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.