Broadcom currently trades at $165.14 and has been a dream stock for shareholders. It’s returned 431% since November 2019, blowing past the S&P 500’s 87.9% gain. The company has also beaten the index over the past six months as its stock price is up 16.8%. This was partly thanks to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is now still a good time to buy AVGO? Or are investors being too optimistic? Find out in our full research report, it’s free.

Why Is AVGO a Good Business?

Originally the semiconductor division of Hewlett Packard, Broadcom (NASDAQ: AVGO) is a semiconductor conglomerate that spans wireless, networking, data storage, and industrial end markets along with an infrastructure software business focused on mainframes and cybersecurity.

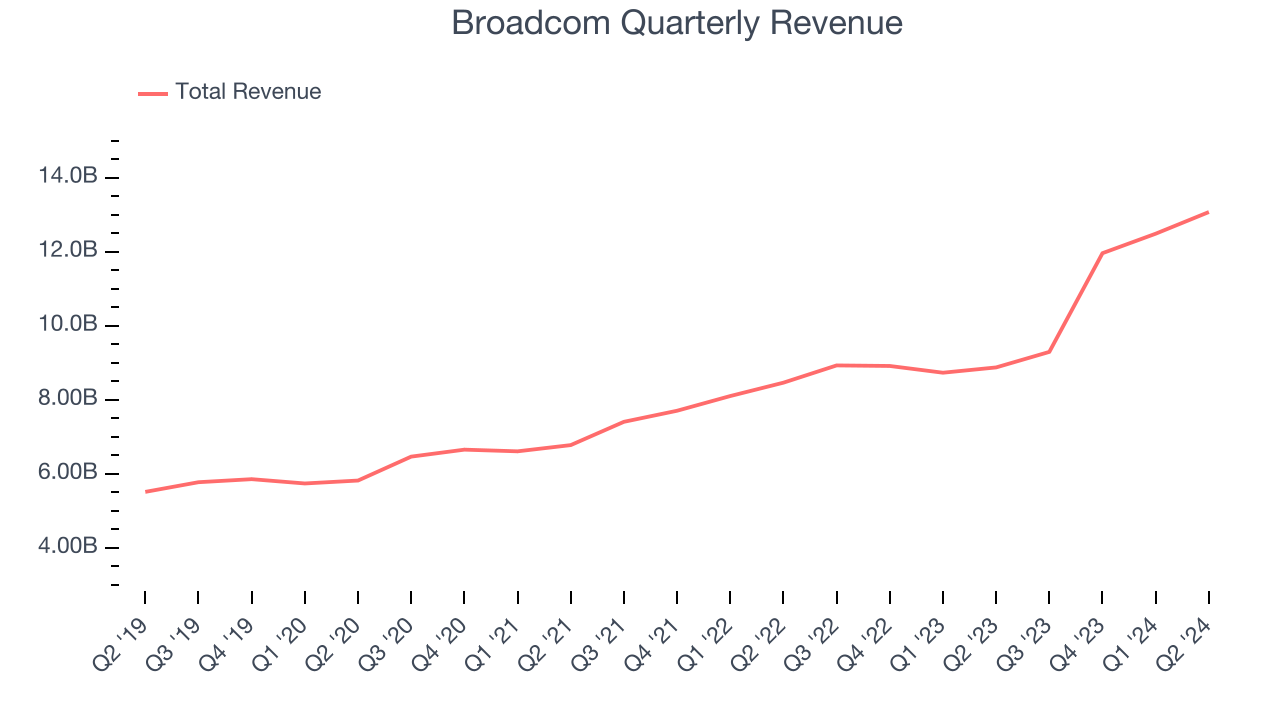

1. Skyrocketing Revenue Shows Strong Momentum

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for multiple years. Over the last five years, Broadcom grew its sales at an excellent 16% compounded annual growth rate. Its growth beat the average semiconductor company and shows its offerings resonate with customers. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions (which can sometimes offer opportune times to buy).

2. Projected Revenue Growth Is Remarkable

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite, though some deceleration is natural as businesses scale.

Broadcom’s management team is currently guiding for a 50.6% year-on-year increase in sales next quarter. Looking further ahead, sell-side analysts expect Broadcom’s revenue to grow 24.6% over the next 12 months, an improvement versus its 21.6% annualized growth rate for the last two years. This projection is noteworthy and implies its newer products and services will catalyze higher growth rates.

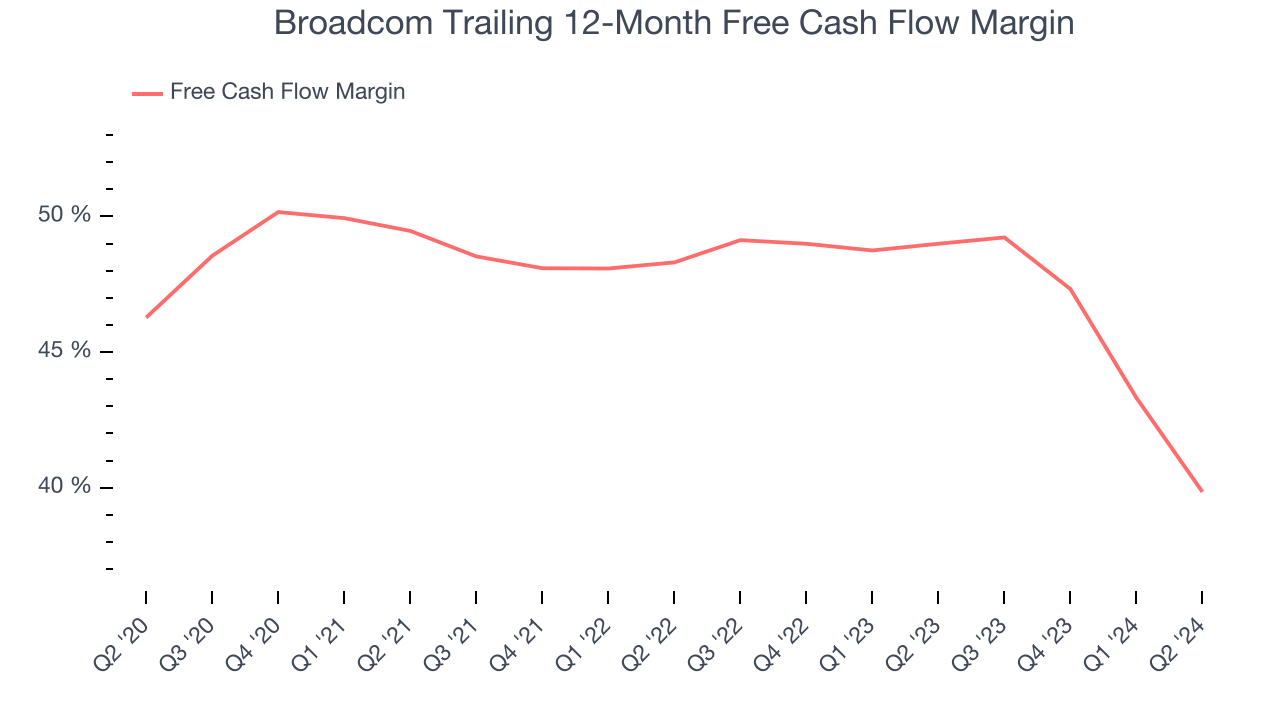

3. Excellent Free Cash Flow Boosts Reinvestment Potential

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Broadcom has shown terrific cash profitability, and if sustainable, puts it in an advantageous position to invest in new products, return capital to investors, and consolidate the market during industry downturns. The company’s free cash flow margin was among the best in the semiconductor sector, averaging an eye-popping 43.8% over the last two years.

Final Judgment

These are just a few reasons why we think Broadcom is a great business, and with its shares outperforming the market lately, the stock trades at 28.2x forward price-to-earnings (or $165.14 per share). Is now a good time to initiate a position? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than Broadcom

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.