UFP Industries trades at $130.40 per share and has moved in lockstep with the market. It has returned 8.2% over the last six months while the S&P 500 has gained 11.7%.

Is there a buying opportunity in UFP Industries, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.We're cautious about UFP Industries. Here are three reasons why UFPI doesn't excite us and a stock we'd rather own.

Why Is UFP Industries Not Exciting?

Beginning as a lumber supplier in the 1950s, UFP Industries (NASDAQ: UFPI) is a holding company making building materials for the construction, retail, and industrial sectors.

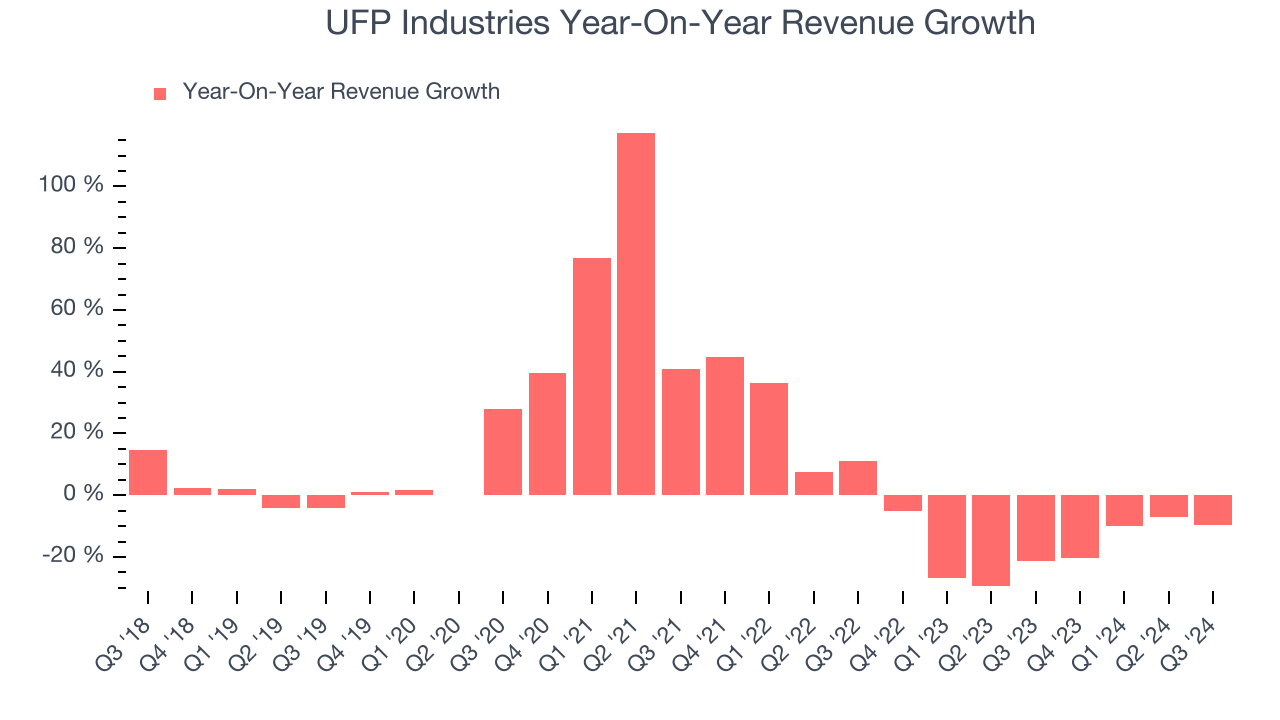

1. Revenue Tumbling Downwards

Long-term growth is the most important, but within industrials, a stretched historical view may miss new industry trends or demand cycles. UFP Industries’s recent history marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 16.9% over the last two years.

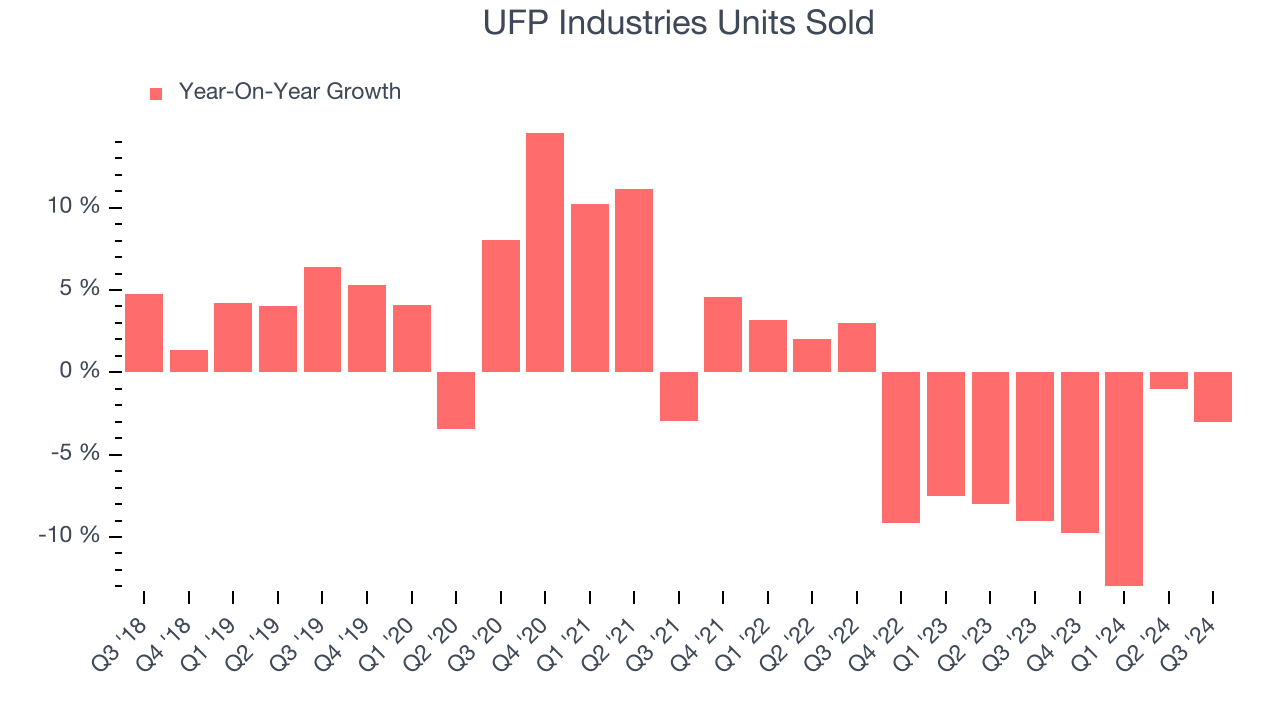

2. Demand Slipping as Sales Volumes Decline

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful Building Materials company because there’s a ceiling to what customers will pay.

Over the last two years, UFP Industries’s units sold averaged 7.5% year-on-year declines. This performance was underwhelming and implies there may be increasing competition or market saturation. It also suggests UFP Industries might have to lower prices or invest in product improvements to grow, which can hinder near-term profitability.

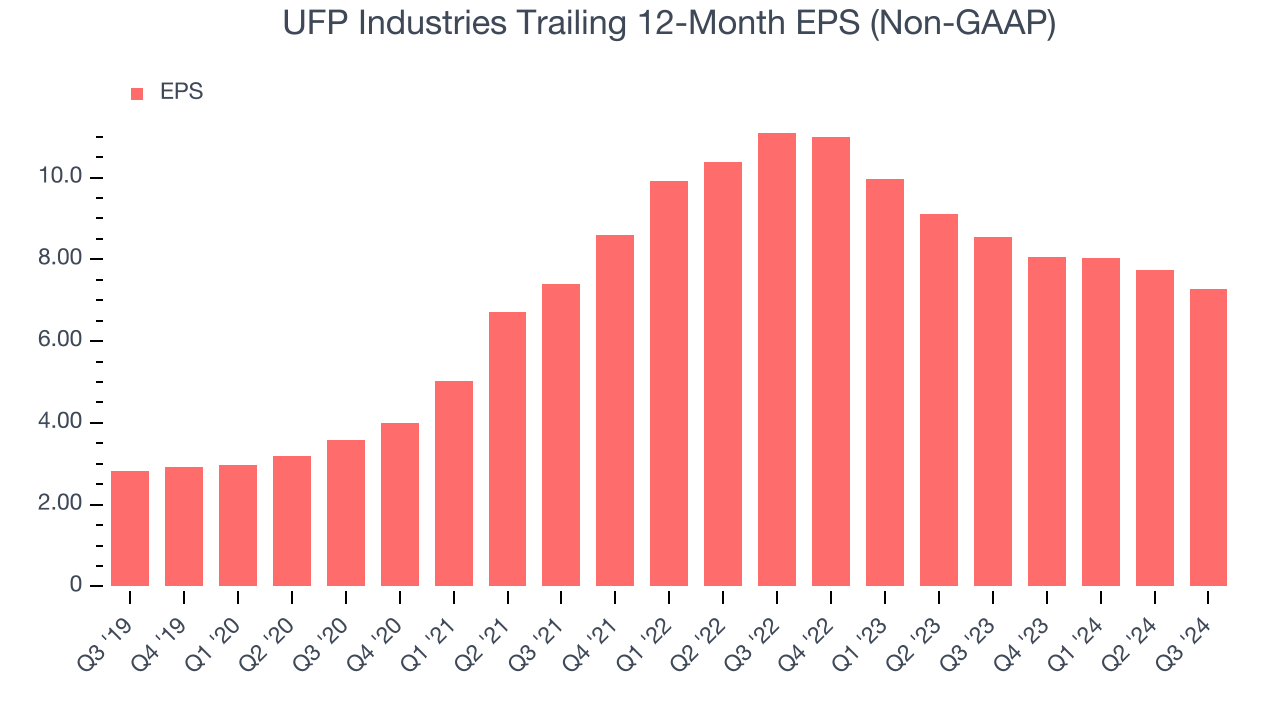

3. EPS Took a Dip Over the Last Two Years

While long-term earnings trends give us the big picture, we also track EPS over a shorter period because it can provide insight into an emerging theme or development for the business.

Sadly for UFP Industries, its EPS declined by more than its revenue over the last two years, dropping 19.1%. This tells us the company struggled to adjust to shrinking demand.

Final Judgment

UFP Industries isn’t a terrible business, but it doesn’t pass our bar. That said, the stock currently trades at 16.4x forward price-to-earnings (or $130.40 per share). While this valuation could be justified, the upside isn’t great compared to the potential downside. We're pretty confident there are superior stocks to buy right now. We’d recommend taking a look at Costco, one of Charlie Munger’s all-time favorite businesses.

Stocks We Like More Than UFP Industries

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.