Internet security and content delivery network Cloudflare (NYSE: NET) reported Q3 CY2024 results exceeding the market’s revenue expectations, with sales up 28.2% year on year to $430.1 million. On the other hand, the company expects next quarter’s revenue to be around $451.5 million, slightly below analysts’ estimates. Its non-GAAP profit of $0.20 per share was also 9.5% above analysts’ consensus estimates.

Is now the time to buy Cloudflare? Find out by accessing our full research report, it’s free.

Cloudflare (NET) Q3 CY2024 Highlights:

- Revenue: $430.1 million vs analyst estimates of $424.1 million (1.4% beat)

- Adjusted EPS: $0.20 vs analyst estimates of $0.18 (9.5% beat)

- Adjusted Operating Income: $63.47 million vs analyst estimates of $51.46 million (23.3% beat)

- Revenue Guidance for Q4 CY2024 is $451.5 million at the midpoint, below analyst estimates of $455.8 million

- Revenue guidance for 2024 slightly raised to $1.66 billion, in line with expectations

- Adjusted operating income guidance for the full year raised to $220.5 million at the midpoint, beating analyst estimates by 11.8%

- Adjusted EPS guidance for the full year is $0.74 at the midpoint, beating analyst estimates by 3.4%

- Gross Margin (GAAP): 77.7%, in line with the same quarter last year

- Operating Margin: -7.2%, up from -11.7% in the same quarter last year

- Free Cash Flow Margin: 10.5%, similar to the previous quarter

- Billings: $447.3 million at quarter end, up 24.2% year on year

- Market Capitalization: $31.61 billion

"I am pleased with our results for the third quarter—exceeding expectations for revenue, operating margin, and free cash flow while also reaching a key inflection point in the transformation of our go-to-market organization. In addition, we added a record 219 large customers and achieved a new milestone—35% of the Fortune 500 are now paying Cloudflare customers,” said Matthew Prince, co-founder & CEO of Cloudflare.

Company Overview

Founded by two grad students of Harvard Business School, Cloudflare (NYSE: NET) is a software as a service platform that helps improve security, reliability and loading times of internet applications and websites.

Content Delivery

The amount of content on the internet is exploding, whether it is music, movies and or e-commerce stores. Consumer demand for this content creates network congestion, much like a digital traffic jam which drives demand for specialized content delivery networks (CDN) services that alleviate potential network bottlenecks.

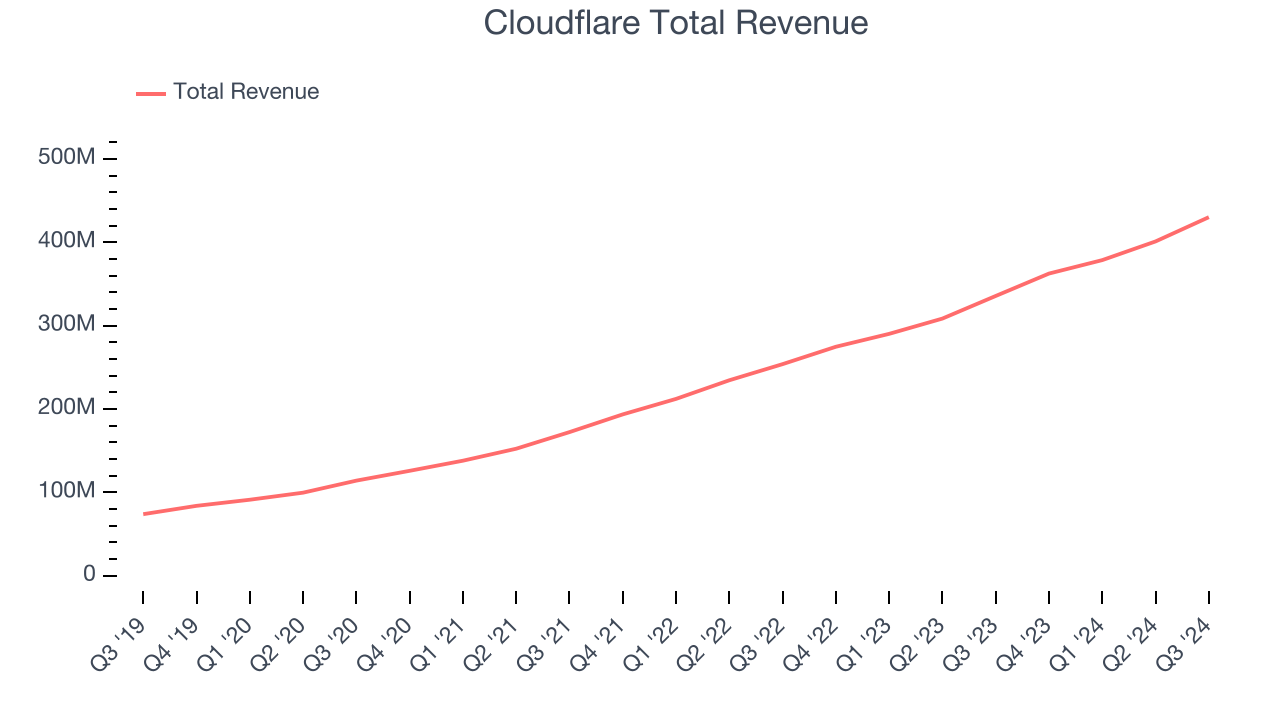

Sales Growth

Reviewing a company’s long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Thankfully, Cloudflare’s 38.7% annualized revenue growth over the last three years was exceptional. This is a great starting point for our analysis because it shows Cloudflare’s offerings resonate with customers.

This quarter, Cloudflare reported robust year-on-year revenue growth of 28.2%, and its $430.1 million of revenue topped Wall Street estimates by 1.4%. Management is currently guiding for a 24.6% year-on-year increase next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 25.6% over the next 12 months, a deceleration versus the last three years. Still, this projection is admirable and shows the market sees success for its products and services.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

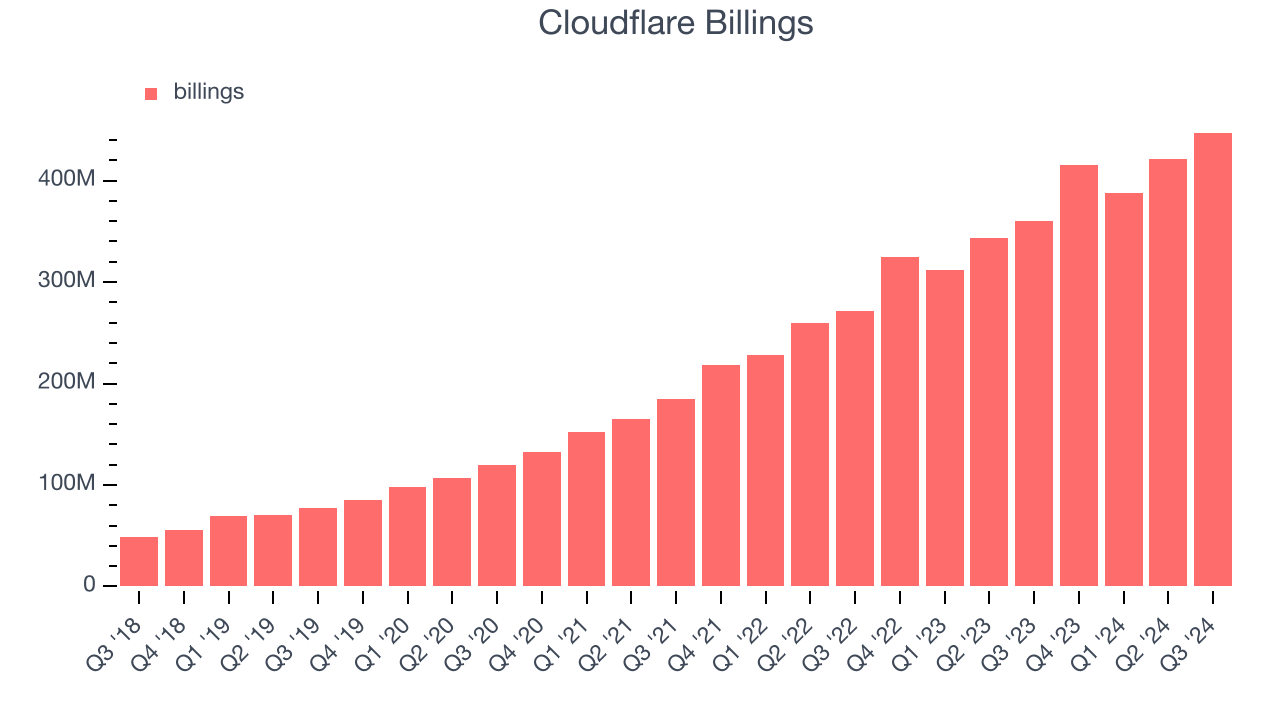

Billings

In addition to revenue, billings is a non-GAAP metric that sheds additional light on Cloudflare’s business quality. Billings is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Over the last year, Cloudflare’s billings growth has been impressive, averaging 24.8% year-on-year increases and punching in at $447.3 million in the latest quarter. This alternate topline metric has been growing slower than revenue, meaning the company recognizes revenue faster than it collects cash - a headwind for its liquidity that could also signal a slowdown in future revenue growth.

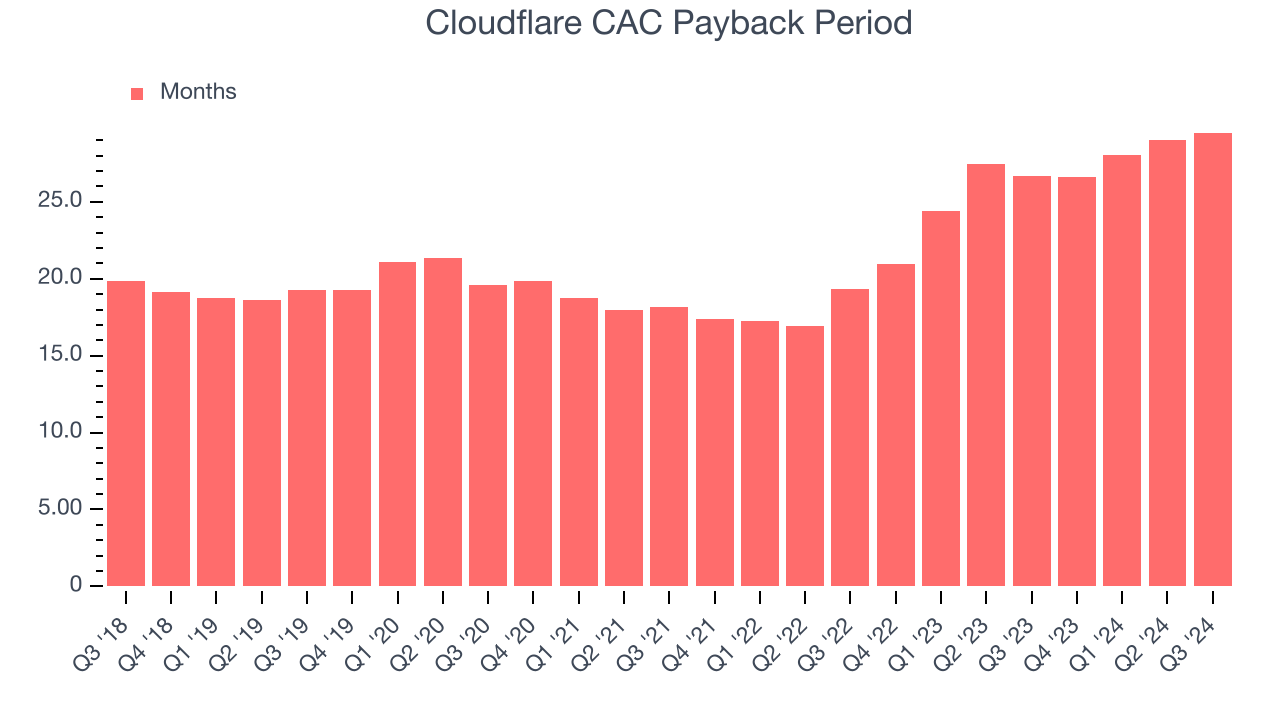

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Cloudflare is quite efficient at acquiring new customers, and its CAC payback period checked in at 29.5 months this quarter. The company’s efficiency indicates that it has a highly differentiated product offering, giving it the freedom to invest its resources into new growth initiatives.

Key Takeaways from Cloudflare’s Q3 Results

We were impressed by Cloudflare’s optimistic full-year adjusted operating income and EPS forecasts, which handily beat analysts’ expectations. We were also glad next quarter’s EPS guidance exceeded Wall Street’s estimates. On the other hand, its revenue guidance for next quarter missed analysts’ expectations and its billings this quarter missed Wall Street’s estimates. Overall, this quarter was mixed. The areas below expectations seem to be driving the move, and the stock traded down 10.1% to $86.00 immediately following the results.

Big picture, is Cloudflare a buy here and now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.