During the past six months, United Parcel Service has fallen to $133.45 per share. Shareholders have lost 9.7% of their capital, which is highly disappointing because the S&P 500 has climbed 15.5%. This may have investors wondering how to approach the situation.

Is there a buying opportunity in United Parcel Service, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.Even with the cheaper entry price, we're swiping left on UPS for now. Here are three reasons why United Parcel Service doesn't excite us and one stock we'd rather own today.

Why Do We Think United Parcel Service Will Underperform?

Trademarking its recognizable UPS Brown color, UPS (NYSE: UPS) offers package delivery, supply chain management, and freight forwarding services.

1. Demand Slipping as Sales Volumes Decline

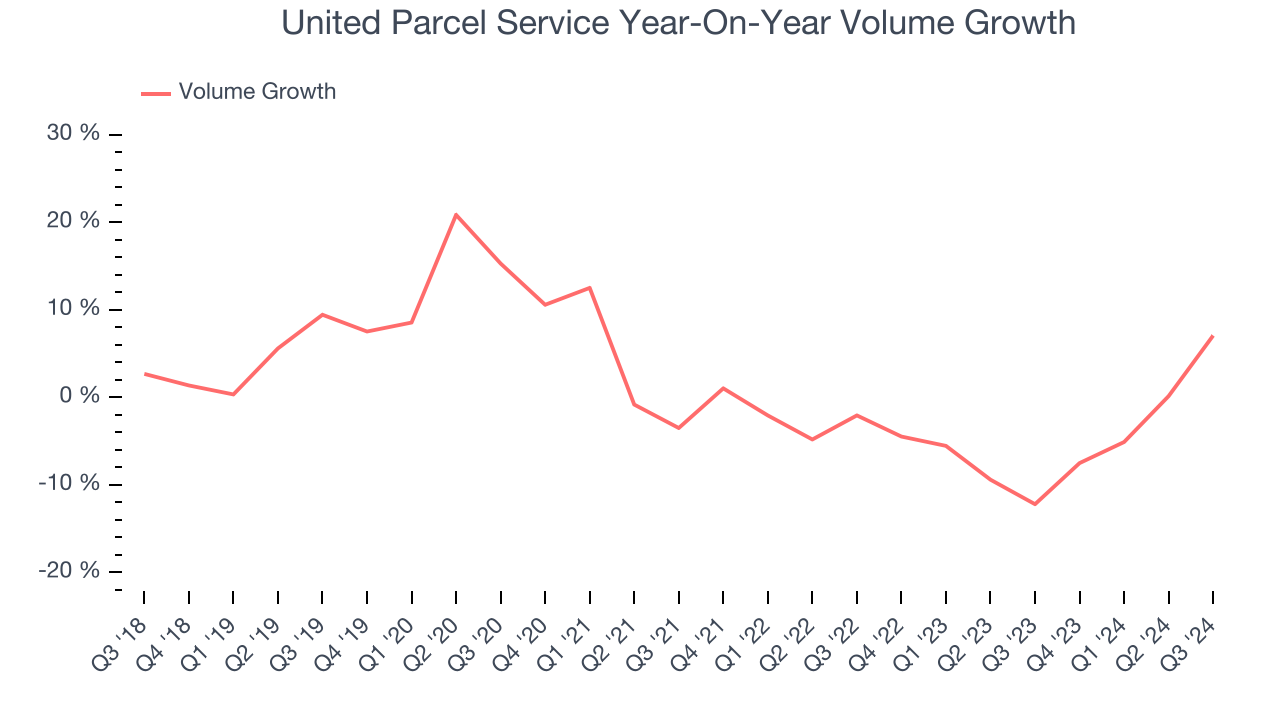

We can better understand transportation and logistics companies by analyzing their sales volumes, which show how many products they are selling. This metric reached 1.38 billion units shipped in the latest quarter. Over the last two years, United Parcel Service’s sales volumes averaged 4.6% year-on-year declines. Because this number is in line with its revenue growth, we can see the company kept its prices fairly consistent in aggregate.

2. Treading Water: Long-Term EPS Showing Little Movement

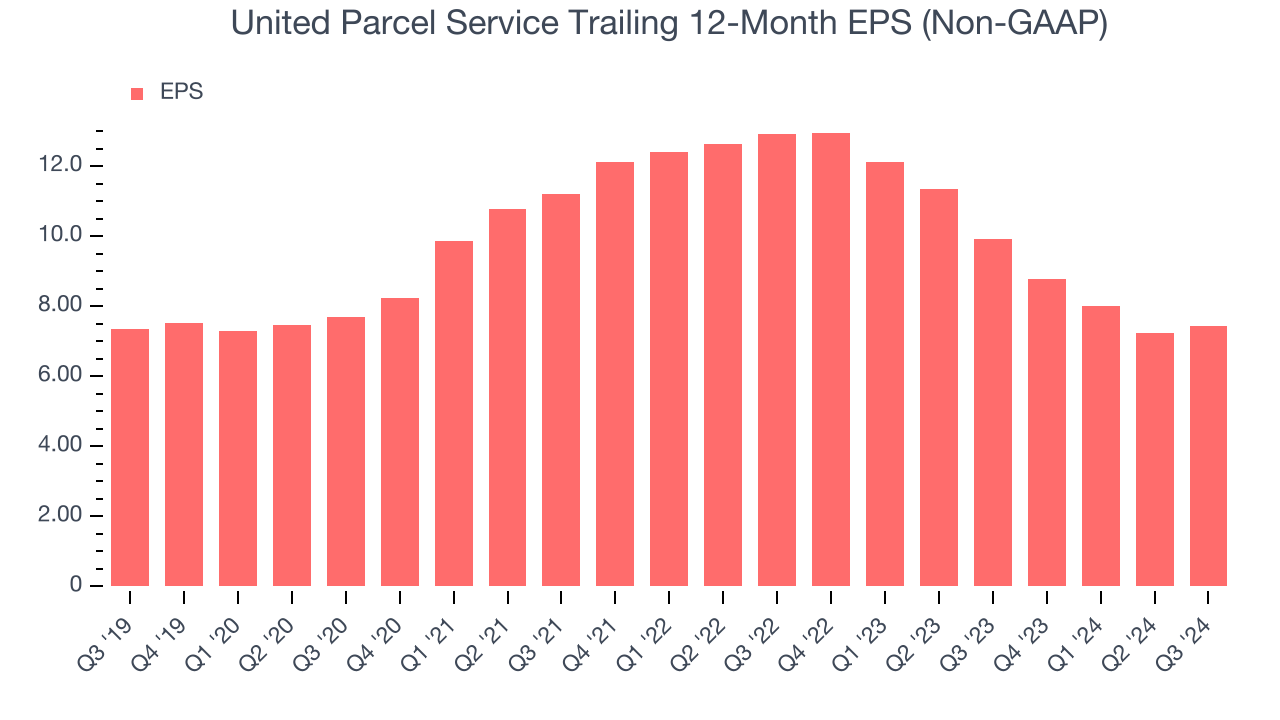

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

United Parcel Service’s flat EPS over the last five years was below its 4.3% annualized revenue growth. However, its operating margin didn’t change during this timeframe, telling us that non-fundamental factors affected its ultimate earnings. Find out why here.

3. ROIC Declining as New Investments Fail to Bear Fruit

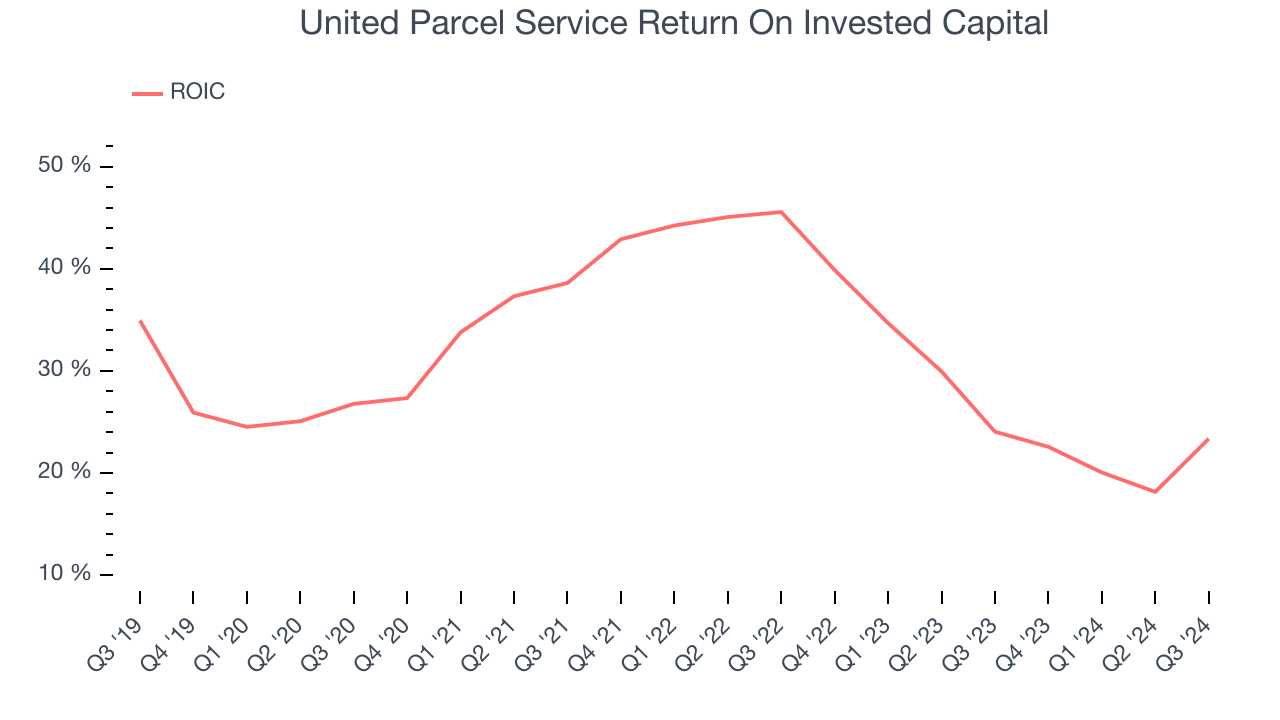

A company’s ROIC, or return on invested capital, shows how much operating profit it makes compared to the money it raised (debt and equity).

We typically prefer investing in businesses with high returns because it means they have viable business models, but the trend in a company’s ROIC is often what surprises the market and moves the stock price. United Parcel Service’s ROIC has decreased over the last few years. We like what management has done in the past but are concerned its ROIC is declining, perhaps a symptom of fewer profitable business opportunities.

Final Judgment

We see the value of companies addressing major industrial pain points, but in the case of United Parcel Service, we’re out. Following the recent decline, the stock trades at 15.4x forward price-to-earnings, or $133.45 per share. We don’t really see a big opportunity at the moment, we think there are better opportunities elsewhere. We’d suggest taking a look at Nextracker, the market leader in utility-scale solar trackers and foundations.

Stocks We Would Buy Instead of United Parcel Service

Now, with the elections behind us, rates dropping and inflation cooling off, many analysts are expecting a breakout market to the end of the year — and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. These are a curated subset of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% five-year return) as well as under-the-radar businesses like Comfort Systems (+783%) and United Rentals (+550%). Find your next big winner with StockStory today, it’s free.