MYR Group currently trades at $147.72 per share and has shown little upside over the past six months, posting a middling return of 1.3%. The stock also fell short of the S&P 500’s 7.7% gain during that period.

Is now the time to buy MYR Group, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free.

We're cautious about MYR Group. Here are three reasons why MYRG doesn't excite us and a stock we'd rather own.

Why Do We Think MYR Group Will Underperform?

Constructing electrical and phone lines in the American Midwest dating back to the 1890s, MYR Group (NASDAQ: MYRG) is a specialty contractor in the electrical construction industry.

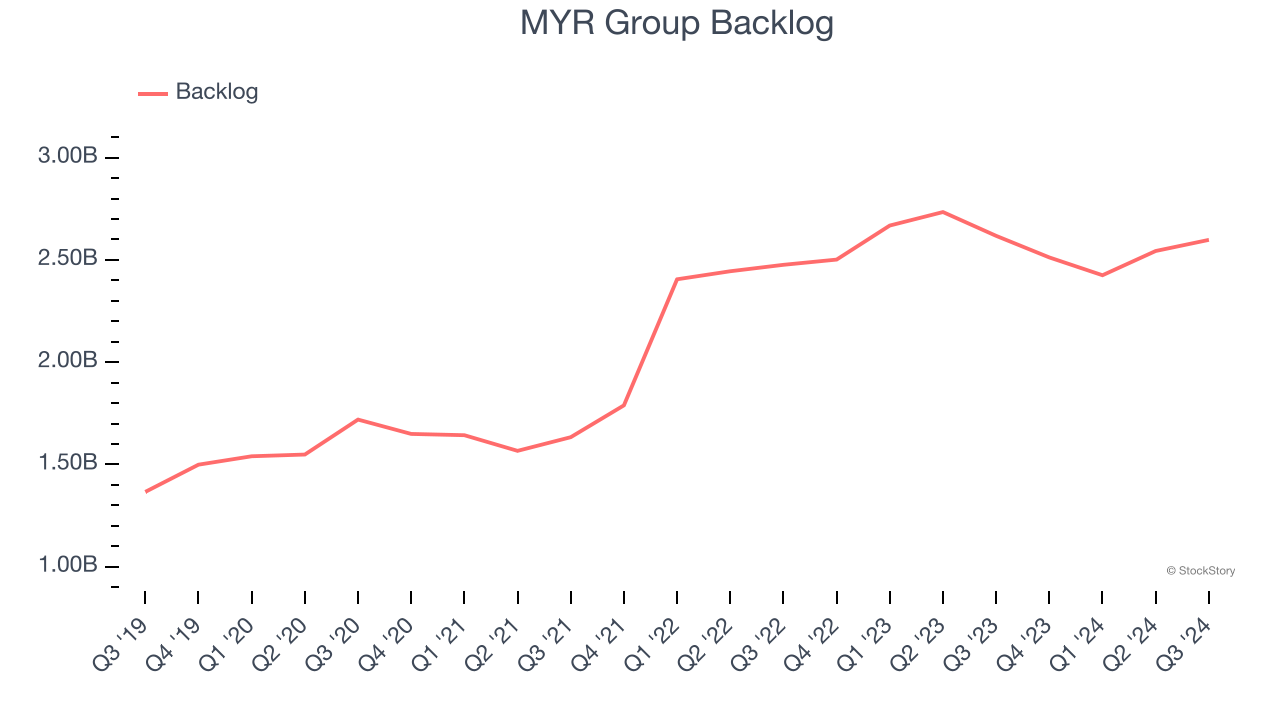

1. Weak Backlog Growth Points to Soft Demand

In addition to reported revenue, backlog is a useful data point for analyzing Construction and Maintenance Services companies. This metric shows the value of outstanding orders that have not yet been executed or delivered, giving visibility into MYR Group’s future revenue streams.

MYR Group’s backlog came in at $2.60 billion in the latest quarter, and over the last two years, its year-on-year growth averaged 6.5%. This performance slightly lagged the sector and suggests that increasing competition is causing challenges in winning new orders.

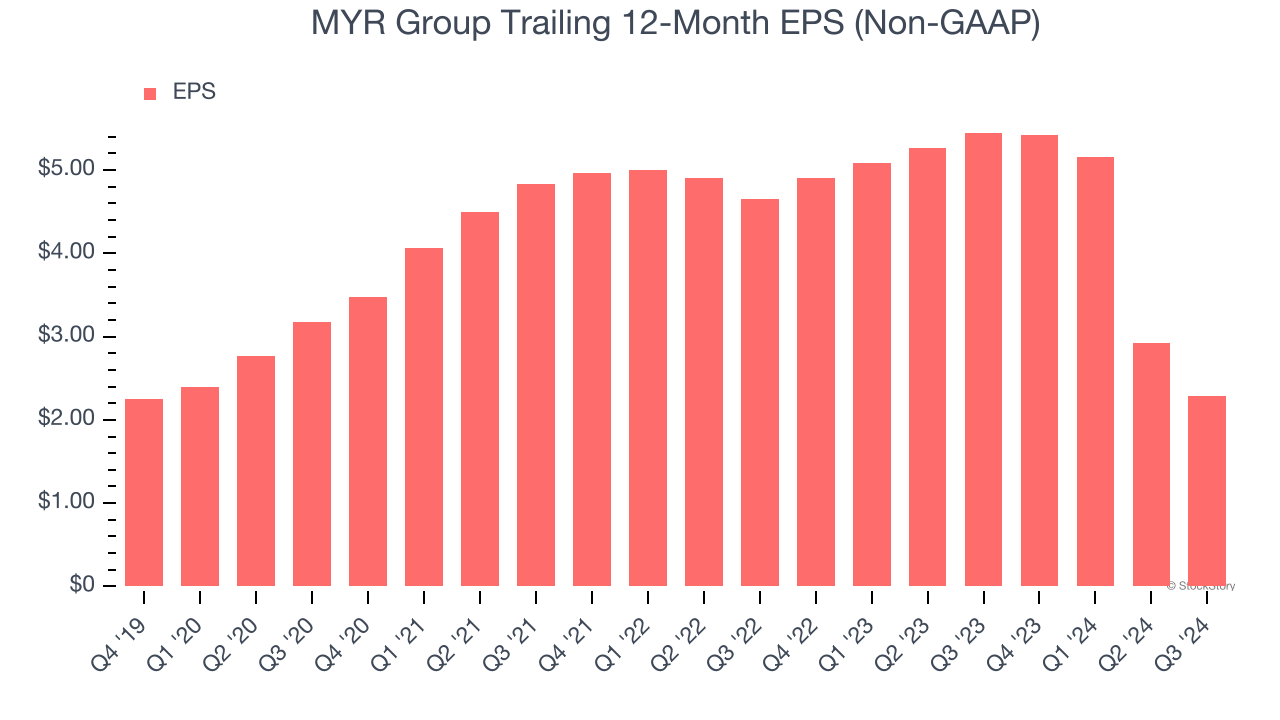

2. EPS Trending Down

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for MYR Group, its EPS declined by 10.4% annually over the last five years while its revenue grew by 12.7%. This tells us the company became less profitable on a per-share basis as it expanded.

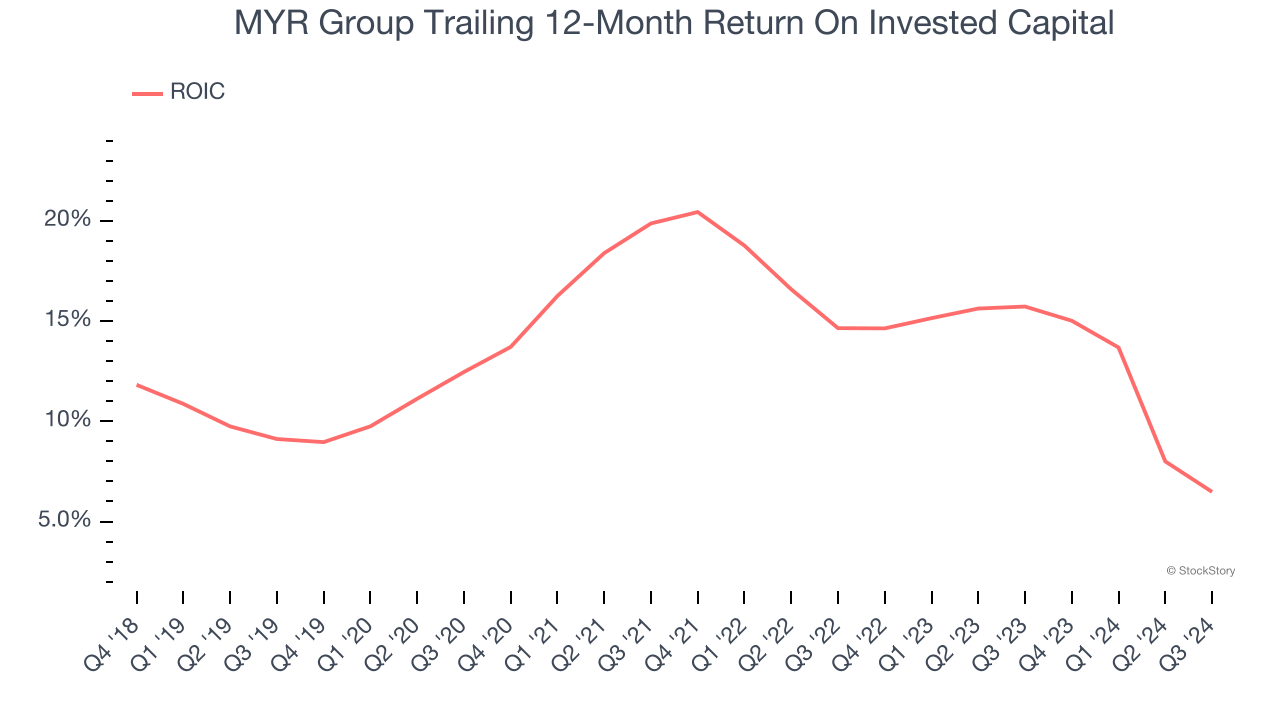

3. New Investments Fail to Bear Fruit as ROIC Declines

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We typically prefer to invest in companies with high returns because it means they have viable business models, but the trend in a company’s ROIC is often what surprises the market and moves the stock price. MYR Group’s ROIC has decreased over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

Final Judgment

MYR Group doesn’t pass our quality test. With its shares underperforming the market lately, the stock trades at 31.8× forward price-to-earnings (or $147.72 per share). At this valuation, there’s a lot of good news priced in - we think there are better opportunities elsewhere. We’d suggest looking at MercadoLibre, the Amazon and PayPal of Latin America.

Stocks We Like More Than MYR Group

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.