Over the past six months, GE HealthCare’s stock price fell to $82.47. Shareholders have lost 10.8% of their capital, disappointing when considering the S&P 500 was flat. This might have investors contemplating their next move.

Is there a buying opportunity in GE HealthCare, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Even though the stock has become cheaper, we're cautious about GE HealthCare. Here are three reasons why there are better opportunities than GEHC and a stock we'd rather own.

Why Is GE HealthCare Not Exciting?

Spun off from industrial giant General Electric in 2023 after over a century as its healthcare division, GE HealthCare (NASDAQ: GEHC) provides medical imaging equipment, patient monitoring systems, diagnostic pharmaceuticals, and AI-enabled healthcare solutions to hospitals and clinics worldwide.

1. Slow Organic Growth Suggests Waning Demand In Core Business

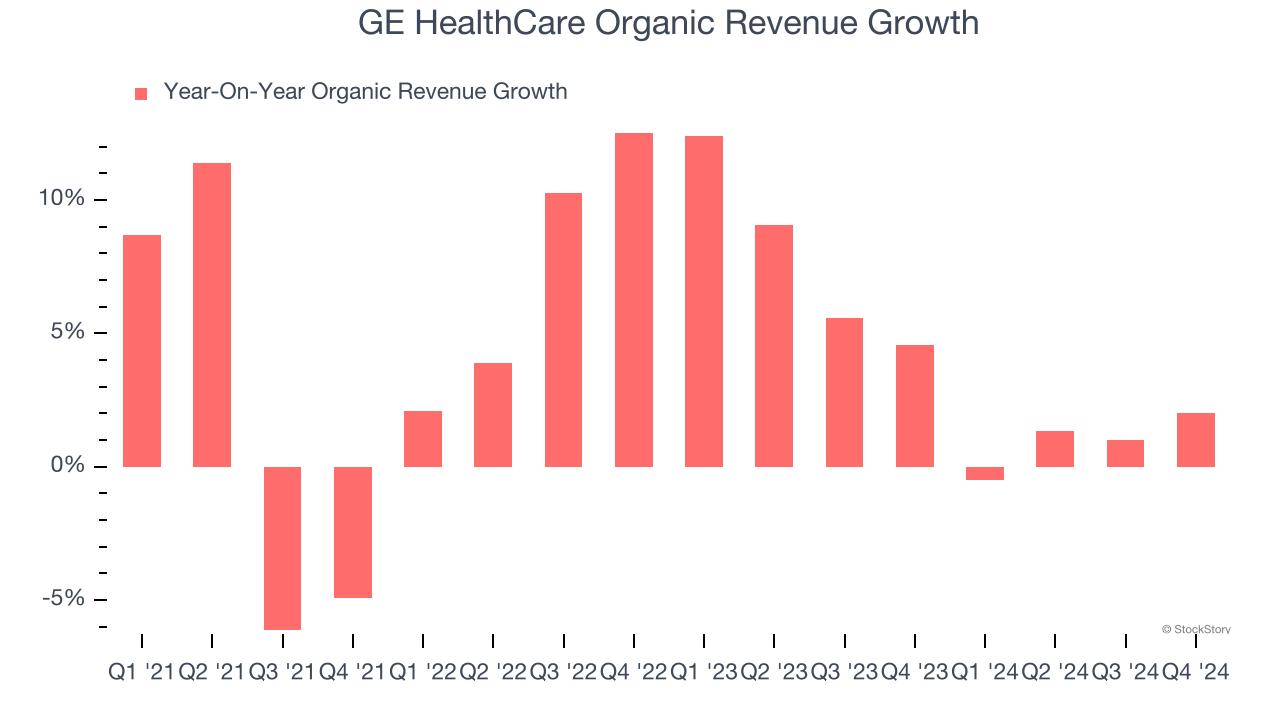

We can better understand Medical Devices & Supplies - Imaging, Diagnostics companies by analyzing their organic revenue. This metric gives visibility into GE HealthCare’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, GE HealthCare’s organic revenue averaged 4.4% year-on-year growth. This performance slightly lagged the sector and suggests it may need to improve its products, pricing, or go-to-market strategy, which can add an extra layer of complexity to its operations.

2. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect GE HealthCare’s revenue to rise by 1.6%, a slight deceleration versus its 3.6% annualized growth for the past two years. This projection doesn't excite us and suggests its products and services will face some demand challenges.

3. EPS Trending Down

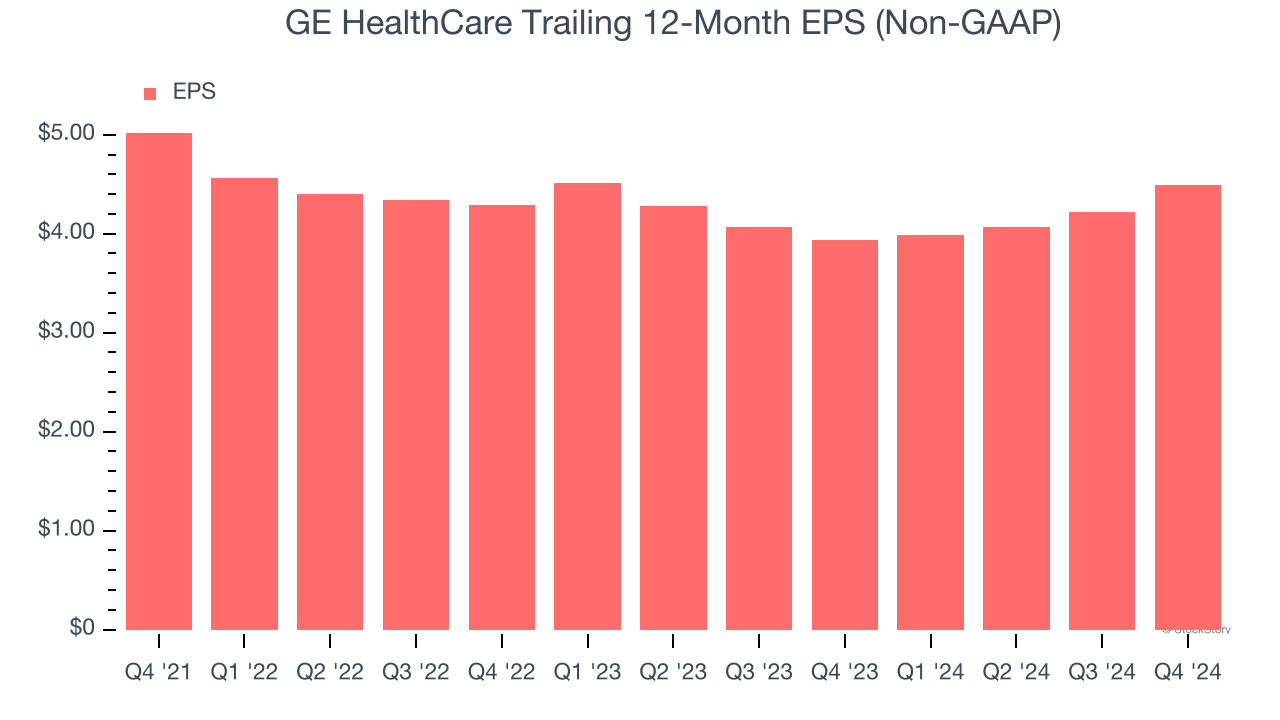

We track the change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for GE HealthCare, its EPS declined by 3.6% annually over the last three years while its revenue grew by 3.8%. This tells us the company became less profitable on a per-share basis as it expanded.

Final Judgment

GE HealthCare’s business quality ultimately falls short of our standards. After the recent drawdown, the stock trades at 17.8× forward price-to-earnings (or $82.47 per share). Investors with a higher risk tolerance might like the company, but we think the potential downside is too great. We're pretty confident there are more exciting stocks to buy at the moment. Let us point you toward one of our all-time favorite software stocks.

Stocks We Like More Than GE HealthCare

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.