Although the S&P 500 is down 1.4% over the past six months, Gibraltar’s stock price has fallen further to $62.15, losing shareholders 11.1% of their capital. This may have investors wondering how to approach the situation.

Is there a buying opportunity in Gibraltar, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Even with the cheaper entry price, we're sitting this one out for now. Here are two reasons why you should be careful with ROCK and a stock we'd rather own.

Why Is Gibraltar Not Exciting?

Gibraltar (NASDAQ: ROCK) makes renewable energy, agriculture technology and infrastructure products. Its mission statement is to make everyday living more sustainable.

1. Long-Term Revenue Growth Disappoints

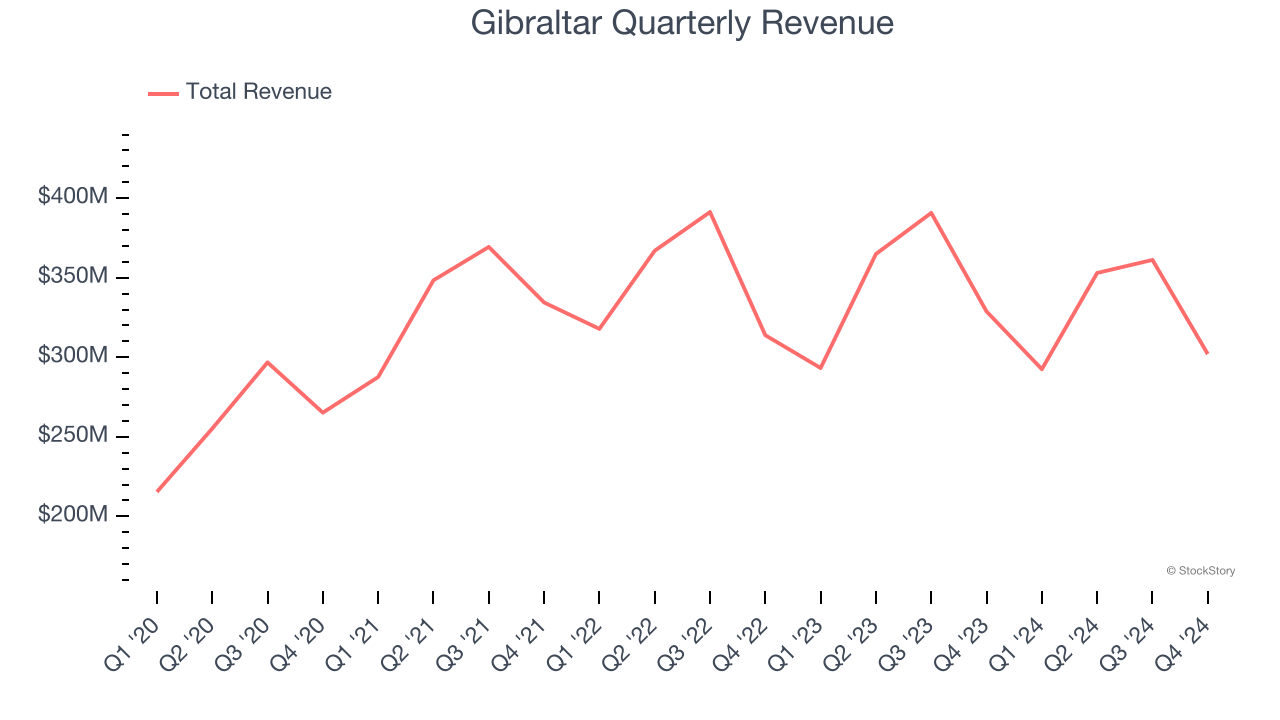

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, Gibraltar’s 6.1% annualized revenue growth over the last four years was mediocre. This fell short of our benchmark for the industrials sector.

2. Low Gross Margin Reveals Weak Structural Profitability

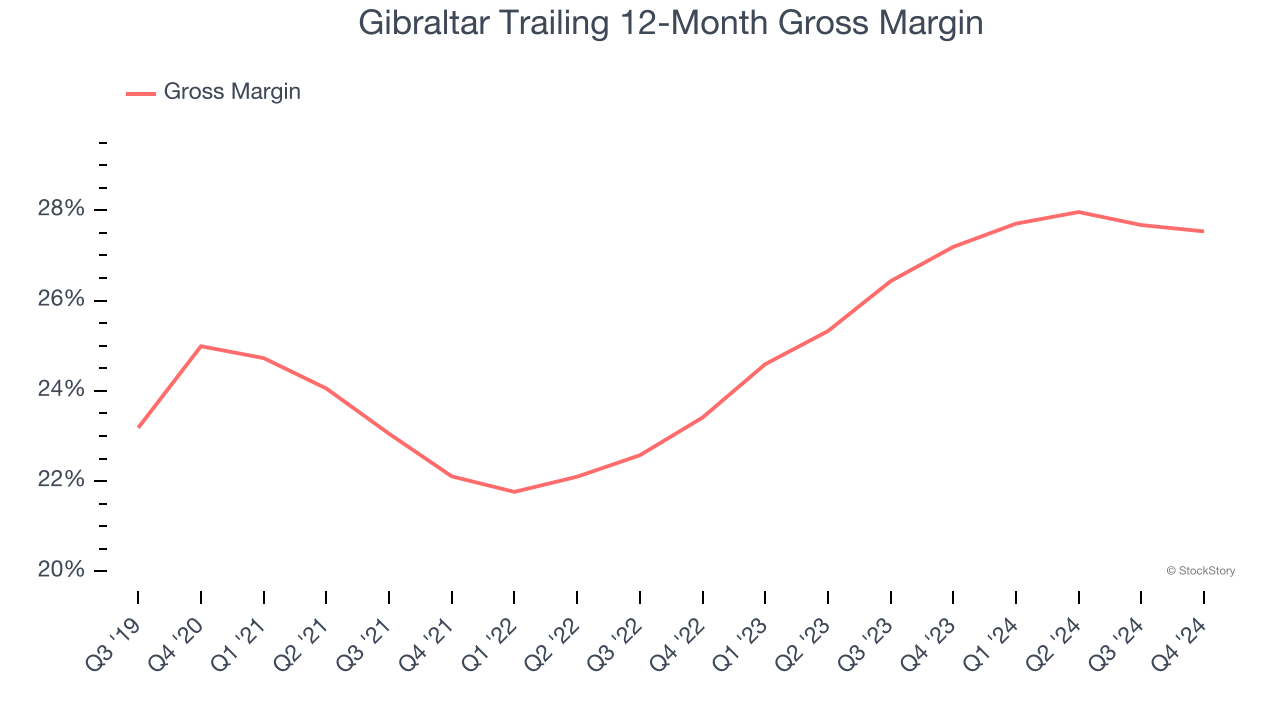

Cost of sales for an industrials business is usually comprised of the direct labor, raw materials, and supplies needed to offer a product or service. These costs can be impacted by inflation and supply chain dynamics.

Gibraltar has bad unit economics for an industrials company, giving it less room to reinvest and develop new offerings. As you can see below, it averaged a 25% gross margin over the last five years. Said differently, Gibraltar had to pay a chunky $74.96 to its suppliers for every $100 in revenue.

Final Judgment

Gibraltar isn’t a terrible business, but it doesn’t pass our quality test. After the recent drawdown, the stock trades at 12.9× forward price-to-earnings (or $62.15 per share). While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're fairly confident there are better stocks to buy right now. We’d suggest looking at a dominant Aerospace business that has perfected its M&A strategy.

Stocks We Would Buy Instead of Gibraltar

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.