Although the S&P 500 is down 6.9% over the past six months, Trex’s stock price has fallen further to $54.94, losing shareholders 15.8% of their capital. This might have investors contemplating their next move.

Is now the time to buy Trex, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Even with the cheaper entry price, we're swiping left on Trex for now. Here are three reasons why you should be careful with TREX and a stock we'd rather own.

Why Is Trex Not Exciting?

Addressing the demand for aesthetically-pleasing and unique outdoor living spaces, Trex Company (NYSE: TREX) makes wood-alternative decking, railing, and patio furniture.

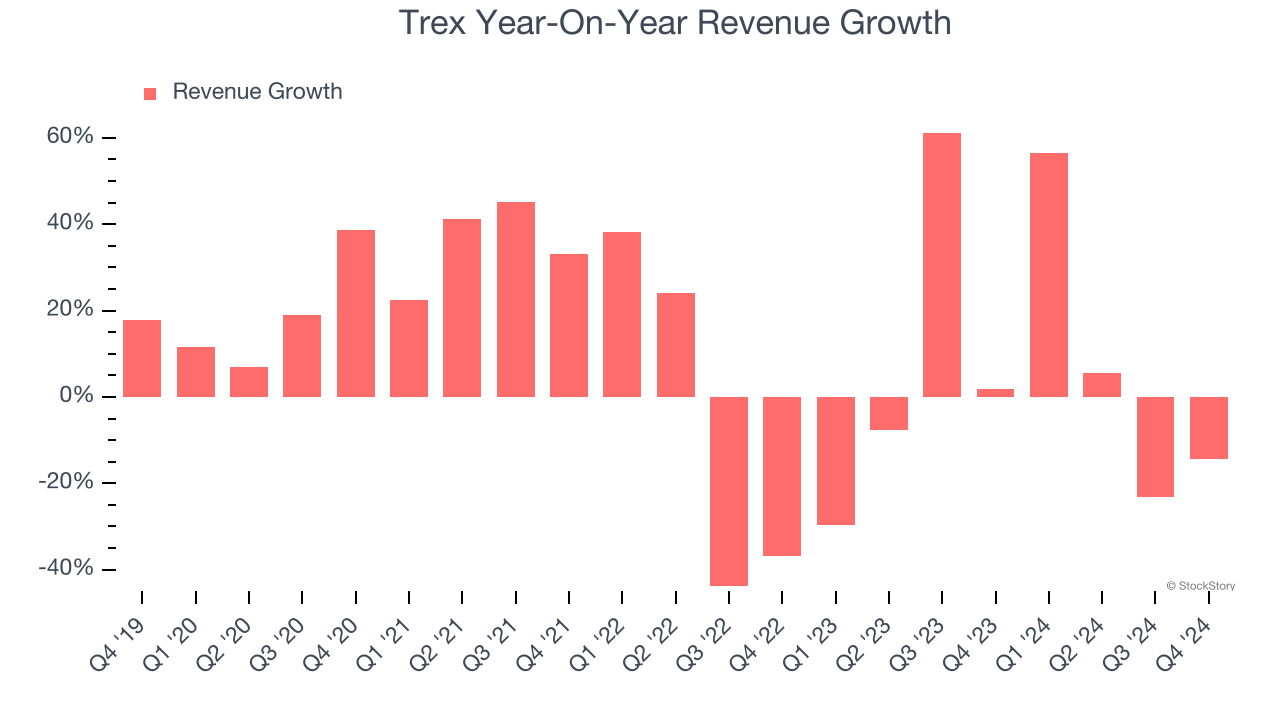

1. Lackluster Revenue Growth

We at StockStory place the most emphasis on long-term growth, but within industrials, a stretched historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Trex’s recent performance shows its demand has slowed as its annualized revenue growth of 2% over the last two years was below its five-year trend.

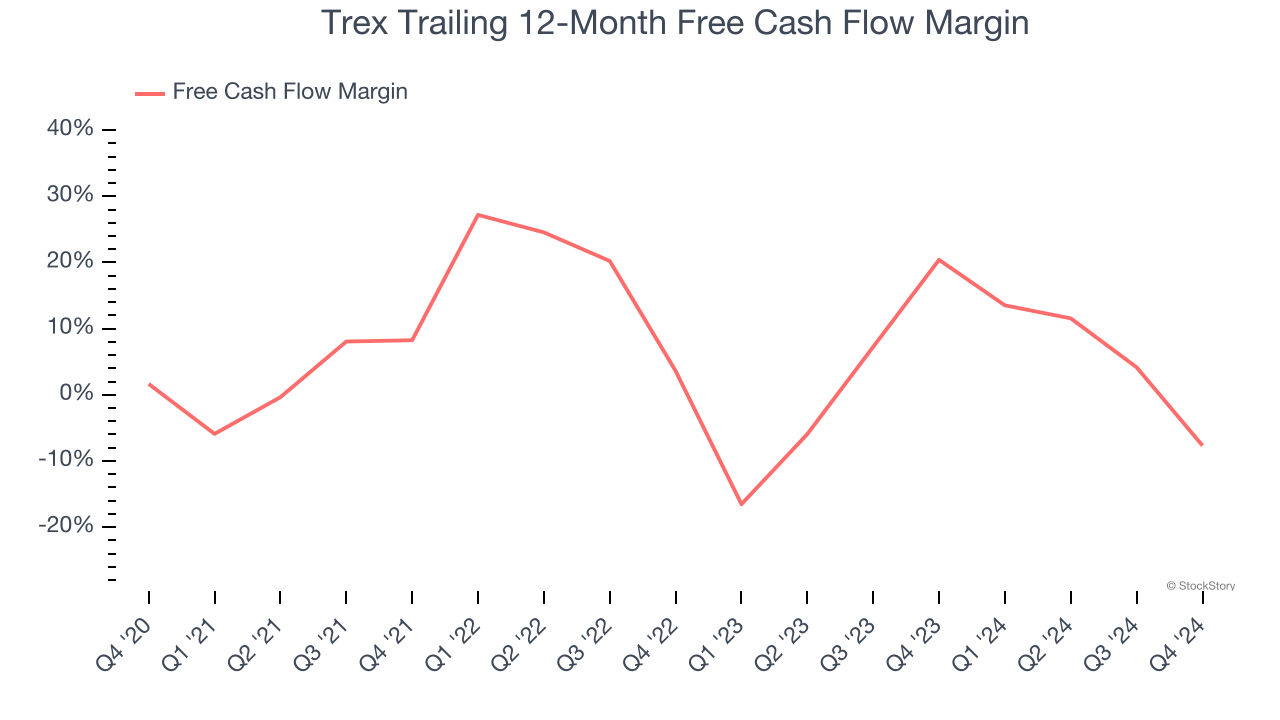

2. Free Cash Flow Margin Dropping

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Trex’s margin dropped by 9.3 percentage points over the last five years. This along with its unexciting margin put the company in a tough spot, and shareholders are likely hoping it can reverse course. If the trend continues, it could signal it’s becoming a more capital-intensive business. Trex’s free cash flow margin for the trailing 12 months was negative 7.7%.

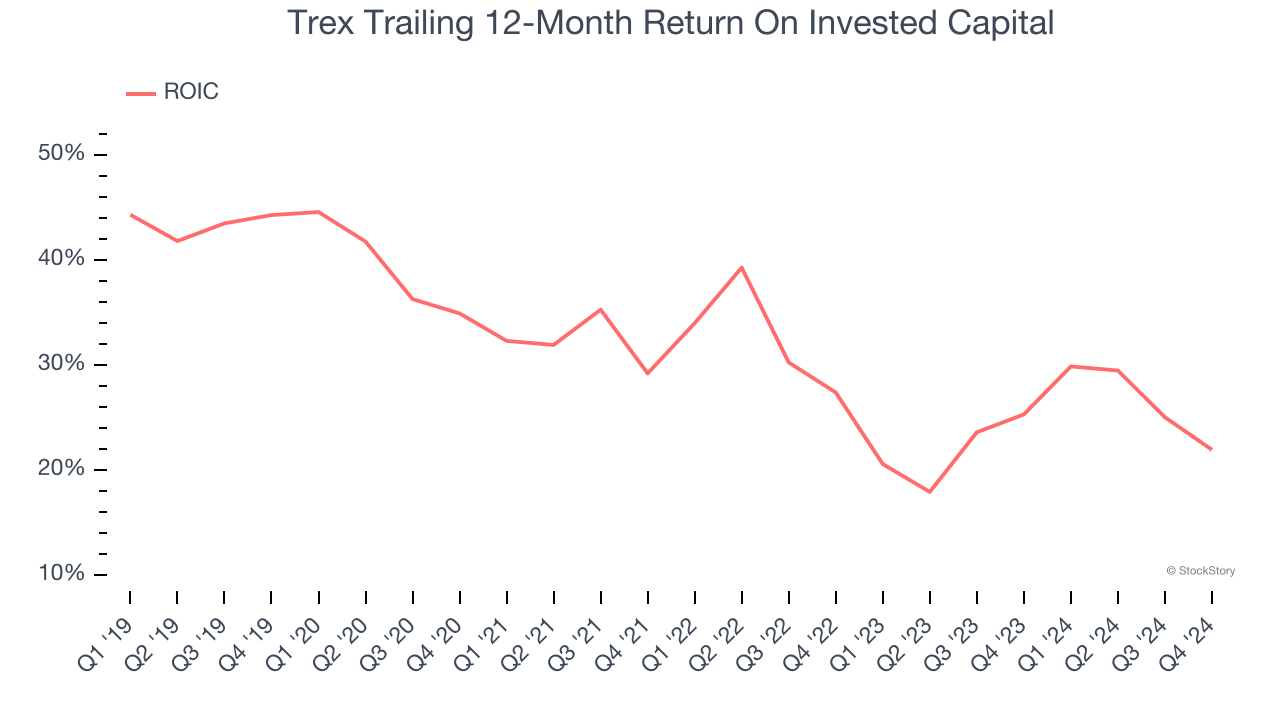

3. New Investments Fail to Bear Fruit as ROIC Declines

A company’s ROIC, or return on invested capital, shows how much operating profit it makes compared to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Trex’s ROIC has decreased over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

Final Judgment

Trex isn’t a terrible business, but it doesn’t pass our bar. After the recent drawdown, the stock trades at 25.2× forward price-to-earnings (or $54.94 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - we think there are better stocks to buy right now. We’d suggest looking at one of Charlie Munger’s all-time favorite businesses.

Stocks We Would Buy Instead of Trex

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.