Plant-based protein company Beyond Meat (NASDAQ: BYND) missed Wall Street’s revenue expectations in Q1 CY2025, with sales falling 9.1% year on year to $68.73 million. Its non-GAAP loss of $0.67 per share was 41.3% below analysts’ consensus estimates.

Is now the time to buy Beyond Meat? Find out by accessing our full research report, it’s free.

Beyond Meat (BYND) Q1 CY2025 Highlights:

- Revenue: $68.73 million vs analyst estimates of $74.92 million (9.1% year-on-year decline, 8.3% miss)

- Adjusted EPS: -$0.67 vs analyst expectations of -$0.47 (41.3% miss)

- Adjusted EBITDA: -$42.33 million vs analyst estimates of -$22.13 million (-61.6% margin, 91.3% miss)

- Operating Margin: -81.8%, down from -70.7% in the same quarter last year

- Free Cash Flow was -$30.63 million compared to -$33 million in the same quarter last year

- Sales Volumes fell 11.2% year on year (-16.1% in the same quarter last year)

- Market Capitalization: $192.5 million

Beyond Meat President and CEO Ethan Brown commented, “As the first quarter of 2025 progressed to a close, we saw a slowdown in consumption as the uncertain macroeconomic environment likely exacerbated category challenges. Nevertheless, we drove year-over-year reductions in operating expenses, notwithstanding the impact of certain transitory items, to partially offset disappointing net revenues and gross profit.”

Company Overview

A pioneer at the forefront of the plant-based protein revolution, Beyond Meat (NASDAQ: BYND) is a food company specializing in alternatives to traditional meat products.

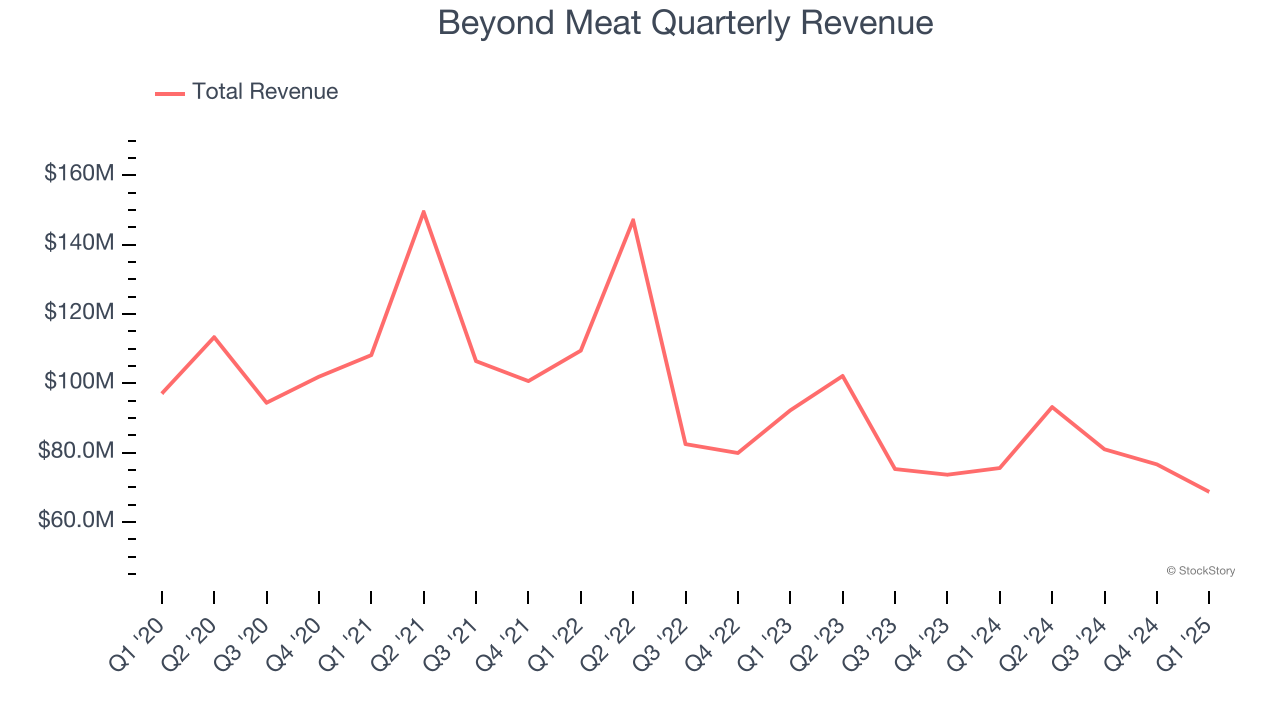

Sales Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $319.6 million in revenue over the past 12 months, Beyond Meat is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers.

As you can see below, Beyond Meat struggled to generate demand over the last three years. Its sales dropped by 11.8% annually as consumers bought less of its products.

This quarter, Beyond Meat missed Wall Street’s estimates and reported a rather uninspiring 9.1% year-on-year revenue decline, generating $68.73 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 1.8% over the next 12 months. Although this projection indicates its newer products will spur better top-line performance, it is still below the sector average.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

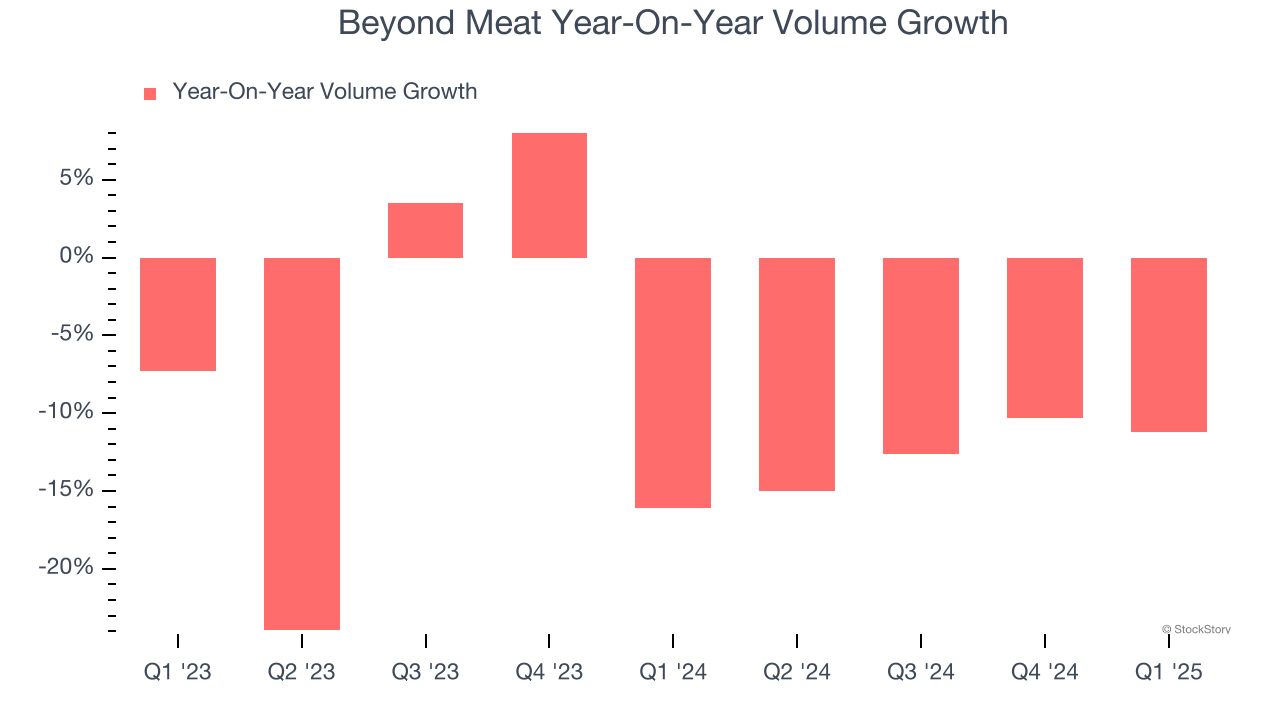

Volume Growth

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

Beyond Meat’s average quarterly sales volumes have shrunk by 9.7% over the last two years. This decrease isn’t ideal because the quantity demanded for consumer staples products is typically stable.

In Beyond Meat’s Q1 2025, sales volumes dropped 11.2% year on year. This result represents a further deceleration from its historical levels, showing the business is struggling to move its products.

Key Takeaways from Beyond Meat’s Q1 Results

We struggled to find many positives in these results as its revenue, EPS, and EBITDA fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 5.5% to $2.41 immediately after reporting.

Beyond Meat underperformed this quarter, but does that create an opportunity to invest right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.